If you’re looking for a new way to invest your money and create passive income, you should consider supporting DeFi!

Defi is a decentralized platform that allows you to invest in various digital assets.

It can be a great way to generate passive income, as the value of these assets often increases over time.

This blog post will discuss how to invest in DeFi and how it can help you achieve your financial goals!

Different Ways to Invest in DeFi

1.DeFi Staking

DeFi staking involves locking up your digital assets to earn rewards. It can be done with any DeFi protocols, but the most popular ones are MakerDAO and Compound. By staking your assets, you’re essentially lending them out to be used by others and earning interest on the loan.

The most significant benefit of DeFi staking is the potential to earn high-interest rates. For example, the annual interest rate on MakerDAO is over 11%. If you lock up $100 worth of digital assets, you could earn over $11 in interest after one year.

Source: Images from DeFi Coins

Of course, there are also some risks to consider. One is that you’re essentially giving up control of your assets while they’re locked up. If the protocol fails or is hacked, you could lose everything. Another risk is that the interest rates could change.

If the protocols you use decrease their interest rates, your earnings will also go down. DeFi staking is a great way to earn passive income on digital assets. However, make sure you understand the risks before getting started.

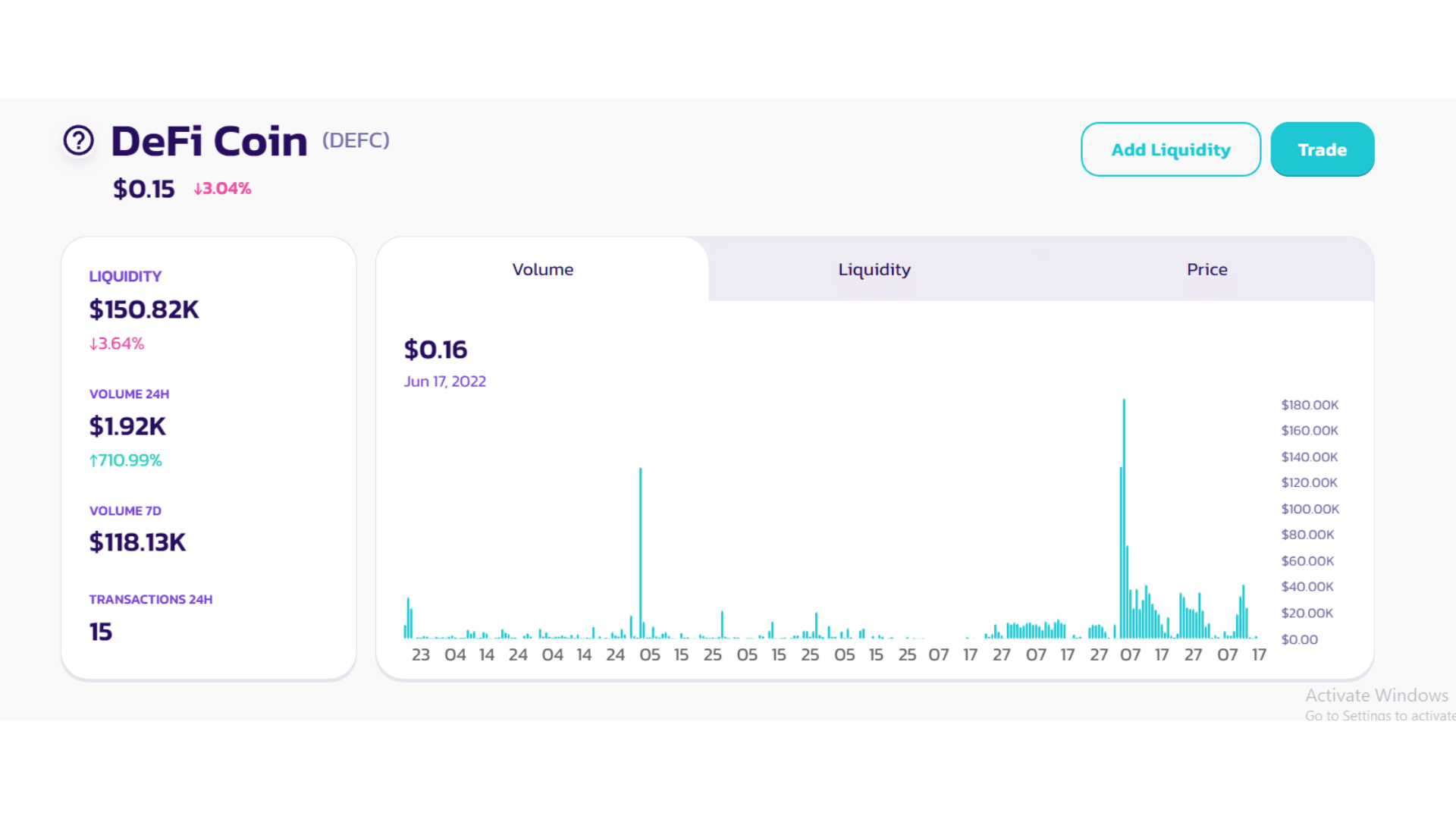

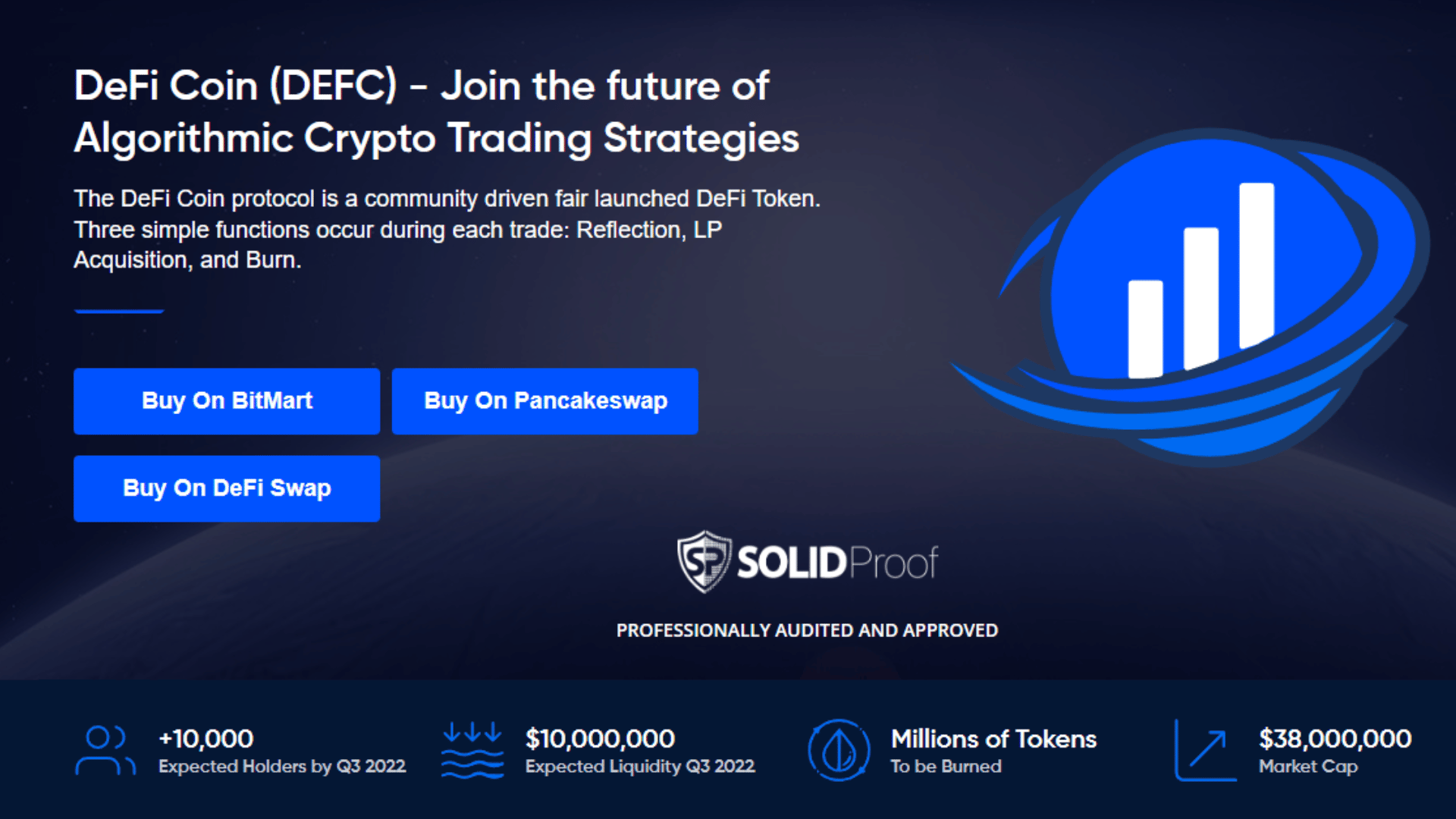

2.Investing in DeFi Coin

If you want to get in on the action early, investing in DeFi coin offerings (ICOs) is excellent. By buying tokens during an ICO, you can get access to new projects and platforms that have the potential to change the financial landscape. ICOs are a form of crowdfunding, where startups raise money by selling tokens or coins that can be used on their platform.

