We considered a variety of factors when compiling this list, including ease of use, features, customer support, and price.

Whether you’re a small business owner or an individual taxpayer, we’re confident that one of these products will meet your needs.

So without further ado, here are the 10 best professional tax preparation software solutions of 2022:

What are the best professional tax preparation software?

1. Intuit ProSeries Tax

ProSeries is a popular tax preparation software that offers users a lot of great features. The software comes in two versions, with the Professional version offering more features. The Professional version includes all of the features of the Standard version, plus additional features such as electronic filing, state tax return preparation, and support for multiple businesses.

Nick's Take

It seems to me that ProSeries has streamlined integration across the platform by allowing simple importing of financial data from QuickBooks and TXT.

Features:

- ProSeries allows users to plan their taxes by estimating withholdings, expenses, income, and payments for future years.

- Users can manage client signatures electronically with eSignature.

- The input guidance and forms make data entry easy, and the Undo and Redo features make fixing mistakes easy.

- Import your clients’ 1099-B, 1099-INT, and 1099-DIV data directly into ProSeries.

- The Forms bar helps you locate and fix errors quickly.

- Split a married filing joint return into two separate returns.

- Create a checklist of required information for this year’s return, based on last year’s return.

- Flag missing data and send an email to the client requesting all the missing data.

- The tax planner offers advisory tools to help you create custom tax plans for your clients.

Pricing:

