Check out these top KYC software providers of 2022!

What are the best KYC software providers for 2022?

Trulioo is a provider of global identity verification solutions. The company’s dataset gives users privacy-compliant access to 5 billion identities globally. Via Trulioo’s APIs, companies can conduct robust KYC and AML audits. The company’s KYC vetting process is efficient, scalable, and on-demand.

Nick's Take

With Trulioo’s reliable data, you’ll be able to vet your customers quickly and easily, eliminating the need for time-consuming manual processes.

Features:

– A quick search on Trulioo reveals verification results for you to make intelligent business decisions.

– Trulioo’s powerful matching engines enable it to cross-match and compare identified information in minutes.

– Trulioo’s information is based on reliable data sources, including government files and documents, mobile carriers, marketing firms, credit card bureaus, public records, and utilities.

– Trulioo is the world’s leading identity verification marketplace.

– Validates identity data against independent data sources.

– Provides ID Document Verification and Business Verification services to help companies verify the details of their customers and employees.

Pricing:

Trulioo offers three flexible, pay-as-you-go plans for GlobalGateway.

SumSub is a platform that automates all antifraud and compliance procedures. It offers a wide range of benefits, such as streamlined data management, real-time alerts, and comprehensive reporting. The platform is easy to use and can be accessed from any device or computer. SumSub facilitates the submission of multiple forms of documentation, including passports, driving licenses, and ID cards. It also offers a variety of customization options to ensure that the user experience is tailored to each company’s needs.

Nick's Take

The SumSub platform is a centralized KYC solution that allows users to submit their personal and business data in one place.

Features:

– The AI-based solution automates all antifraud and compliance procedures, providing customer data storage to protect and enable a positive customer experience.

– Provides an improved verification process that reduces the time spent on manual tasks, freeing up valuable resources for more important work.

– Secure data storage system helps organizations keep sensitive information safe, granting users access to their profiles anytime.

– Rapid deployment capabilities make it ideal for fast-paced businesses that need an effective antifraud solution in a hurry.

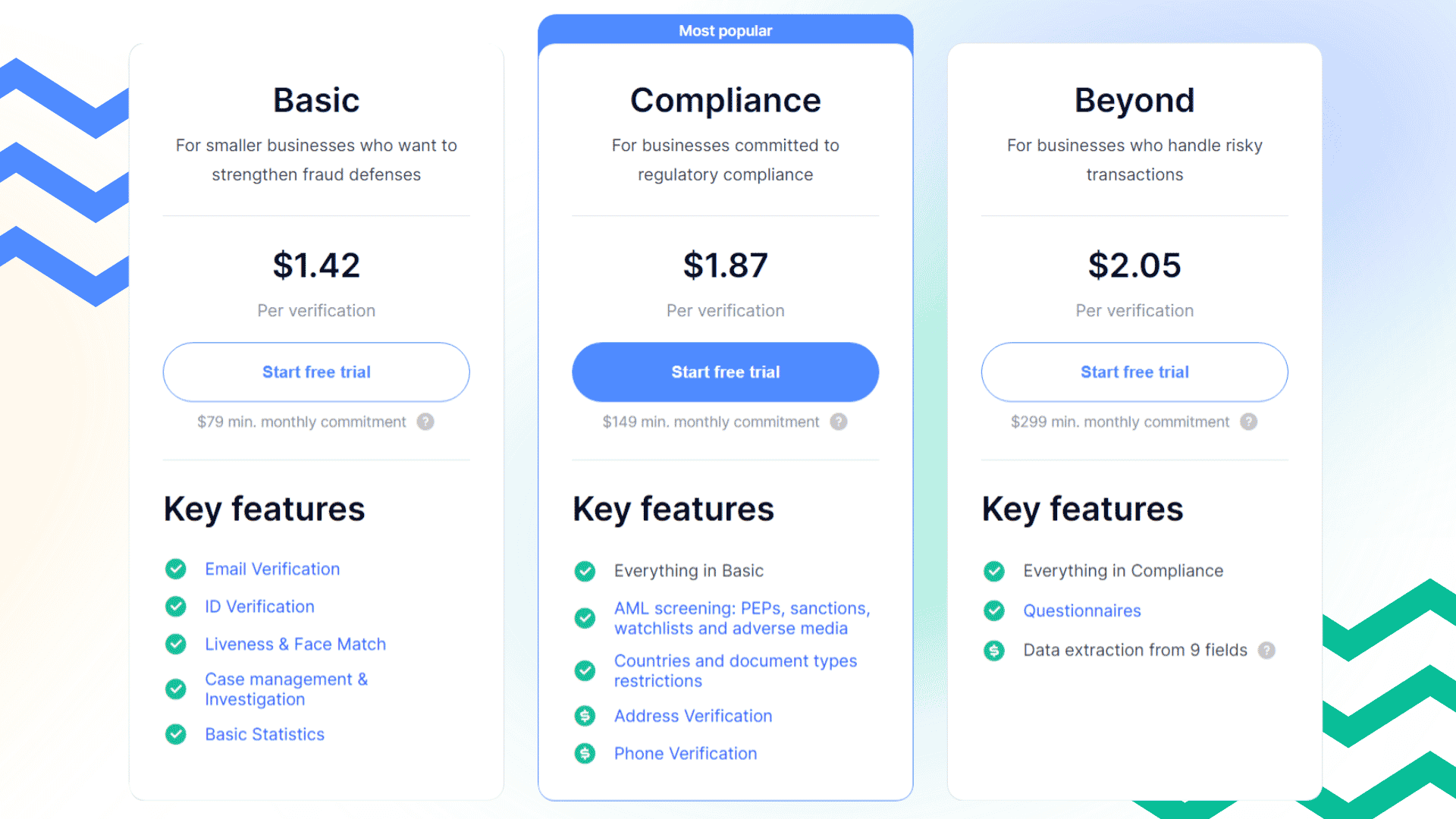

Pricing:

Basic – $1.42 per verification

Compliance – $1.87 per verification

Beyond – $2.05 per verification

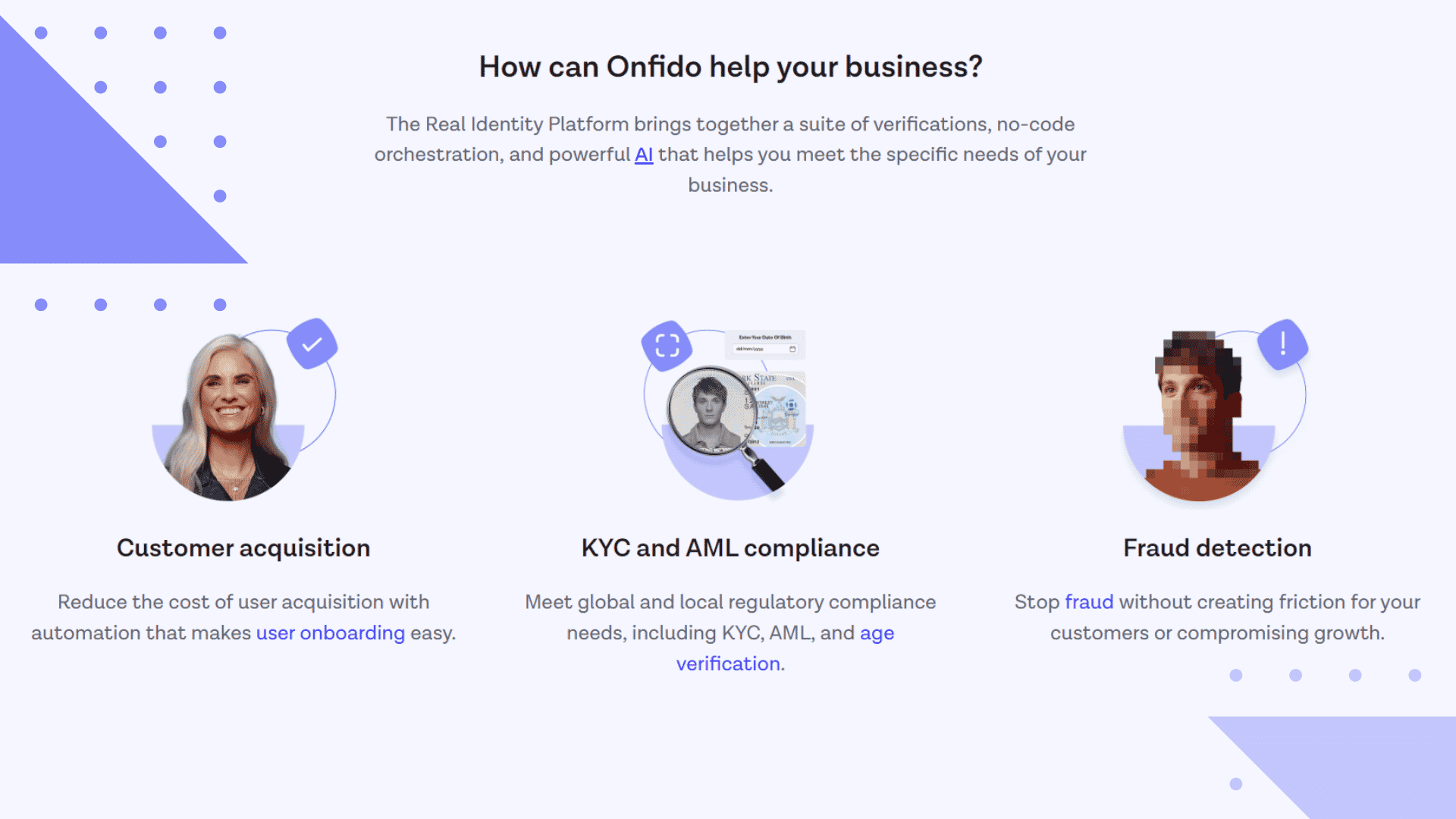

Onfido is a private technology firm that offers a range of services focused on the background checking industry. Onfido has dedicated software engineers, designers, product specialists, and customer service staff who are committed to providing the best possible experience for their customers. Onfido is one of the best KYC software providers for 2022 due to its wide range of features, user-friendly interface, and accurate and reliable data.

Nick's Take

Offers a wide range of services to help you stay safe online, including identity verification, fraud prevention, and more.