Source: Images from PancakeSwap

Some notable projects that have held successful ICOs include MakerDAO, Augur, and Gnosis. When participating in an ICO, you must do your due diligence and research the team and project before investing. Ensure you understand how the tokens will be used on the platform and what kind of return on investment (ROI) you can expect.

Of course, it’s essential to research before investing in any ICO, as risks are always involved. But if you choose wisely, investing in DeFi coins can be a great way to get ahead of the curve and make some serious profits.

3.DeFi Yield Farming

If you want to get involved in DeFi and earn a passive income, yield farming is one of the best ways. Yield farmers provide liquidity to decentralized exchanges (DEXes) by staking their cryptocurrency assets in return for a share of the trading fees generated on the platform. You’ll need to find a DEX offering liquidity mining to start.

Once you’ve found one, you can deposit your cryptocurrency assets into the liquidity pool and start earning rewards. It’s important to note that yield farming is a high-risk investment strategy due to the volatile nature of the crypto markets. However, if you’re willing to take on the risk, it can be a great way to earn a passive income.

4.Earning Interest Via DeFi Savings Accounts

There are a few different ways to earn interest in your cryptocurrency via DeFi protocols. The most popular method is through what’s called a “DeFi savings account.”

This type of account allows you to deposit your crypto into a smart contract, which then locks up your funds and pays you interest based on the underlying rate set by the protocol.

The great thing about DeFi savings accounts is that they are effortless to use and don’t require technical knowledge. All you need to do is deposit your crypto into the smart contract, and the interest will be paid out automatically.

A few different protocols offer DeFi savings accounts, but the most popular one is called Compound. If you’re looking for a more passive way to earn interest on your cryptocurrency, then DeFi savings accounts are a great option.

5.Secured DeFi Loans

Another popular way to earn interest in your cryptocurrency is by taking out a loan. DeFi protocols offer loans that are secured by your crypto assets. If you default on the loan, the lender can take your collateral. The great thing about these loans is that they often have much lower interest rates than traditional loans.

It is because the protocols that offer them can take advantage of the decentralized nature of the blockchain to reduce costs. If you’re looking for a way to earn interest on your cryptocurrency without having to put it at risk, then secured DeFi loans are a great option.

6.Invest in DeFi Stocks

Investing in DeFi stocks is another great way to get involved in the DeFi space. DeFi stocks are essentially tokens representing a share of a company built on top of a blockchain protocol. These companies are often involved in developing or utilizing decentralized finance applications.

One of the great things about investing in DeFi stocks is that they often offer a high degree of liquidity. It means you can buy and sell them quickly and don’t have to worry about holding onto them for long periods. If you’re looking for a way to invest in DeFi without putting your money into the volatile crypto markets, then investing in DeFi stocks is one of the options.

7.Invest in NFTs

If you’re looking for a more speculative way to get involved in DeFi, then investing in NFTs is an excellent option. NFTs are non-fungible tokens that represent ownership of a digital asset. These assets can be anything from artwork to digital collectibles.

One of the great things about investing in NFTs is that they often have a high degree of liquidity. It means you can buy and sell them quickly and don’t have to worry about holding onto them for long periods.

4 Steps to Start Investing in Defi

With the rise of Bitcoin and other cryptocurrencies, there has been a recent surge in interest in decentralized finance (DeFi). DeFi is a new financial paradigm that enables anyone to access financial services without going through traditional intermediaries like banks or governments.

This new way of handling finances is made possible by the use of blockchain technology. One of the most attractive aspects of DeFi is that it has the potential to generate passive income. This article will show you how to invest in DeFi to create passive income.

1.Prepare your Digital Wallet

Before you can start earning interest on your digital assets, you’ll need to create a digital wallet. There are many different types of wallets available, so research to find the one that best suits your needs. We recommend using a software wallet like MetaMask, which is easy to set up and use. Once you’ve created your wallet, you’ll need to deposit some digital assets into it.

2. Purchase your Crypto Coins

The next step is to purchase your crypto coins. You can do this through many exchanges, including Coinbase and Binance. Once you have your cash, you’ll need to store them in a wallet. I recommend using a hardware wallet like the Ledger Nano S for security purposes.

3. Start with DeFi Protocols

The easiest way to get started with earning interest in your cryptocurrency is to use one of the many protocols that have been developed specifically for this purpose. The most popular protocols are Compound, Maker, and dYdX, but there are many others to choose from. Each protocol has its strengths and weaknesses, so be sure to research before deciding which one is right for you.

Once you’ve chosen a protocol, the next step is to connect your wallet to it. This process will be different for each protocol. Still, generally, you’ll need to provide some collateral (usually ETH or DAI) and then deposit your cryptocurrency into the protocol’s smart contract. After that, you’ll be able to earn interest on your deposit, which will be paid out to you in the form of the protocol’s native token.

