This blog post will discuss the best credit repair software available and how it can help you get your credit score up!

5 Best Credit Repair Software

1. Credit Versio

Source: Images from Credit Versio

Credit Versio is a credit repair software that is designed to help you improve your credit score. The software will help you dispute any errors on your credit report and also help you negotiate with creditors to remove negative items from your account.

It provides you with tips and advice on how to improve your credit scores. It is one of the best credit repair business software options available. It allows you to cancel the plan at any time.

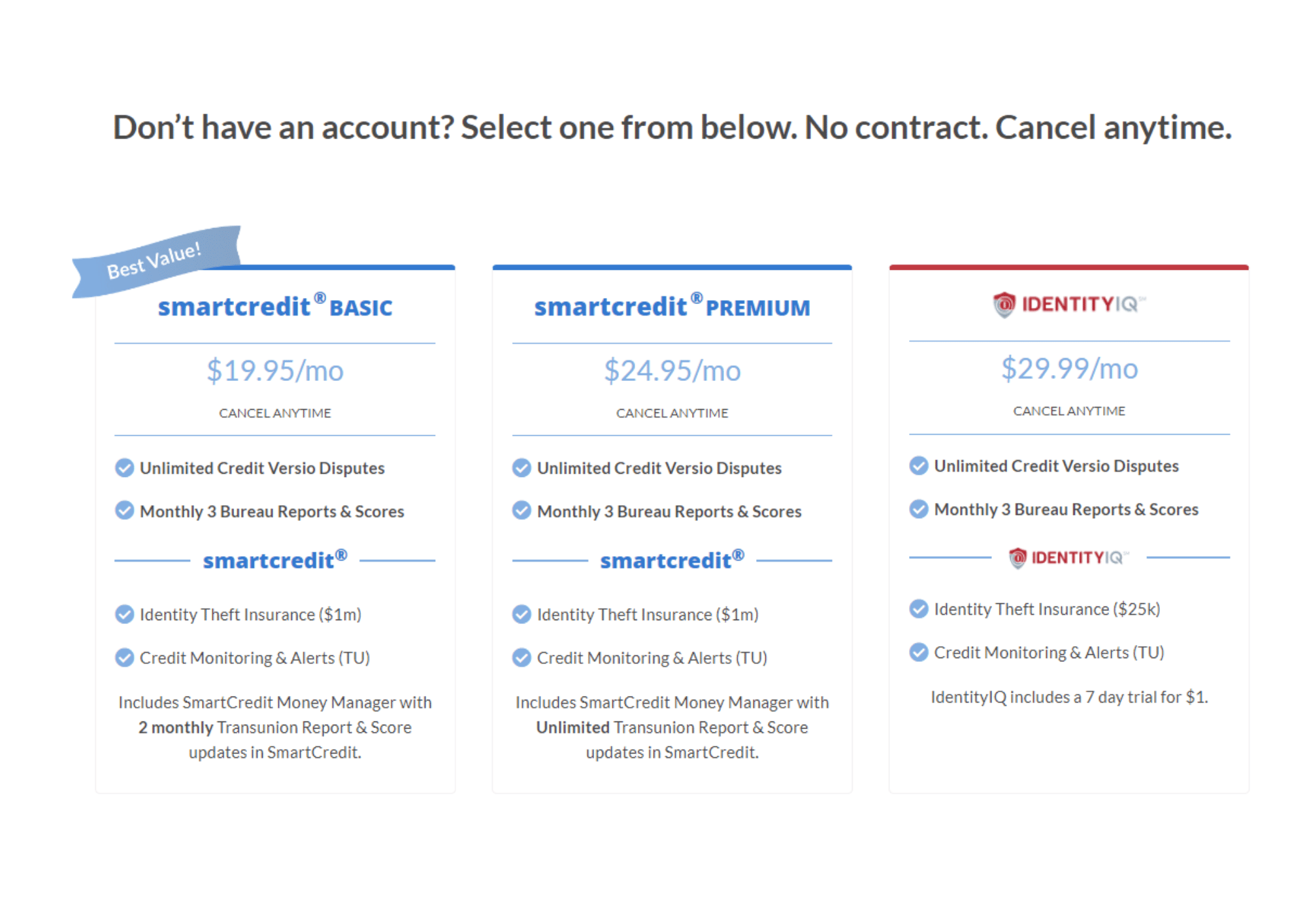

Source: Images from Credit Versio

Some of the features offered by Credit Versio include:

- The ability to dispute items on your credit report: This is one of the essential features of any credit repair software, as it allows you to challenge negative things on your account that may be dragging down your score.