ProSeries Basic

Basic 20 – $519/year

Basic 50 – $829/year

Basic Unlimited – $1,299/year

ProSeries Professional

Pay-Per-Return – $379/year

Choice 200 – Call Intuit for pricing

1040 Complete – $2079/year

Power Tax Library – Call Intuit for pricing

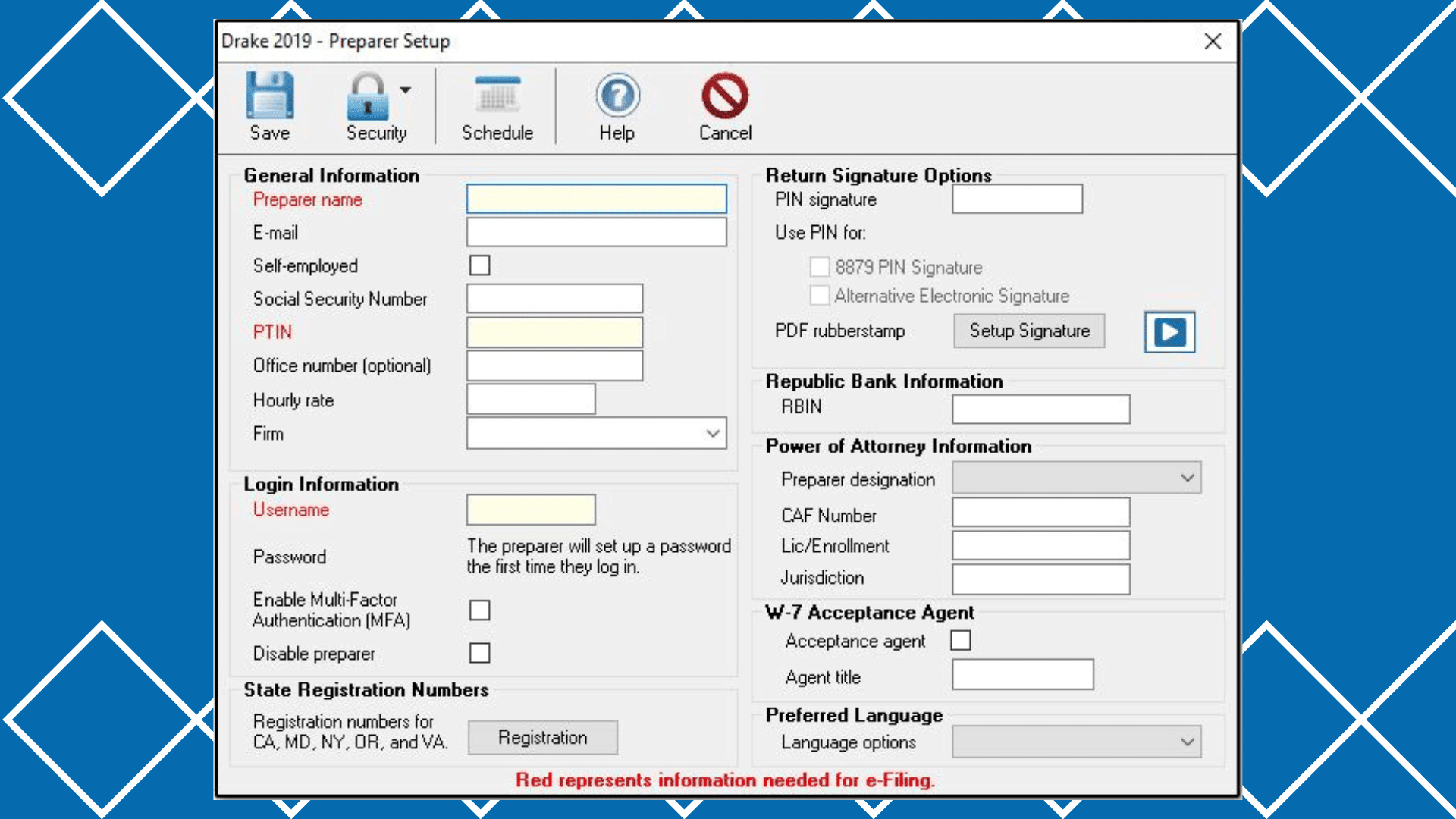

2. Drake Tax

Drake Tax is a comprehensive tax preparation software that supports a variety of tax forms and schedules. The software is easy to use and provides step-by-step guidance, making it a great choice for those who are new to tax preparation. In addition, the customer service team is available to help with any questions or problems that may arise.

Nick's Take

I believe that this software is popular among CPA firms with small and mid-size clients, as well as those serving small businesses. It supports a wide range of federal and state returns, automatic forms filing, and streamlined data entry.

Features:

- The user dashboard provides easy access to archived information.

- Drake Tax has features to prevent oversights that could lead to IRS rejections.

- The speed of Drake Tax helps you enter data quickly and easily, and reduces the number of keystrokes required.

- The Drake Tax Planner allows users to show clients how their marital status, dependents, income, and more can affect their taxes.

- The Amortization Schedule calculates loan payment amounts, interest or loan length.

- The Calculation Results display return info at a glance including error messages and notes about calculations performed.

- You can customize your print sets and order forms.

- Allows users to electronically obtain source documents from their clients that they will use in the tax preparation process.

Pricing:

Power Bundle – $1875

Unlimited – $1,725

Pay-Per-Return – $345

3. TaxAct Professional

TaxAct Professional is an affordable solution for small businesses and individual tax professionals. It offers a 30-day money-back guarantee, as well as payment acceptance and practice management features. The TaxAct ProAdvance package also provides resources to help you improve your practice, including digital marketing capabilities and access to a dedicated support team.

Nick's Take

From my perspective, TaxAct Professional is a great option for accounting firms on a budget.

Features:

- The support team is available via phone and email, so you have easy access to assistance should you need it.

- There are several add-ons that allow you to customize the software based on your needs, including payment acceptance and practice management features.

- You can also access digital marketing capabilities and facilitate client returns.

- You can choose between an on-site application or having it hosted on the provider’s servers for cloud access.

- Import options allow you to quickly and easily import your past files into TaxAct.

- The e-signature feature allows you to securely sign documents with clients.

- Reports and tools make it easy to provide clients with customized tax planning information.

- The document manager allows you to save encrypted copies of documents from clients.

- The online data backup lets you backup client returns to TaxAct’s secure servers for 7 years beyond the filing deadline.

Pricing:

Professional Federal Editions – $150

1040 Bundle – $735

Complete Bundle – $1475

4. TaxSlayer Pro

TaxSlayer is a comprehensive tax preparation software solution that offers a user-friendly interface, mobile app, and extensive filing features. Thousands of tax professionals use TaxSlayer Pro each year to help their clients file their taxes accurately and efficiently.

Nick's Take

I think that TaxSlayer Pro is great for independent professionals and larger firms.

Features:

- Unlimited filing and business returns with bank products.

- Has a depreciation module that allows users to easily enter their client’s assets and select the correct depreciation method.

- Bank products allow your clients to deduct your preparation fees from their refunds, meaning there are no out-of-pocket expenses.