4. Start tracking your DeFi Investments and Portfolio Performance

The best way to ensure you’re earning the highest possible return on your investment is to track your portfolio’s performance. By monitoring your investments, you can see their worth in real-time and make adjustments to ensure you’re consistently earning the highest possible return.

The first step is to find a good tracking platform. The most popular one right now is DeFi Pulse, but there are others like Codefi Data and DefiStats. Once you have chosen a platform, you can start adding your investments.

Most tracking platforms will give you an overview of your portfolio performance, including your realized and unrealized gains. It is a valuable tool to help you understand how your investments are doing and whether you need to rebalance your portfolio.

5 Best DeFi Lending Platforms

1.AQRU

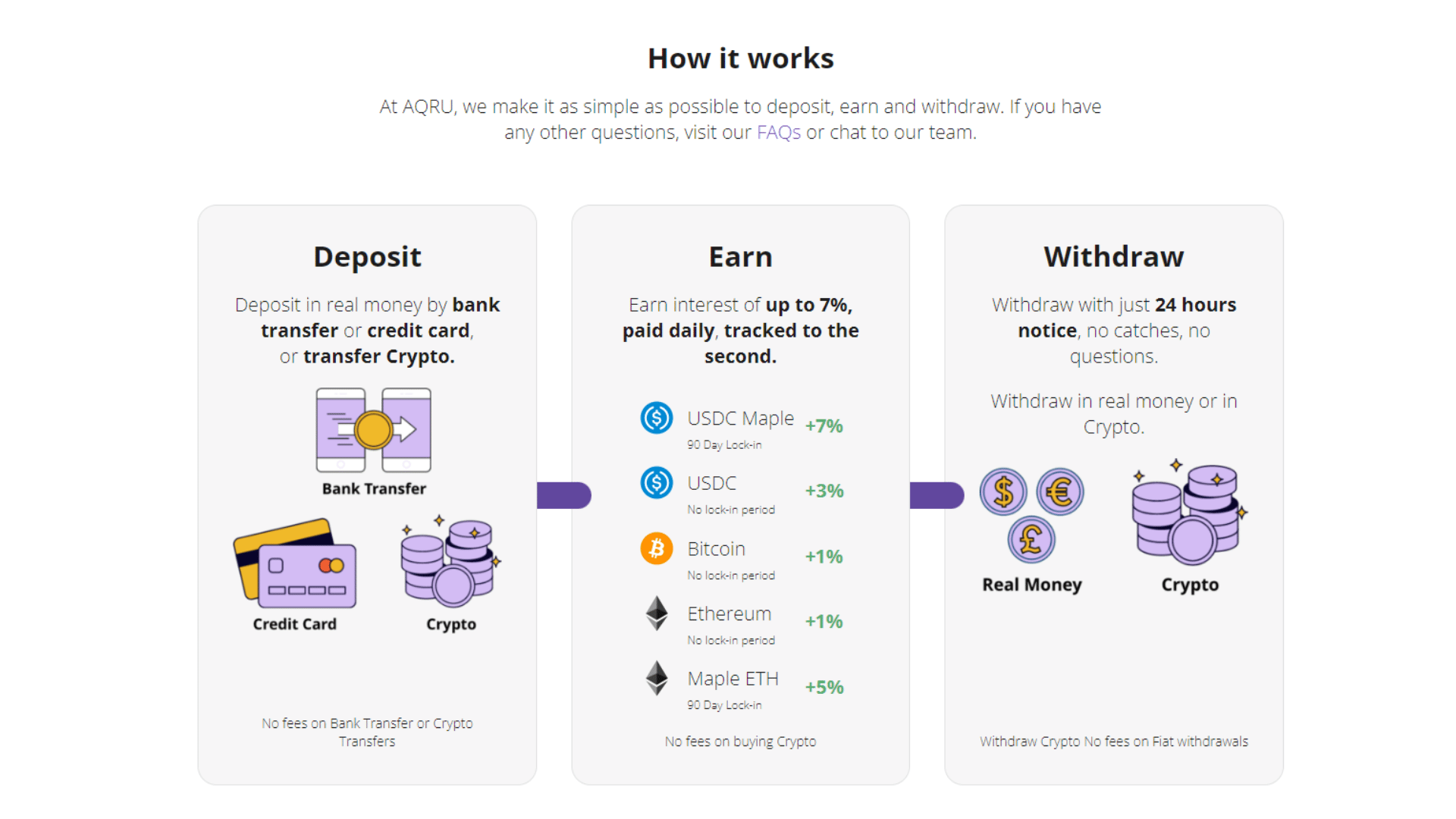

Source: Images from AQRU

AQRU is a lending platform that allows users to earn interest on their digital assets. It is one of the most popular DeFi lending platforms and has been used by many users to generate income from their digital assets.