- A credit monitoring service: This feature allows you to keep track of your progress over time and see how your credit score is improving.

- A debt management tool: This tool can help you create a plan to pay off your debts and improve your credit score.

- A personal finance management tool: It can help you budget and track your spending, so you can stay on top of your finances and improve your credit score.

Source: Images from Credit Versio

Pricing: Based on their website, the credit repair software is created for free and you only have to pay for a 3 credit bureaus subscription and postage for the dispute letters. They also offer three different plans, which include:

- Basic – $19.95 per month

- Premium – $24.95 per month

- Identity IQ – $29.99 per month

Credit Versio is an excellent option if you’re looking for the best credit repair software to help you get your credit score. Its powerful features and an easy-to-use interface can help you dispute negative items on your report, monitor your progress, and get your finances back on track.

2.Dovly

Source: Images from Dovly

Dovly is a credit repair software that allows users to dispute errors on their credit reports, negotiate with creditors, and develop a plan to pay down debt. Dovly also offers educational resources to help users understand credit and build financial literacy skills.

Some of the features offered by Dovly include:

- Debt settlement: Dovly offers a debt settlement service that can help you get out of debt faster. They will work with your creditors to get them to agree to lower your payments or interest rates.

- Credit counseling: Dovly also offers credit counseling services. This can help you get your finances back on track and improve your credit score.

- Identity theft protection: Dovly offers a service that can help you protect your identity. This can help you avoid becoming a victim of identity theft and keep your personal information safe.