Features:

– Smart Capture SDK allows easy integration with your existing applications.

– Full automation sets smart conditions within your workflows to automate decision-making and improve turnaround time, clear rates, and fraud detection accuracy.

– Offers pinpoint accuracy with over 10,000 micro-models that specialize in individual tasks.

– Workflow Builder that allows you to create verification flows that take each customer on the right path.

– Onfido Studio is a powerful orchestration layer that helps you build and optimize identity verification flows.

– Verification Suite allows you to navigate KYC and AML compliance at scale.

Pricing:

Pricing information is supplied by the software provider or retrieved from publicly accessible pricing materials.

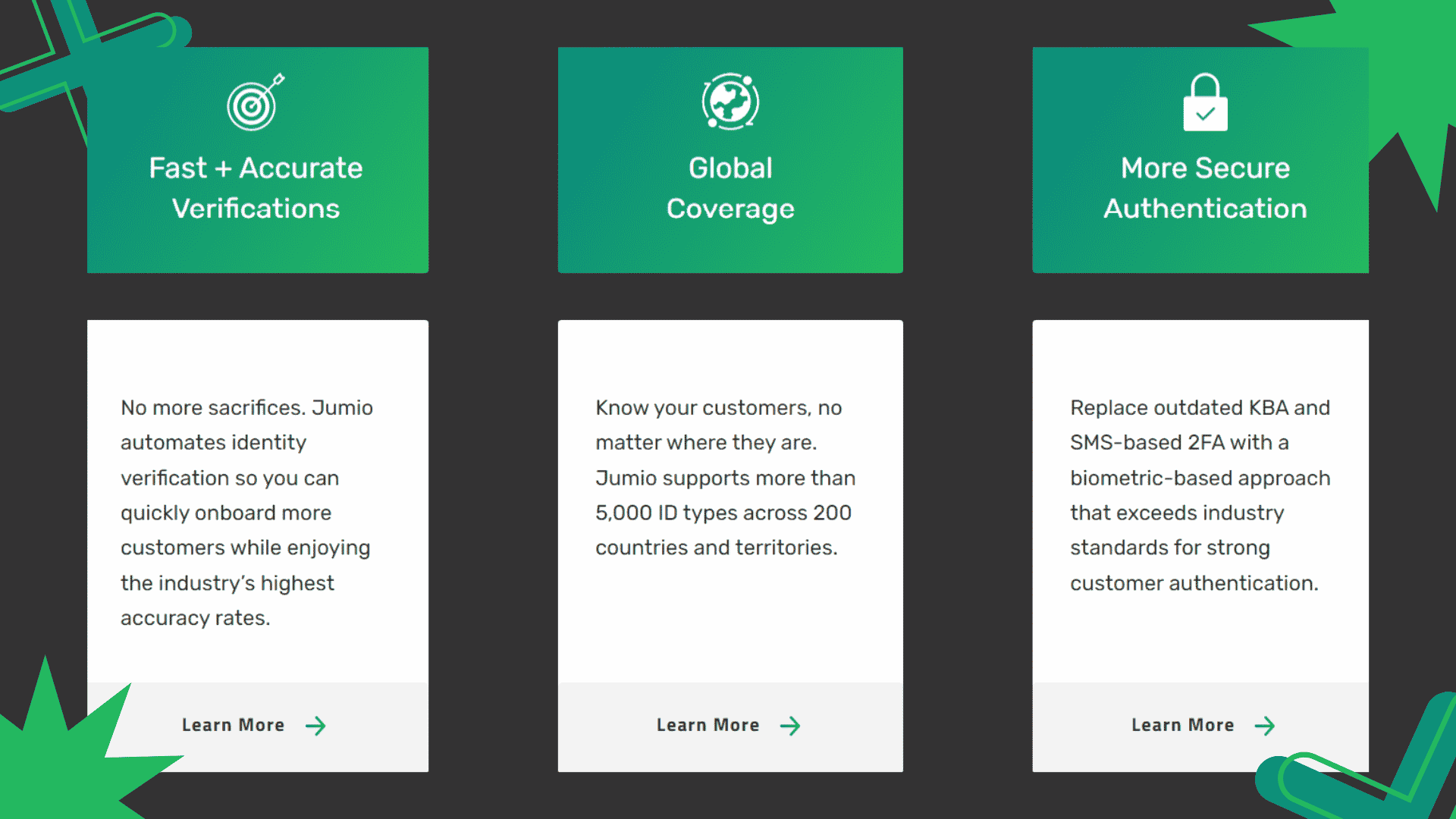

Jumio is a dependable KYC software provider that offers various features and services to businesses to help them verify the identity of their customers. The organization employs AI, biometrics, machine learning and validated liveness detection to help an organization convert more consumers faster. Jumio also has a free-to-use database of organization identities which allows for easy identification of customers and compliance with regulatory requirements.

Nick's Take

Jumio’s technology combines Artificial Intelligence, trusted data sources, and expert human reviewers to offer the industry’s most powerful yet simplest solution.

Features:

– Machine learning models that have been trained on hundreds of millions of real-world identity verifications.

– Big data solutions that are intelligently tagged with the data relevant to your business needs

– Jumio audits identity verification transactions to ensure the accuracy of their system.