AQRU offers a variety of features that make it an excellent choice for users looking to earn interest in their digital assets. AQRU is a decentralized platform that allows users to earn interest in their digital assets without going through a centralized entity. It means that users can earn interest on their digital assets without having to trust a central authority with their funds. AQRU also offers an excellent user interface that allows users to manage their digital assets and earn interest in them. AQRU’s user interface is designed to be user-friendly and easy to use.

Source: Images from AQRU

PROS:

- AQRU is one of the most popular and well-known DeFi lending platforms.

- It offers a wide range of features and services, making it an excellent choice for those looking for a comprehensive solution.

- AQRU has been around for a while, so it has a good track record.

- Its platform is user-friendly and easy to navigate.

CONS:

- AQRU’s fees can be on the high side, so it’s essential to compare them with other platforms before deciding to use this one.

- The platform can sometimes be slow, which can be frustrating for users.

- AQRU doesn’t offer as many lending options as some of the other platforms.

The platform currently supports BTC, ETH, LTC, XRP, and BCH. AQRU offers competitive interest rates and has a very user-friendly interface. One of the best things about AQRU is that it allows users to borrow against their deposited crypto assets.

So, if you need cash but don’t want to sell your crypto, AQRU is an excellent option. The platform also has a meager minimum deposit amount of just 0.01 BTC. If you’re looking for a lending platform that offers both high-interest rates and the ability to borrow against your deposited crypto, AQRU is an excellent option.

Regarding security, AQRU uses cold and hot storage for its user’s crypto assets. Cold storage is used for most users’ funds, while hot storage is used for a small percentage of funds to allow quick withdrawals. Overall, AQRU is a very safe and secure platform.