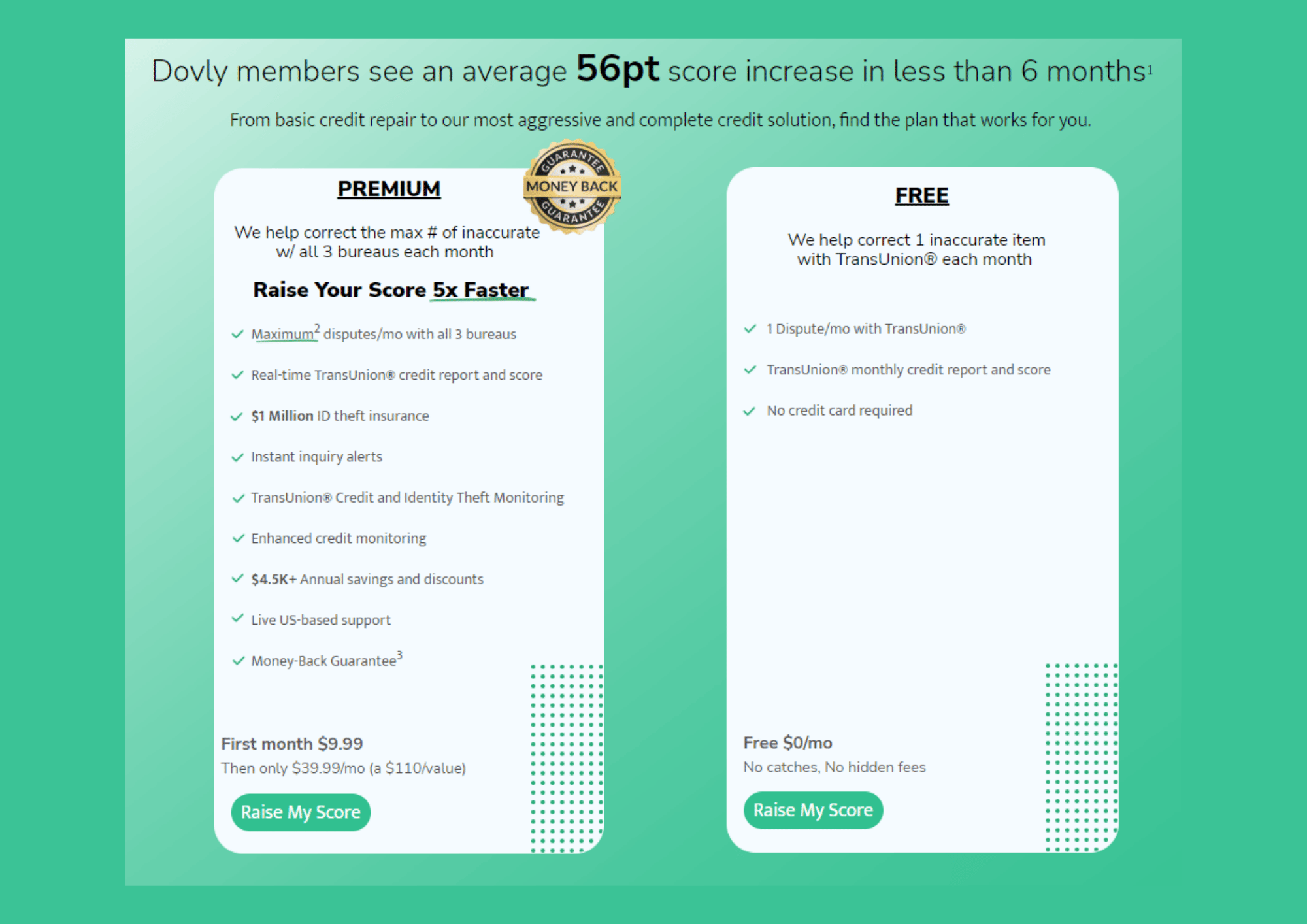

Source: Images from Dovly

Pricing: Dovly offers a free version that does not require a credit card. You can have one dispute per month with TransUnion and has a monthly free service of credit report score with no hidden fees. It also offers Premium Plan, which is $9.99 for the first month.

Dovly is a powerful tool that can help users improve their credit scores and get on the path to financial success. If you’re looking to improve your credit, Dovly is an excellent option to consider and could potentially help you qualify for better interest rates and terms on future loans and lines of credit.