– Certified liveness detection provider that helps thwart fraudsters who are increasingly using spoofing attacks.

– Supports all the possible versions and permutations of each type of ID document

– Jumio’s tools help you to reduce false positives in your AML transactions monitoring.

Pricing:

Jumio provides pricing information to the customer or retrieved from publicly accessible pricing materials.

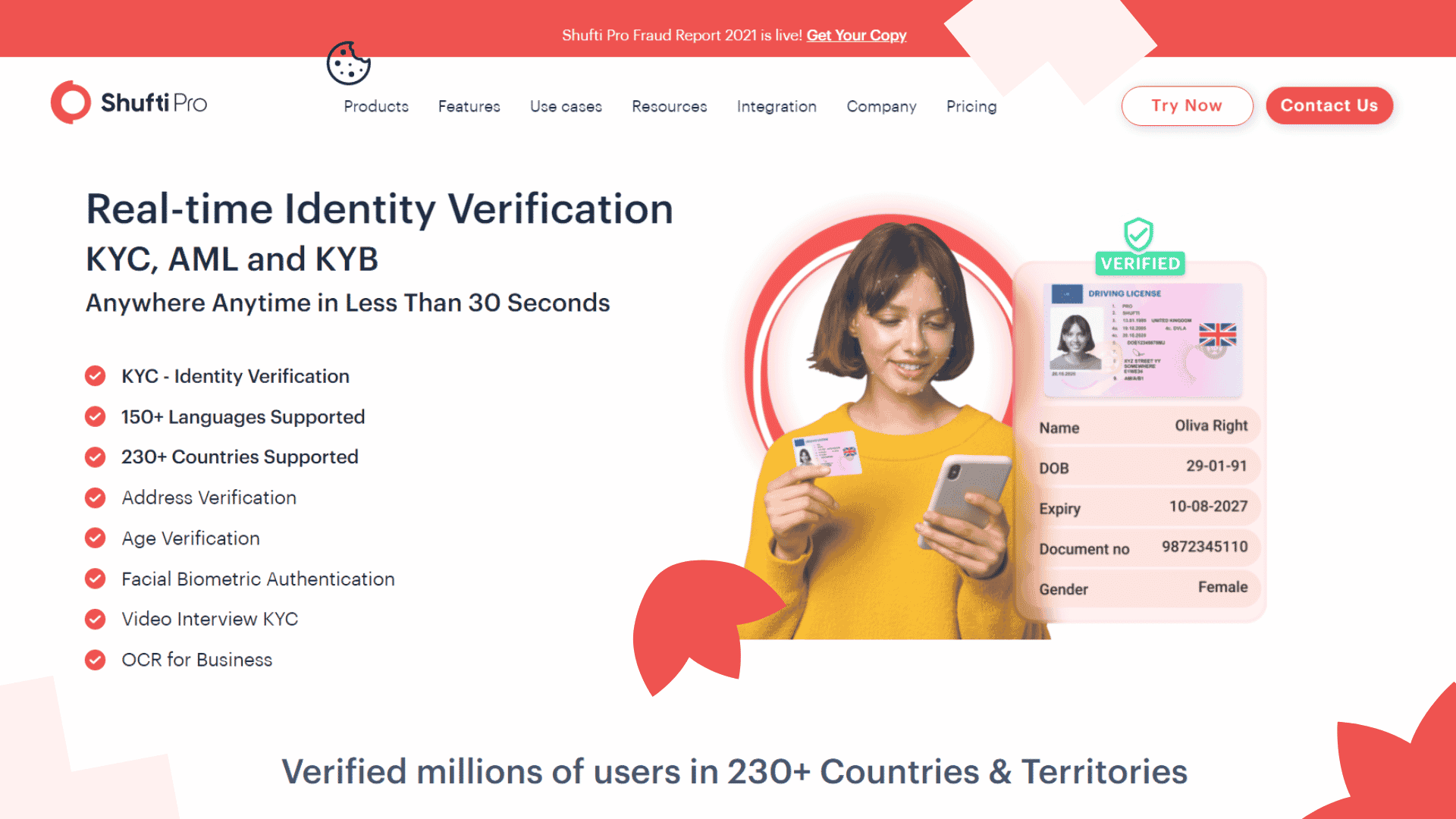

Shufti Pro

Shufti Pro is one of the best KYC software providers in the market and is known for its Know Your Customer (KYC) compliance capabilities. The company will be making a statement at stand A 147 at the RDS Arena in Dublin, focusing on providing an innovative and efficient solution that is perfect for businesses of all sizes.

Nick's Take

With its easy-to-use interface and powerful GPT-3 AI-based writing software, this platform is perfect for beginners and SEO professionals.

Features:

– The platform offers advanced features: SERP guided AI writing software, detailed SERP analysis, and more—Shufti Pro has everything you need to produce great content for your website or blog.

– Reduced research time with tools like Google Trends: Unlike other tools that require multiple steps (such as keyword research), Shufti Pro provides all of this information in one place so that researching keywords is easier than ever!

– Employs AI and HI hybrid technology to provide robust identity verification solutions.