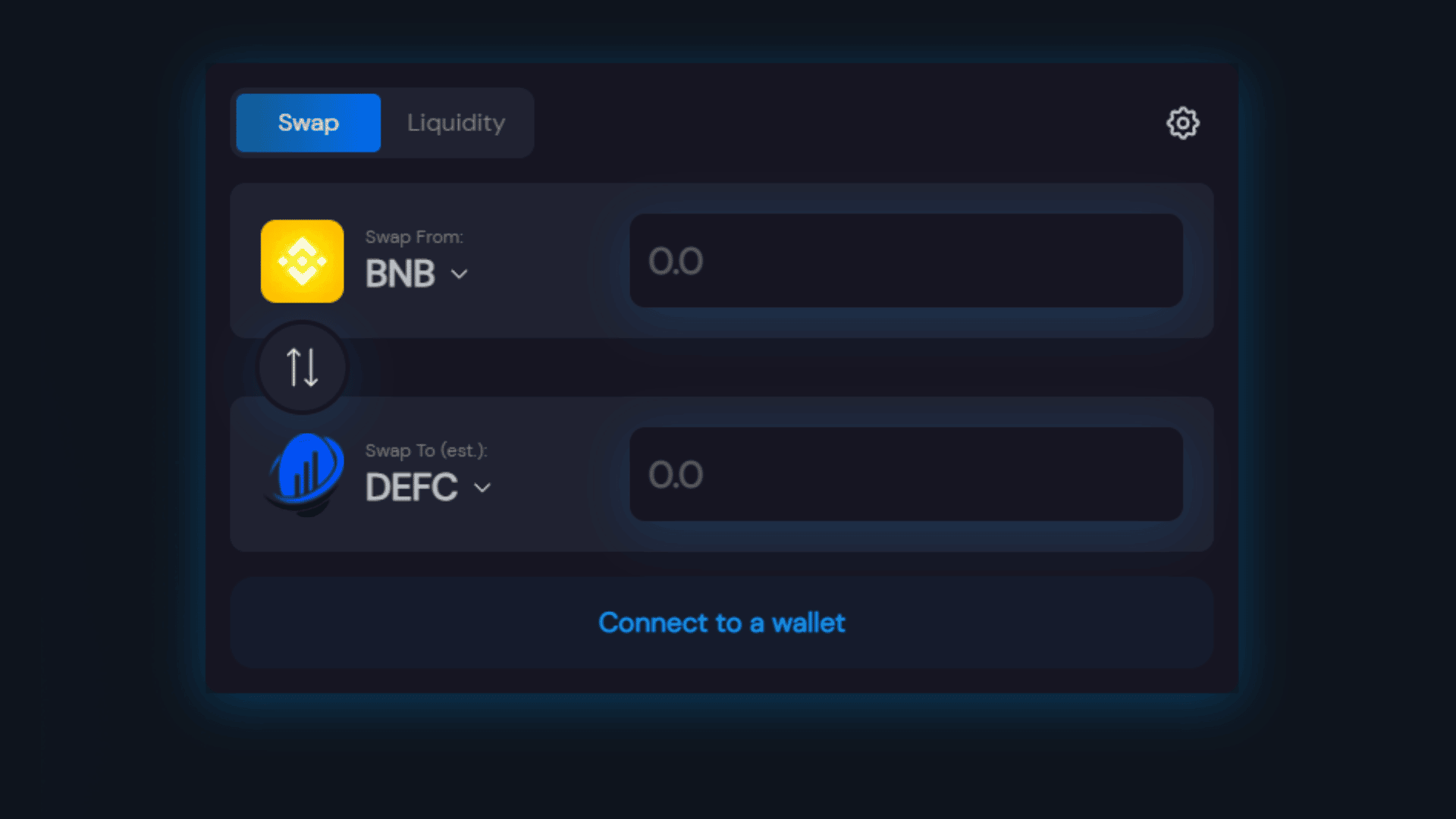

2.DeFi Swap

Source: Images from DeFi Swap

DeFi Swap is a decentralized lending platform that allows users to borrow and lend cryptocurrencies. The platform uses smart contracts to facilitate the lending and borrowing of cryptocurrencies. DeFi Swap is one of the world’s most popular DeFi lending platforms.

The platform allows users to earn interest on their deposited funds. The interest rates are variable and depend on the supply and demand of the platform. DeFi Swap also enables users to take out loans in cryptocurrencies. The loan terms are inconsistent and turn on the collateral the borrower deposits. It is a popular platform because it offers high security and transparency. The platform is also easy to use and has a user-friendly interface.

Source: Images from DeFi Swap

PROS:

- DeFi Swap is a trustless platform that doesn’t require any third party to hold your assets. It means there’s no counterparty risk involved in using the service.

- The platform is also non-custodial, meaning you always retain ownership of your funds.

- The platform supports various assets, including crypto, fiat, and even commodities.

- DeFi Swap is one of the most affordable DeFi lending platforms, with low fees and competitive rates.

CONS:

- Lack of customer support: One downside of DeFi Swap is that there is no customer support team to help you if you have any problems. It can be a problem if you’re not familiar with the platform and need some help.

- Limited payment options: DeFi Swap only supports a few payment methods, so you may not be able to use your preferred payment method. If you’re looking to trade on the platform, this is something to keep in mind.

- Lack of features: DeFi Swap is a reasonably primary platform, so it doesn’t have all the bells and whistles that some other exchanges do. It may not be a problem for experienced traders, but it could be an issue for newcomers.

3.Crypto.com

Source: Images from Crypto.com

Crypto.com is a crypto lending platform that offers up to 12% interest on your deposited cryptocurrency. They also offer a great referral program where you can earn up to $50 worth of CRO tokens for each friend you refer.

It is a digital asset platform that aims to make it easy for everyone to buy, sell, and use cryptocurrencies. Crypto.com is one of the most popular cryptocurrency platforms in the world, with over 2 million users.

PROS:

- Easy to use: The platform is designed to be easy to use, even for those unfamiliar with cryptocurrencies.

- Secure: Crypto.com takes security seriously and offers many features to keep your account safe, such as 2-factor authentication and a built-in wallet.

- Affordable: The platform has low fees and no hidden costs. You can also earn cashback on purchases made with the Crypto.com debit card.

- Rewarding: The platform offers a rewards program that allows you to earn CRO tokens when you refer friends or family to the platform.

CONS:

- The exchange is still in beta testing mode and has not been fully launched yet. This means that there are still some bugs that need to be worked out.

- The interface can be a bit confusing for new users.

Source: Images from Crypto.com

Crypto.com is worth trying! They offer excellent security features, a user-friendly interface, and a wide variety of cryptocurrencies. Overall, Crypto.com is a perfect option for a reliable and trustworthy crypto lending platform.