- A mobile app that allows you to reach more clients and prepare tax returns in less time.

- TaxSlayer Pro files returns for all 45 US states, including business and personal income tax returns.

- Offers unlimited support with year-round availability.

- Offers a range of features to simplify the tax process, including paperless office and full corporate business suite.

Pricing:

Web – $1495

Premium – $1595

Classic – $1295

5. TurboTax

TurboTax is a market leader in providing virtual assistance for tax preparation and filing and offers a wide range of features and services to its customers. TurboTax covers all types of small businesses, from sole proprietorships to S corporations, and has an easy-to-use online interface that makes it simple and straightforward to file your taxes.

Nick's Take

It seems to me that TurboTax is perfect for business owners who want to prepare their taxes on the go as you can use it either online or offline.

Features:

- Includes robust technical support that is available 24/7, including evenings and weekends.

- Offers both excellent user interfaces and built-in guidance.

- TurboTax Live is an option that includes access to a CPA or tax expert on-demand.

- The import feature for cryptocurrency transactions is great.

- Offers audit support after you file your taxes.

- Has a MAX package which includes additional protection against identity theft in tax season.

- The TurboTax app is a great way to file your taxes from your phone or tablet.

- TaxCaster is a free deductions estimator that will help you understand your tax situation.

Pricing:

Free Edition – $0

Deluxe – $59

Premier – $89

Self-Employed – $119

6. ATX Tax

ATX is a reliable and popular tax software. It’s a great choice for small to medium-sized businesses that need to comply with corporate and business clients. ATX has a vast and comprehensive tax form library, making it easy to find the right form for your needs.

Nick's Take

It seems to me that ATX’s diagnostic system is helpful in identifying e-filing errors and tracking refunds or balances due, while its form library makes it easy to find the right form for your needs.

Features:

- The interview tool helps prevent mistakes and saves time.

- ATX offers a great multi-tasking platform for accountants who need to work on multiple forms at once.

- The Interview feature is a great way to quickly and easily fill out tax returns.

- Ability to file your taxes online and receive immediate results, as well as 24/7 customer support.

- Tax Organizer is a handy tool for adding additional information to open tax returns.

- The ATX Solution Center provides access to the knowledge base, which is a repository of information on all ATX-related queries.

Pricing:

ATX 1040 – $899

ATX Max – $2069

ATX Total Tax Office – $3069

ATX Advantage – $5029

7. H&R Block

H&R Block is a well-known tax preparation company that provides representation in the event of an audit. The software accuracy guarantee offers reimbursement for penalties or interest charges. The H&R Block filing program is easy to use and can help you get things done quickly.

Nick's Take

From my perspective, If you’re looking for dependable, comprehensive tax preparation software that won’t break the bank, H&R Block is your go-to choice.

Features:

- H&R Block offers five federal e-files, including audit support.

- Starting your taxes without a CD is easy and painless.

- H&R Block takes accuracy seriously and will review your returns for an extra fee.

- Offers a range of tax preparation options to suit different needs and preferences.

- The Max Refund Guarantee feature guarantees that you will get the largest refund possible.

- H&R Block provides experienced tax professionals to help you with your taxes.

- The upfront pricing allows you to know the cost of tax prep before starting, ensuring no surprises.

Pricing:

Basic – $19.95

Deluxe + State – $44.95

Premium – $64.95

Premium & Business – $79.95

8. Credit Karma Tax

Credit Karma Tax is the best professional tax preparation software available. It is designed to help small taxpayers who do not need expert help filing taxes. The software guarantees you a maximum refund and offers access to customer service if needed.

Nick's Take

It seems to me that Credit Karma is a great option for those looking for affordable and accurate tax preparation.

Features:

- You’ll be able to file your state and federal taxes at no cost, receive guaranteed refunds, and access expert help if needed.

- The majority of the features are free of charge, which makes this software very affordable.

- Credit Karma Tax is very accurate when it comes to filing taxes, leaving no room for error.

- The app is also very fast and efficient.

- The tax calculator is a useful addition, allowing you to estimate your returns in advance before filing them.

- Credit Karma Tax offers a maximum refund guarantee – as long as you’re entitled to it – so there’s no need to worry about missing out on anything important!

- Overall, Credit Karma Tax is an excellent option for those who want something simple and affordable to use when filing their taxes

Pricing:

Credit Karma offers a free online tax preparation service.