3.The Personal Credit Builder

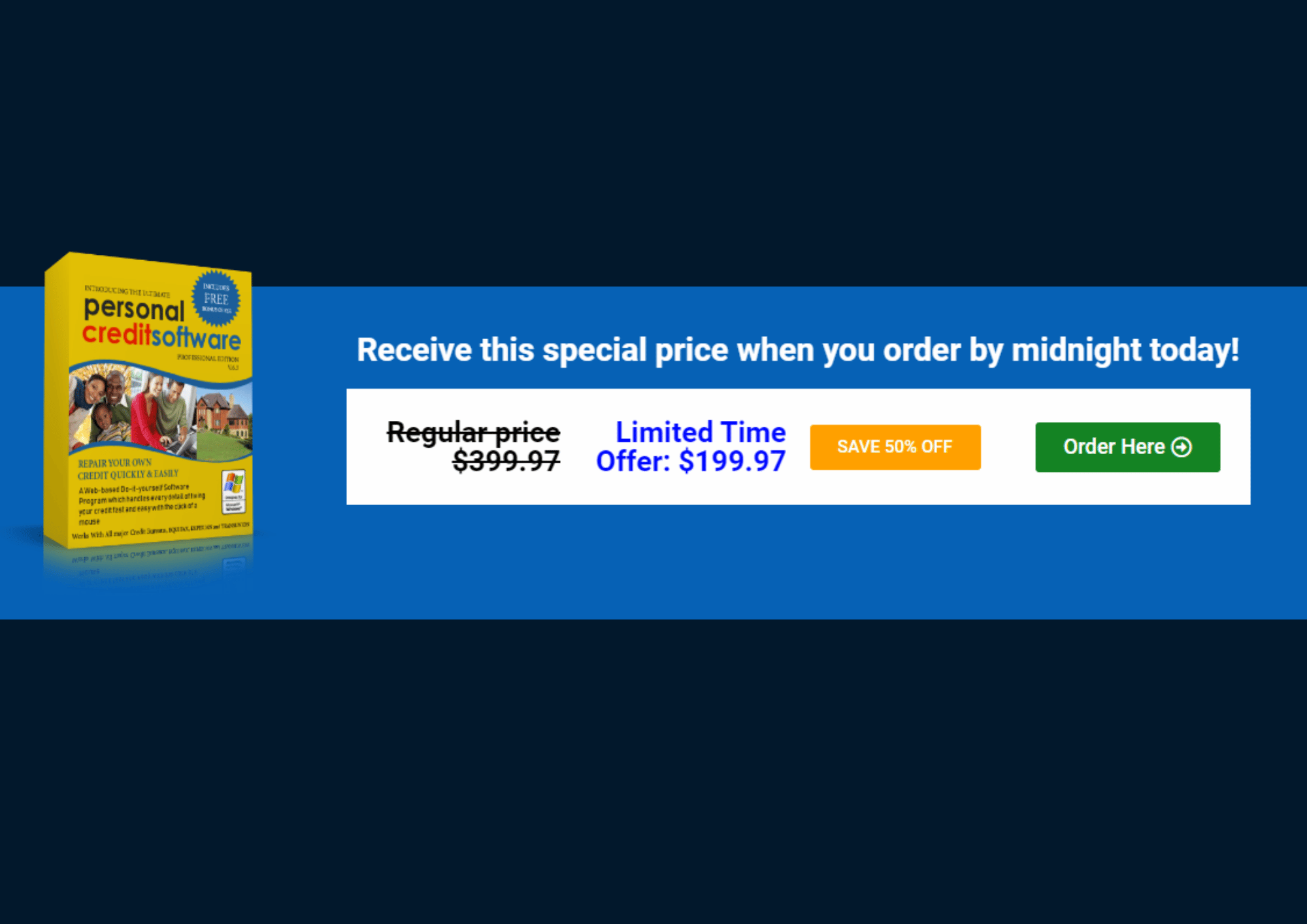

Source: Images from The Personal Credit Builder

The Personal Credit Builder is a financial tool that helps individuals build their credit history and improve their credit score. It can be used by anyone but is especially helpful for those with no credit or limited credit history.

Using the Personal Credit Builder, individuals can learn how to manage their credit and improve their creditworthiness responsibly. The Personal Credit Builder can help individuals monitor their credit reports and identify potential red flags or fraudulent activity. It can help individuals take control of their financial future and make better financial decisions.

Some of the features offered by The Personal Credit Builder include:

- A credit report and score from all three bureaus

- The ability to dispute errors on your credit report

- A personalized action plan to improve your credit score

- Credit monitoring and alerts

- Educational resources on credit and financial management

Source: Images from The Personal Credit Builder

Pricing: The Personal Credit Builder does not offer any free trial and no money-back guarantee. It offers $199.97 one-time payment, which allows you to use the software for 18 months.

The Personal Credit Builder has been given generally positive reviews. Many people find it an effective way to improve their credit score. However, there are also some negative reviews. Some people have complained that the program is challenging to use and does not work as advertised. Overall, though, The Personal Credit Builder seems to be a helpful tool for people who want to improve their credit score.

4. DisputeBee

Source: Images from DisputeBee

DisputeBee is an AI-powered platform that helps businesses automate their dispute resolution process. DisputeBee uses machine learning to identify patterns in customer disputes, and then provides recommendations on how to resolve those disputes. DisputeBee also offers a self-service portal for customers to submit and track their disputes.

Some of the features offered by DisputeBee include:

- A dispute management system that helps users to track their disputes and progress

- A document management system that helps users to store and share documents related to their dispute

- A communication tool that helps users to communicate with other parties involved in their dispute

- A payment gateway that allows users to make payments for dispute resolution services