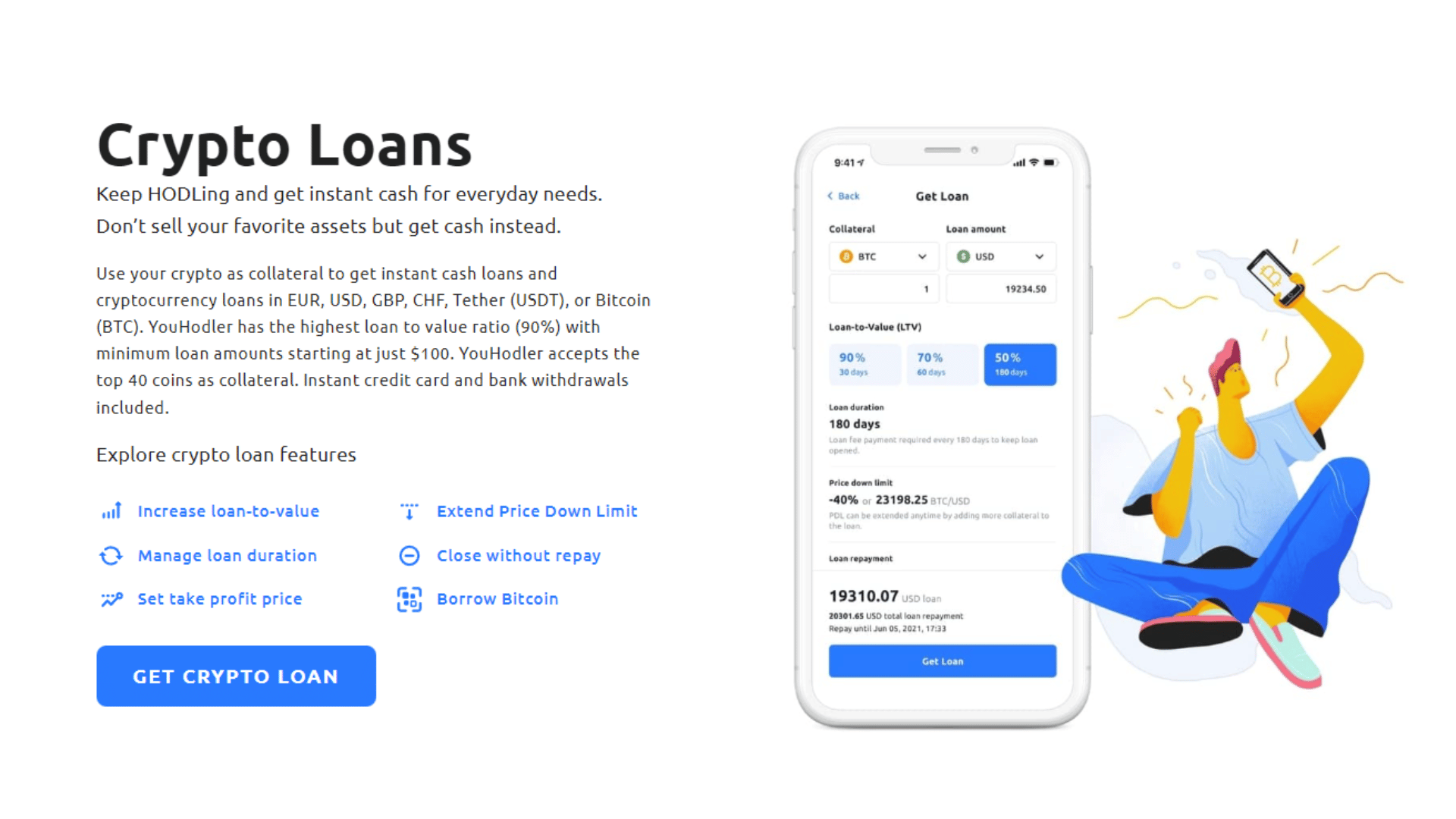

4.YouHodler

Source: Images from YouHoudler

YouHodler is a digital platform that allows users to securely store and invest their cryptocurrencies. The platform offers a variety of features including a multi-currency wallet, a portfolio tracker, and a range of investment tools. YouHodler also provides users with access to a range of lending services, allowing them to borrow against their cryptocurrency holdings.

Source: Images from YouHoudler

PROS:

- YouHodler is a universal crypto wallet that offers a one-stop solution for all your cryptocurrency needs.

- The wallet allows you to store, send, receive and exchange your cryptocurrencies.

- YouHodler also offers a built-in exchange which allows you to instantly convert your cryptocurrencies into other currencies.

- The wallet is available on both iOS and Android devices.

- YouHodler is a non-custodial wallet which means that you are the only one who has access to your private keys.

- The wallet also offers 2 Factor Authentication for added security.

- YouHodler is a Hierarchical Deterministic Wallet which means that your funds are always safe and secure.

CONS:

- YouHodler does not currently support all cryptocurrencies.

- The platform is not available in all countries.

- YouHodler charges a small fee for each transaction.

YouHodler is a great platform for those who want to invest in cryptocurrencies but do not want to risk losing their investment. YouHodler also offers a mobile app, which makes it even more convenient for users. The only downside of YouHodler is that it does not offer a lot of features and services as compared to other platforms. However, if you are looking for a platform that offers simple and straightforward borrowing and lending services, then YouHodler is the right choice for you.