– Shufti Pro has high-end technology like biometric facial recognition, liveness detection, and anti-spoofing techniques which allows its clients to trust their data in a secure way

– Provides an SDK to help businesses develop custom applications that use the system. Secondly, the Shufti Pro API provides many opportunities for integrations with software products

– Shufti Pro’s AML tools enhance security by checking for politically exposed persons.

Pricing:

Shufti Pro offers two different plans: the Pay-As-You-Go plan and Monthly Commitment, which can be found on Shuti Pro’s pricing page.

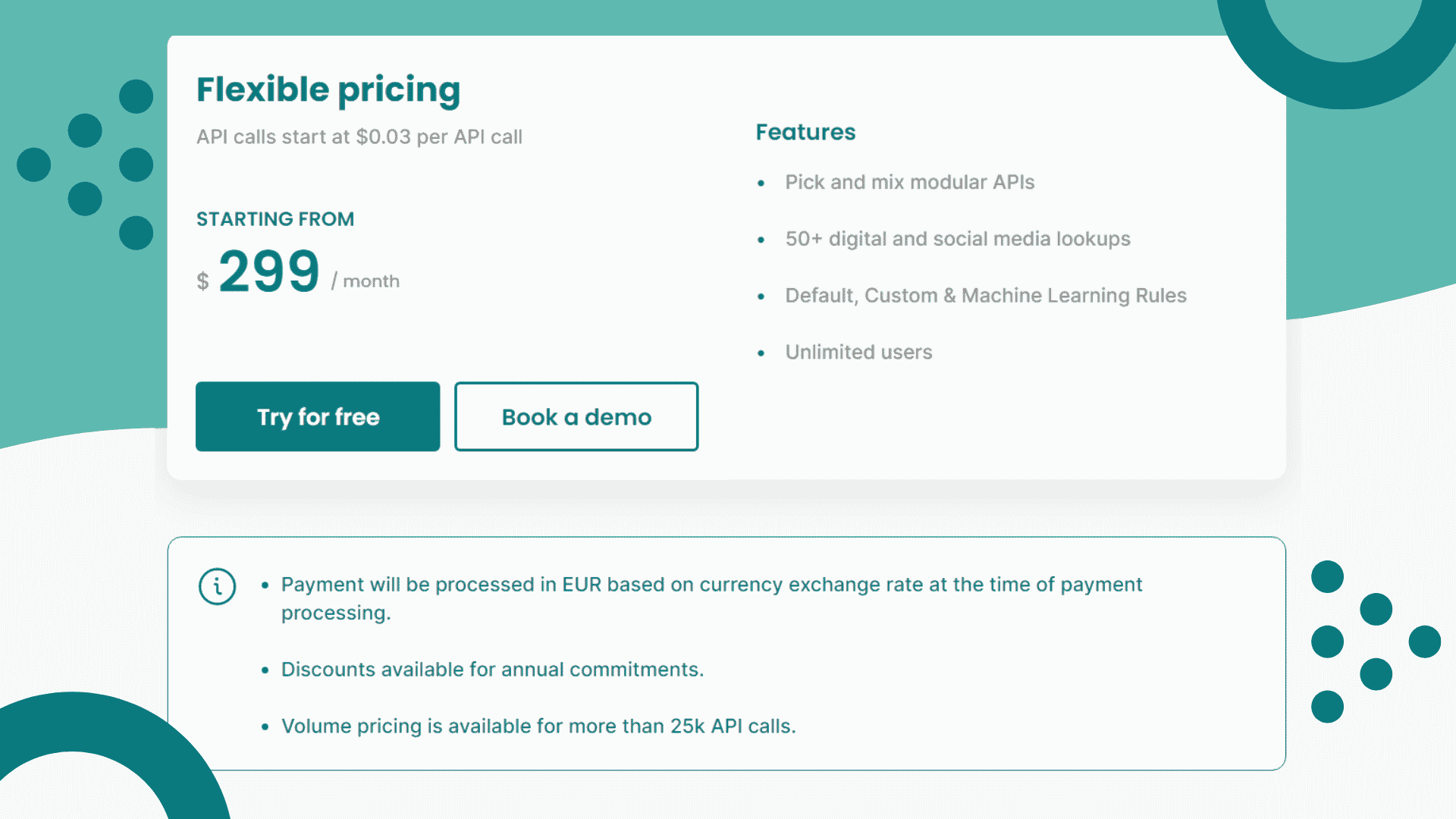

SEON

SEON is a software provider that offers fast, frictionless KYC checks. Its tools give you insightful data points thanks to reverse phone lookup, reverse email analysis, and device fingerprinting. SEON is a pre-KYC filter or tool for extra info during a manual review.

Nick's Take

SEON does not provide full KYC functionality but it can save companies a lot of time and money spent on KYC by weeding out fraudulent users before they reach that crucial step.

Features:

– With SEON, your business can quickly and easily identify fraudulent or questionable users before they reach the crucial step of a KYC process.

– With device fingerprinting and risk scoring, SEON gives you insightful data points that help you make smart decisions about who to let through your doors.

– SEON is fast and frictionless – getting results in split seconds via API.

– SEON includes device fingerprinting and risk scoring – giving you insights into user behavior that other tools simply don’t have access to.