- A wide range of tools to help you build your case and get the best results

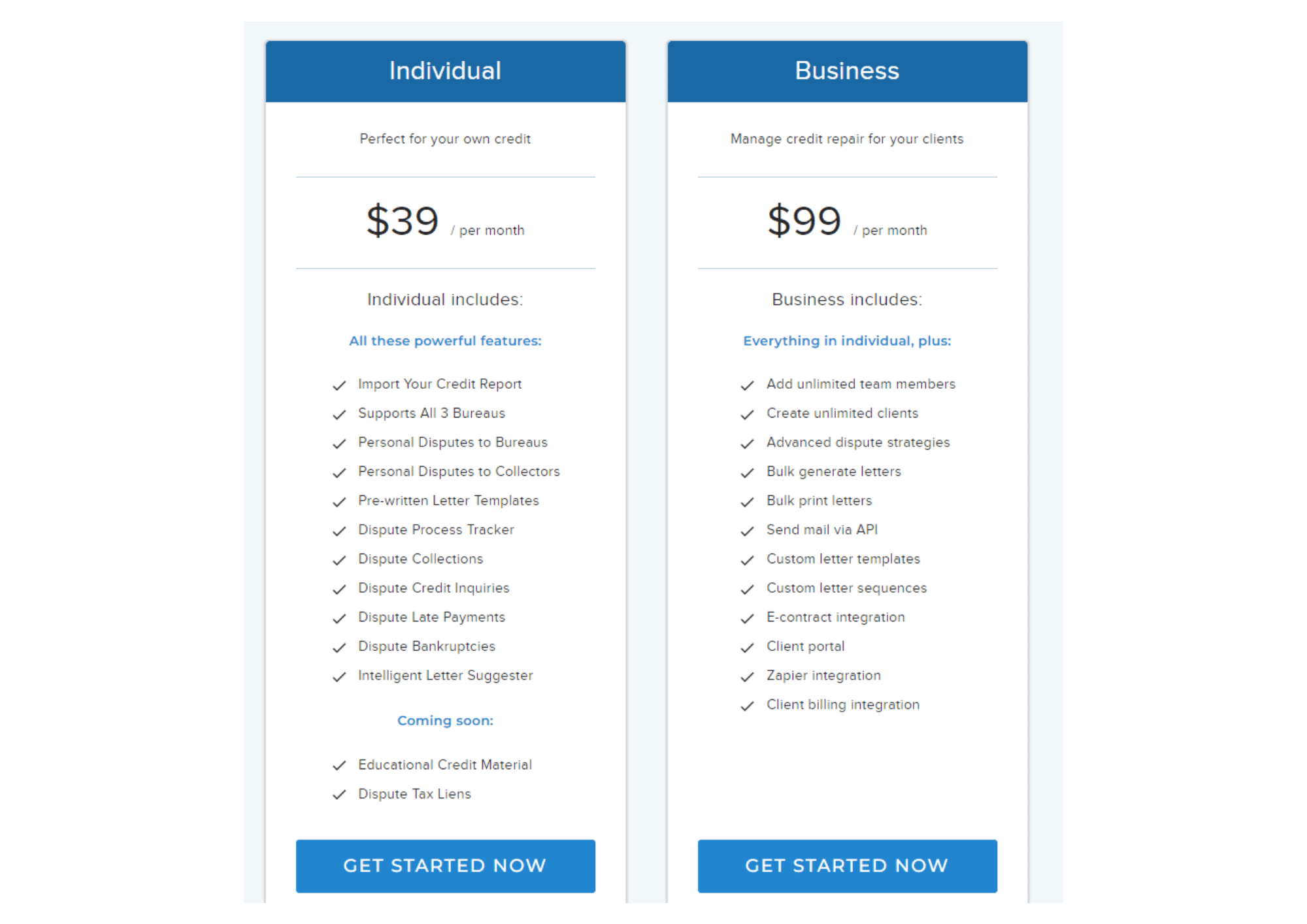

Source: Images from DisputeBee

Pricing: DisputeBee offers $39 per month for individual and $99 monthly payment for business.

The software provides users with a step-by-step guide on how to improve their credit score, as well as tools and resources to help them along the way. It offers a variety of features, such as a credit report analysis, a dispute management system, and a credit simulator, that can help users better understand their credit situation and make more informed decisions about repairing their credit.