5.Nexo

Source: Images from Nexo

Nexo is a lending platform that allows users to borrow against their crypto holdings. Nexo is one of the pioneering companies and has been operational since 2018. Nexo offers instant loans in over 45 fiat currencies and 10 digital assets. Loans are issued without any credit checks or employment verification. The interest on the loans is paid in the form of the underlying crypto asset, which means that users don’t have to sell their holdings to pay back the loan. Nexo has a mobile app (iOS and Android) as well as a web interface. The platform is available in over 200 countries.

PROS:

- Low interest rates (as low as 5%)

- No collateral needed

- Get your loan in less than 24 hours

- Option to choose fixed or variable interest rates

- Lend in over 45 different fiat currencies

CONS:

- Minimum loan amount of $500 worth of digital assets

- Not available in all countries

Nexo is one of the most popular decentralized lending platforms in the world. It offers a wide range of features and benefits that make it a great choice for those looking to take out a loan or earn interest on their digital assets. One of the best things about Nexo is that it allows you to use your crypto assets as collateral for a loan.

This means that you can take out a loan without having to sell your crypto assets. Another great thing about Nexo is that it offers competitive interest rates on loans. Interest rates on Nexo range from 5% to 12% APR depending on the asset being used as collateral. Nexo also has no hidden fees or charges. All you need to do to get started is to deposit your crypto assets into your Nexo account. Overall, Nexo is a great choice for those looking for a decentralized lending platform.

What Is DeFi?

DeFi, decentralized finance, is a growing ecosystem of financial protocols built on Ethereum. From lending and borrowing platforms to stablecoins and tokenized BTC, the DeFi ecosystem has launched an expansive network of integrated protocols that anyone can use. By deploying smart contracts on Ethereum, DeFi applications can offer their users unprecedented financial autonomy and opportunity.

For the uninitiated, getting started with DeFi can be a daunting task. There are many protocols and applications to choose from, and new ones seem to launch daily.

Why use DeFi?

There are many benefits of DeFi, including the ability to trade without intermediaries, increased security through decentralized exchanges, and improved liquidity. In addition, DeFi can help you earn interest on your cryptocurrency holdings and even take out loans using your crypto as collateral. With all of these potential benefits, it’s no wonder that more and more people are looking to get involved in the DeFi space.

If you’re thinking about investing in DeFi, there are a few things you should keep in mind. First, remember that DeFi is still a relatively new industry, and as such, it is subject to much more volatility than traditional markets. This means that you could potentially lose all of your investment, so only invest what you can afford to lose.

Second, because DeFi is built on the Ethereum blockchain, you’ll need to have some ETH in order to get started. If you don’t already own any ETH, you can purchase some on a cryptocurrency exchange. Finally, make sure to do your own research before investing in any DeFi project. There are a lot of scams out there, so it’s important to know what you’re getting into before you put any money down.

If you’re willing to take on the risks, investing in DeFi can be a great way to grow your cryptocurrency portfolio. With the right projects, you could see some massive returns in a relatively short period of time.

Are DeFi investments worth it?

The potential benefits of investing in DeFi are numerous. For one, decentralized applications tend to be much more accessible than traditional finance services. They’re often available 24/seven and can be used by anyone with an Internet connection. Additionally, many DeFi protocols offer their users significantly higher yields than what’s available from centralized platforms like banks or lending startups.

But as with any new and emerging technology, many risks are associated with investing in DeFi. These include the potential for technical issues or hacks and regulatory uncertainty. Additionally, because most DeFi protocols are built on Ethereum, they tend to be much more volatile than traditional financial assets.

So, are DeFi investments worth it? That depends on your risk tolerance and investment goals. If you’re looking for higher yields and are willing to stomach more volatility, then investing in DeFi could be a good option. However, if you’re risk-averse or looking for more stability, you may want to stick with more traditional investments.

What Is Passive Income?

Before we dive into the world of DeFi, let’s first take a step back and define what passive income is. Passive income is defined as earnings derived from a rental property, limited partnership, or other enterprises in which a person is not actively involved. So, instead of going to a job every day to earn money, you can make money through investments requiring little to no upkeep.

There are a few key characteristics that make passive income so desirable:

- It allows you to earn money without trading your time for dollars.

- It has the potential to generate consistent, predictable cash flow.

- If done correctly, it can provide you with financial independence and the ability to retire early.

Conclusion

There you have it! These are just a few things to remember if you’re considering investing in the DeFi space. Overall, investing in DeFi can be a great way to earn extra income without putting in a lot of effort. As always, do your research before putting any money down.

The 5 DeFi lending platforms reviewed above are great options if you want to earn interest in your cryptocurrency. Each platform has unique features and benefits, so be sure to research each one thoroughly before deciding which is suitable for you.

As always, it’s important to remember to diversify your portfolio and not put all your eggs in one basket. A lending platform should only be a small part of your overall cryptocurrency strategy.