– SEON aggregates data from 50+ online platforms for user information.

– SEON includes device fingerprinting and risk scoring – giving you insights into user behavior that other tools simply don’t have access to.

Pricing:

SEON is a KYC software provider that offers a range of services starting from $299 per month.

Refinitiv

Refinitiv is a data analytics company that specializes in KYC and AML compliance. The company’s human-vetted data allows banks to comply with KYC and AML checks. Refinitiv focuses on top-tier financial institutions, meaning you’ll likely get a higher quote than if you were to use another provider. You must contact the sales team for a quote before using Refinitiv’s services.

Nick's Take

Refinitiv is a top-tier provider of KYC software focusing on financial institutions. If you’re looking for a comprehensive solution that will meet the needs of your investment banking and asset management customers, then Refinitiv is the right choice.

Features:

– Data-focused company: Refinitiv specializes in keeping an extensive financial data catalog which they use to help clients with KYC (know your customer) and AML (anti-money laundering).

– They provide leading data and insights, trading platforms, and open data and technology platforms that connect a thriving global financial markets community.

– Digital identification or “Digital ID” can be authenticated unambiguously through a digital channel, unlocking access to banking, government benefits, and education services among other things.

– Offers insights into the behavior and activities of third parties to help ensure compliance with regulations.

– Offers various due diligence services to help organizations manage and mitigate risk.

– With its updated real-time interface and ability to store documents by specific titles, it makes it easy to keep track of your audit reports and correlating documents.

KYC-Chain is a technology provider that offers blockchain KYC solutions. The company helps over half a million customers create accounts in various industries. KYC-Chain has a bank-grade compliance toolkit that can scan over 10,000 data sources in 240 counties with a response time of 30 seconds. The company is gaining traction in the crypto world but is still in its infancy and requires mass adoption to be truly valuable. No information is available online about KYC-Chain’s pricing.

Nick's Take

This company is dedicated to providing innovative solutions that help businesses verify the identities of their customers.

Features:

– Blockchain ID verification: KYC-Chain uses blockchain technology to verify identities, which is an innovative approach.

– Not only does it use blockchain technology for ID verification, it also has traction in the crypto world.

– Allows you to screen your clients for associated criminal or prohibited activities in real time.

– Offers flexible and scalable solutions that can be customized to your requirements.

– Provides the most advanced technologies to comply with GDPR, KYC, AML, CRS, MIFID, and FACTA laws globally.

– Makes document verification extremely easy using algorithm validity checks with the quotation-based pricing strategy.

– Useful to manage B2B workflow that allows the organization to optimally maintain their end-to-end KYC process for corporate firms and individuals.

Token of Trust is a provider of KYC software tools that help businesses verify the identity of their customers. The company offers various tools, including identity verification, biometric authentication, and age verification. Token of Trust is available in numerous markets worldwide an its pricing is at the higher end of the spectrum.

Nick's Take

Excellent global KYC and AML coverage: Judging from online reviews, customers seem to be satisfied with the results that Token of Trust delivers in numerous markets around the world.

Features:

– Uses location details, risk, and confidence indicators to facilitate international identity verification and digital footprint analysis.

– Configurable workflows allow businesses to set rules for automatically handling the approval process.

– Has a real-world verification module that enables organizations to accept scanned government photo identities.

– Token of Trust collects information from multiple sources in a unified database.

– Token of Trust is a cloud-based anti-money laundering solution designed to help online merchants authenticate data and validate the identity of individuals.