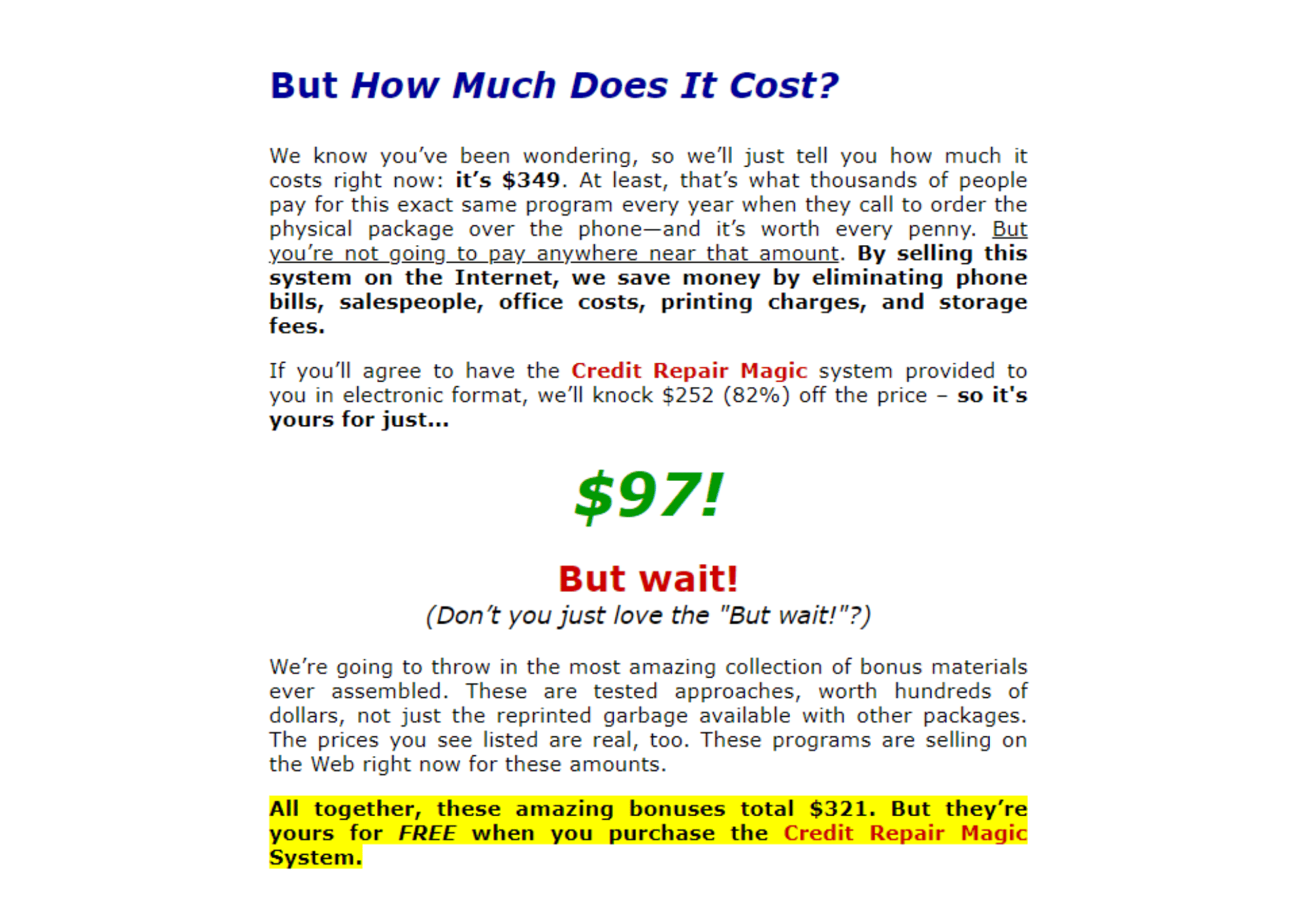

5.Credit Repair Magic

Source: Images from Credit Repair Magic

Credit Repair Magic is a credit repair software that helps you repair your credit and improve your credit score. It is a web-based software that provides you with step-by-step instructions on how to repair your credit. It also provides you with a free credit report from each of the three major credit bureaus.

Some of the features offered by Credit Repair Management include:

- Clear and Concise Instructions – The software provides you with clear and concise instructions on how to repair your credit.

- Free Credit Reports – You will receive free credit reports from each of the three major credit bureaus.

- 60-Day Money Back Guarantee – If you are not satisfied with the results, you can receive a full refund within 60 days.