9. FreeTaxUSA

FreeTaxUSA is one of the best professional tax preparation software solutions available. It offers a clean and professional interface, helpful tools, and excellent mobile apps. It also differentiates itself from other tax preparation websites by offering a variety of package options for taxpayers of all levels of experience.

Nick's Take

It seems to me that FreeTaxUSA is a great resource because it simplifies the tax process.

Features:

- You can opt to have your tax refund deposited electronically, have it loaded onto a prepaid debit card, or have a paper check mailed to you.

- The audit assistance feature gives you access to a specialist who’ll help you get through the IRS notice or audit process.

- FreeTaxUSA will store your completed tax returns in your account for up to seven years.

- You can extend your filing deadline by filing Form 4868.

- FreeTaxUSA offers live chat support which is available Monday-Friday from 10 am-9 pm EST, except on holidays.

- The software is accurate and guaranteed 100% accurate.

- FreeImport makes it easy to switch from another tax preparation software.

Pricing:

FreeTaxUSA offers a free online tax preparation service.

10. Free File Alliance

The Free File Alliance is a coalition of tax software companies that have partnered with the IRS to provide free online tax filing services to eligible taxpayers. The Free File Alliance is available in 21 languages and serves over 100 million taxpayers.

Nick's Take

I think that the software partners with the IRS to provide you with accurate and up-to-date information about your rights as a citizen, which is vital before preparing taxes.

Features:

- The IRS offers a free 1040 tax return online.

- IRS Free File allows you to file your taxes for free if your AGI is less than $73,000.

- The software partners with the IRS to provide you with accurate and up-to-date information about your rights as a citizen, which is vital before preparing taxes.

- The software is reliable and has a no-cost tax filing option that makes it one of the most popular free options.

- OLT offers an easy-to-use platform that helps you file your taxes online, making them easier and faster for you to complete.

Pricing:

FreeTaxUSA offers a free online tax preparation service.

What is a tax software?

Tax software is a type of software program designed to support taxpayers in preparing and filing income tax returns. According to Christopher Jervis, an Annual Filing Season Program (AFSP) tax preparer and managing partner of Lone Wolf Financial Services, LLC, “it functions as a step-by-step guide, calculator, and to a lesser extent, an organizer.

You won’t need to manually complete your taxes if you use tax software because it automates the procedure. It can help you follow the most recent tax laws and regulations while saving you a lot of time, money, and aggravation. Tax software will automatically determine how much tax you owe or how much of a refund you may anticipate once you input your tax information on your W-2s, 1099s, and other pertinent forms.

Tax software will probably make the process of filing your taxes much more bearable, even if you have little to no experience with taxes. It may make it unnecessary to work with a specialist like a CPA. Fortunately, the majority of consumer-based tax software is simple to use and made with non-tax professionals in mind.

How does tax software work?

Numerous taxpayers can benefit greatly from tax software. It is designed so that the average taxpayer can understand the numerous nuances in the tax code and makes the process of preparing taxes much more efficient.

The majority of consumer tax software uses one of two interfaces:

Tax software based on interviews: The most prevalent kind of tax software is interview-based software, which is typically the easiest to use. You don’t have to be aware of where a particular piece of information needs to be reported on a return. Interview-based software, on the other hand, has a question-and-answer format that makes filing easier and places the right information where you need it.

Software for tax forms: Form-based tax software is designed to look like various tax forms and documents. It requires that you enter the correct data into the appropriate boxes on your tax documents.

The following are some of the most typical features found in both interview-based and form-based software:

File electronically: Almost all tax software allows for e-filing, which the IRS prefers because it is safer and speeds up processing and reduces errors.

Indefinite storage: You can easily access your returns and save time when filing them by using many tax software programs that store them in the cloud for several years.

Returns by state: Although all tax software programs are geared toward filing federal returns, the majority of them also provide the option to file state returns.

Diagnostics: According to Robert Gauvreau, a certified public accountant (CPA) at Gauvreau & Associates, tax software will indicate whether you failed to provide the necessary information and prevent you from filing your return until you correct the errors. You are required to provide, for instance, your Social Security number. The tax software will notify you if you enter an invalid number.