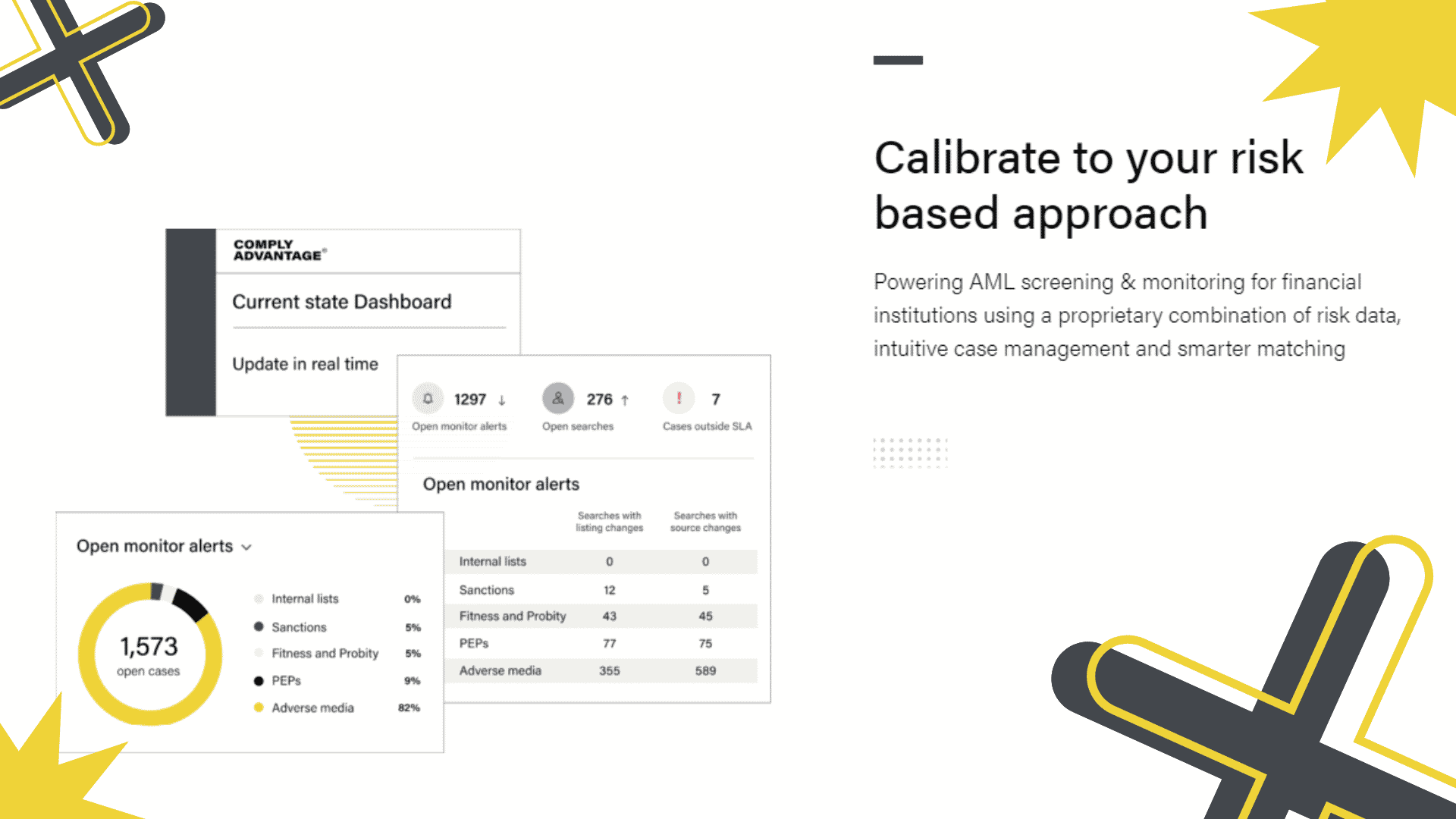

ComplyAdvantage is a private company that helps businesses control their finances by providing real-time financial crime insight. The company was founded in 2014 and is based in the United Kingdom. ComplyAdvantage automates customer screening to reduce false positives by 70%.

Nick's Take

This platform allows businesses to move away from manual customer screenings and rely on our sophisticated algorithms to make quick and accurate decisions.

Features:

– With our Real-time Financial Crime Intelligence, you’ll be able to automate your customer screening processes and reduce the number of erroneous notifications by 70%.

– Identifies tens of thousands of risk events from millions of structured and unstructured data points every day.

– Offers PEP screening, transaction monitoring, case management, risk assessment, and SARs in one place.

– Designed for Windows platforms and provides end-to-end solutions.

– Has a range of clients in the ICO and cryptocurrency space.

– Proprietary combination of risk data, intuitive case management, and more innovative matching allows it to provide the best KYC software providers for financial institutions in 2022.