The benefits of Credit Repair Magic include:

- improve your credit score

- repair your credit

- save money on interest and fees

Source: Images from Credit Repair Magic

Pricing: Credit Repair Magic is a one-time fee of $97 and comes with a 60-day money back guarantee.

Overall, Credit Repair Magic is a comprehensive credit repair solution that offers a number of features and resources that can be beneficial for users looking to improve their credit scores.

What is Credit Repair Software?

Credit repair software is a program that helps you fix your credit score. There are many kinds of credit repair software available, and they all have unique features.

Some credit repair software is designed to help you dispute errors on your credit report, while other types of software can help you create a budget or manage your debt.

No matter what type of credit repair software you choose, finding one that is reputable and easy to use is essential. You should also ensure that the software you select is compatible with the operating system on your computer.

What are the few things to consider in choosing your Credit Repair Software?

Ease of Use

Make sure to choose a credit repair company that has easy-to-use software. If the software is difficult to use, you’ll be less likely to stick with it and see results. Look for a credit repair program that’s easy to understand and follow.

Features

In choosing personal credit repair software, find something with features that best fit your needs. Some people need more hand-holding than others, so look for a program that offers features like credit counseling or a personal financial management tool.

Price

There are paid and free credit repair software programs. Consider what you’re willing to pay for the features you want. There is credit repair business software that is completely free.

User Reviews

Check out user reviews before selecting a credit repair software program. Check their credit repair process to give you an idea of how well the program works and what others think.

Customer Service

Suppose you have questions or run into problems. In that case, you’ll want to be able to contact customer service for help, so make sure to look for professional credit repair software that has responsive customer service.

Money-Back Guarantee

Choose a credit repair program that offers a money-back guarantee so you can try it risk-free.

Results

Of course, you’ll want to see results from using the credit repair software solutions. Be sure to read reviews from other users before choosing one.

The best credit repair software can help you improve your credit score by fixing errors on your credit report. By choosing the right software and following the instructions, you can see a significant difference in your credit score. Consider these factors when selecting credit repair software to get started on the path to better credit.

Why do you need Credit Repair Software?

Your credit score is one of the most critical factors in your financial life. It determines whether you’ll be able to get a loan and at what interest rate. A bad credit score can even prevent you from getting a job or an apartment.

If your credit score is low, you may be looking for ways to improve it. One way to do this is by using credit repair software. Credit repair software can help you dispute errors on your credit report, negotiate with creditors, and take other steps to improve your credit score.

How to improve your Credit Score fast?

If you’re looking to improve your credit score fast, you can do a few things. Start by requesting a free credit report from the three major credit reporting agencies. Review your reports carefully to identify any errors or negative information that may be dragging down your score. If you find anything that looks incorrect, dispute it with the credit bureau immediately.

Next, make sure you’re paying all of your bills on time. Late payments can have a significant negative impact on your score. If you’re having trouble keeping up with your payments, consider setting up automatic payments or reaching out to your creditors to request more flexible payment terms.

Finally, try to keep your credit utilization low. This refers to the percentage of your credit limit used at any given time. The lower your utilization, the better your score. Aim to keep it below 30% if possible.

By following these simple tips, you can boost your credit score in no time.

What are the benefits of using Credit Repair Software?

There are many benefits of using credit repair software to help you improve your credit score. Perhaps the most obvious benefit is that it can help you save time and money by automating the dispute resolution process.

Another significant benefit is that it can help remove errors from your credit report, which can significantly impact your score. Additionally, credit repair software can help you negotiate with creditors to remove negative items from your account, which can also help improve your score.

Finally, credit repair software can help you stay organized and on track with your credit repair goals, making the entire process less overwhelming and more effective. Ultimately, whether or not you choose to use credit repair software is up to you. However, it may be worth considering if you are looking for a way to save time and money and improve your credit score.

Conclusion

Many credit repair software programs are available to help you improve your credit score. While some are more comprehensive than others, all of them can help you take steps to improve your credit report and raise your score.

The best credit repair software will offer a free trial period so that you can try it out before committing to a purchase. It should also have a money-back guarantee in case you’re unsatisfied with the results.

When choosing a credit repair program, read the reviews and compare the features to find the one that best suits your needs. While you can find many credit repair software programs available, these five represent the cream of the crop. With the right program, you can get your credit score up quickly!