Assistance: Assistance is included in some form with almost every tax software. One might have a library of fundamental tax laws, while another might have a “Help” feature or live chat to support you if you get jammed.

Suggestions for credit and deductions: Rich Rhodes, the founder of First Tax Relief, claims that tax software can suggest which tax deductions and credits you might be eligible for. However, you will need to decide if you actually meet the requirements.

Factors to consider when choosing the best professional tax preparation software

There are a few things to keep in mind when looking at online tax software options. Make sure the program you choose supports the forms you need to file if you are aware of them. Check to see if state tax filing is included in the initial cost or if it will cost an additional fee if you need to do so. Software that accurately locates and applies various deductions and credits is a significant time saver if you are looking for the largest federal tax return.

The tax software’s accuracy may be the most significant aspect of all. If you are audited by the Internal Revenue Service (IRS) and find that you owe the government money due to errors or omissions, no matter how quickly it completes the task or how simple it is to use, any money you initially saved will be ineffective.

It’s not enough to just look at interface screenshots and choose the cheapest tax software. Function and precision are paramount.

Platform

A lot of tax programs are online or have mobile apps, so you can do your taxes from pretty much anywhere. However, not all programs are compatible with all platforms. Is the software compatible with a PC or Mac for home or office filing? Will a mobile app that lets you file paperwork or checks your financial situation work on both Android and iOS phones? Before making a purchase, check to see if the software runs on the platforms you prefer. Flexibility and compatibility are key here.

Options for Disbursement

Another thing to think about is how you’ll get your money if you have to file a federal return. This can be made simple with direct deposit and PayPal options provided by some software. Indeed, even a customary check via mail is normally accessible in the event that that is your inclination. Gift cards and prefilled debit cards are two examples of delivery methods that are only supported by some programs. Check to see if the software you’re considering supports the method of payment that works best for you.

Deductions and Credits

There are hundreds of tax deductions and credits in a database that is kept up by any tax software that is worth its salt. It is difficult to determine whether your software will overlook opportunities for you to reduce your tax burden unless you know for certain how the company has integrated deductions into its system. Ask the representatives of the company in detail how the software handles credits and deductions and how you can ensure its accuracy. The majority of online tax software programs perform an accuracy check to guarantee precision; inquire about this feature with company representatives.

Tax Preparers

Accidents do occur, even with the most comprehensive tax software. It is advantageous to have a skilled tax preparer on your side in the event of errors. The services of some of the leading businesses’ tax preparers are either included in the purchase price or can be purchased separately. When comparing tax software, keep this option in mind if you anticipate requiring assistance.

Technical and Customer Support

It’s important to have good technical support and good customer service. If something goes wrong, you want staff members who are trustworthy, helpful, and willing to respond to your requests. Before making a decision, get to know the company you’re considering; Don’t compromise on value here because good tech support can turn a crisis into a minor inconvenience.

Ease of Use

The majority of online tax systems are easy to learn and use once you get used to the user interface, but it’s always a good idea to give them a try before spending any money. You don’t want to discover that the software you bought is difficult to use which makes it even more difficult to complete your tax forms.

Free software demos are offered by many tax software companies. Ask for one if a company doesn’t have one on its website. On the off chance that the supplier denies it, look at that as a warning. The majority of reputable businesses will permit you to test their software.

Options for Filing

The variety of forms that a tax software application can file is one of its most crucial features. Check to see that it supports the necessary forms. If you choose the right pricing tier, you should be able to find what you need because most leading software programs support a wide range of forms.

In addition to federal taxes, you should think about state taxes. Does the software include all of the necessary state forms? Does it charge an extra expense for state returns? Provided that this is true, how much?

Price

Most internet-based charge programming merchants have a few plans with layered evaluation, so the expense relies upon your necessities. Because each software option has its own mix of features and pricing structure, you should figure out which features you need before comparing products. While the less expensive options may meet your requirements, software with more advanced features typically costs more.

There are numerous inexpensive tax software options available, but some of them skimp or lack essential features. Others can file their taxes with great success. It all depends on your specific requirements, but when looking at software, don’t just go with the cheapest option.

Conclusion

When it comes to choosing the best professional tax preparation software, there are a lot of options to consider. However, the programs on this list are some of the best available and offer a variety of features to make tax preparation easy and efficient. So what are you waiting for? Start your search today and find the perfect software for you!