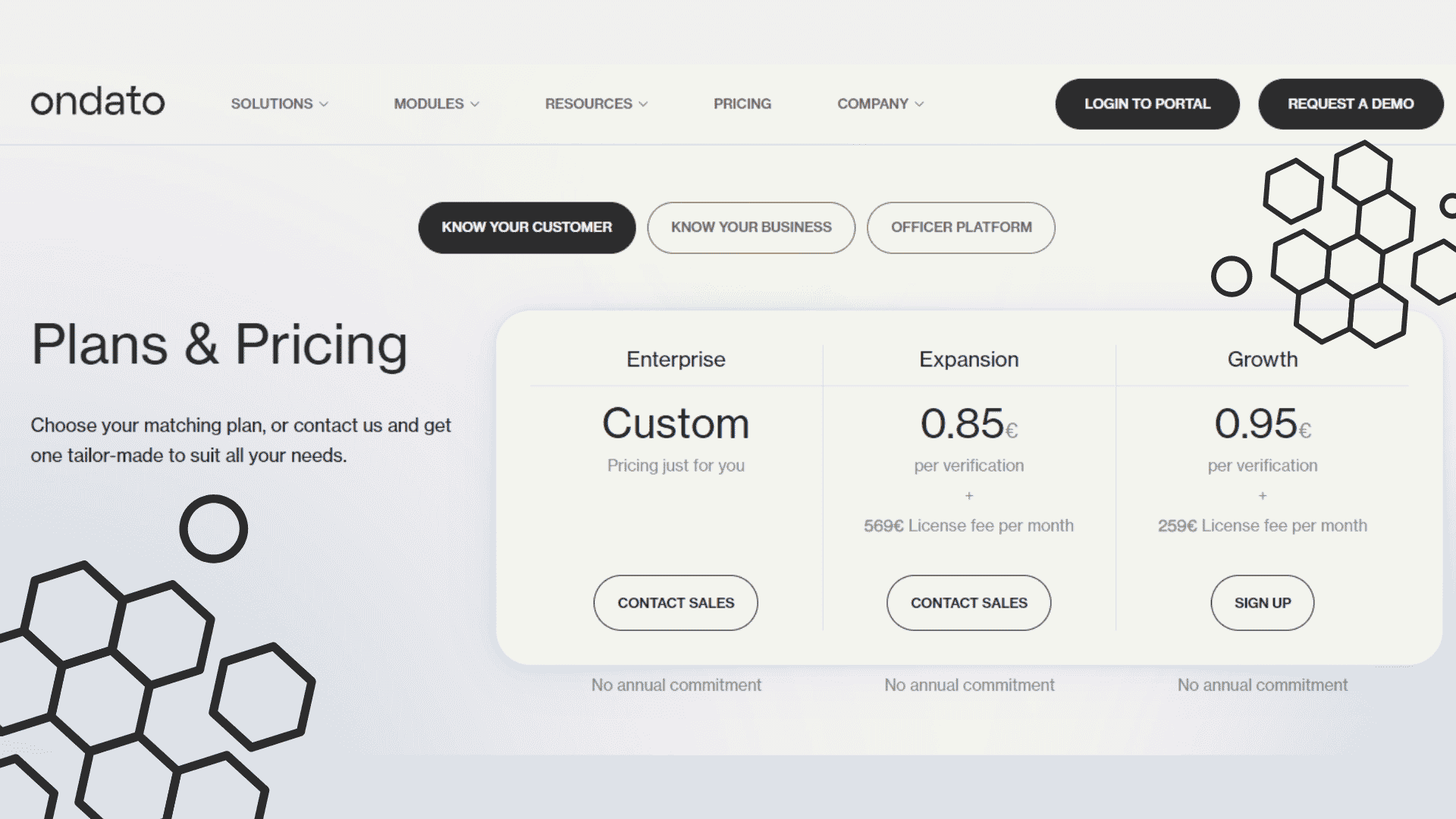

Ondato is a tech company that streamlines KYC and AML-related processes. Ondato helps businesses grow globally by providing KYC compliance solutions in 192 countries and accepting over 10,000 different types of documents. With an average onboarding time of just 60 seconds, it also improves the customer experience.

Nick's Take

Ondato offers due diligence services that help businesses identify potential risks associated with their customers.

Features:

– Provides authentication services to protect businesses against fraud and identity theft

– Provides solutions in 192 countries: Accepts over 10,000 different types of documents from around the world, making it an excellent option for companies looking to expand their reach worldwide.

– Compliant with many global standards, such as PCI DSS and GDPR.

– Has a customer data platform that allows businesses to manage their customer data efficiently.

– Solutions include many different areas of banking: From authentication to virtual branch management; from fraud prevention to enterprise resource planning (ERP).

– Offers a free trial with full functionality. This trial is available to individuals and businesses alike.

Pricing:

Enterprise – Custom

Expansion – 0.85€ per verification + 569€ License fee per month

Growth – 0.95€ per verification + 259€ License fee per month

What is KYC software?

KYC software assists companies in meeting Know Your Customer (KYC) legal requirements. In other words, it helps companies verify their customers’ identities. This is important because it helps to prevent money laundering, terrorist financing, and other financial crimes.

These requirements are clearly defined for specific industries such as banking or financial products. However, even if your company does not fall into one of these regulated industries, you may still need to comply with KYC regulations if you offer certain types of products or services.

KYC software will help you learn a user’s first and last name, as well as an address and an ID document. This information can be used to verify the customer’s identity and prevent fraud.

Overall, KYC software is a valuable tool for any company that needs to comply with KYC regulations.

How can KYC software help with AML compliance?

KYC software can help with AML compliance in a number of ways. The software can check for AML features, such as Politically Exposed People and transactions over a certain threshold. Additionally, the software can monitor transactions to ensure that they comply with AML regulations.

How to choose the right KYC software provider?

When choosing a KYC software provider, it is important to consider the user experience for each employee who will interact with the software and your customers. It is also important to test the software’s verification capabilities and to assess the speed of the KYC verification procedure. Furthermore, it is beneficial to get the opinions of people who have used the software and to read online reviews in order to see how the software holds up over time.

How to get started with the best KYC software provider?

When it comes to KYC software providers, it is important to do your research and find one that best suits your needs. Many vendors offer free trials, so be sure to take advantage of this and test the software from all angles. It is also helpful to get the opinions of people who have used the software, in order to get a complete understanding of its performance.

What are the trends in KYC software?

KYC software is constantly evolving to keep up with the latest trends and best practices. Some of the latest trends in KYC software include frictionless data enrichment, document verification, pay-as-you-go pricing, and AML features.

Frictionless data enrichment allows you to collect more information about users without asking for official documents. This can be done through social media research or by using data aggregators. Document verification helps to determine if an ID is valid, fake, or stolen. Pay as you go pricing means that your KYC software prices will scale along with your usage. AML features help to check for money laundering activity by looking at Politically Exposed People or monitoring transactions over a certain threshold.

Conclusion

There’s no doubt that KYC compliance is a complex and ever-changing landscape. But with the right KYC software in place, you can stay ahead of the curve and keep your business compliant. So what are you waiting for? Go sign up with the best KYC software provider today!