Knowing which is right for you can be challenging with many available options.

To help you make the best decision for your needs, we’ve compiled a list of the 12 best money management software options for 2022.

What are the 12 best money management software options for 2022?

1. Mint

Mint is a free personal finance app that gives you a complete picture of your finances in one place. You can use Mint to track your bills, bank accounts, credit cards, investments, and more. Mint also provides you with a free credit score and financial advice. Mint is one of the most popular money management apps, and for a good reason. It’s free to use and gives you a complete picture of your finances.

Nick's Take

I think Mint is one of the best money management apps out there. It’s free to use, gives you a complete picture of your finances, and gives you a free credit score and financial advice.

Features

- Provides a free credit score and financial advice

- Free to use

- Mint’s ease of use and intelligent personal finance features make it a favorite among users.

- Budgeting with Mint is easy – all you need to do is create budget categories and track monthly spending!

- The software updates transactions automatically as you go, so you never have to worry about forgetting what was spent or how much money you have left in each category.

- As your net worth grows over time, Mint keeps track of it all – so you can be confident in knowing exactly where your money is going!

- It’s simple and comprehensive, so it appeals to financial novices and seasoned Money Managers. Its ease of use and intelligent personal finance features make it a favorite among users.

- Mint integrates with accounts and cards easily, flags areas where improvements are needed and allows users to set personalized alerts for bills that require payment or low balances, so they’re always kept up-to-date on their finances.

Pricing

Mint is a free online money management software.

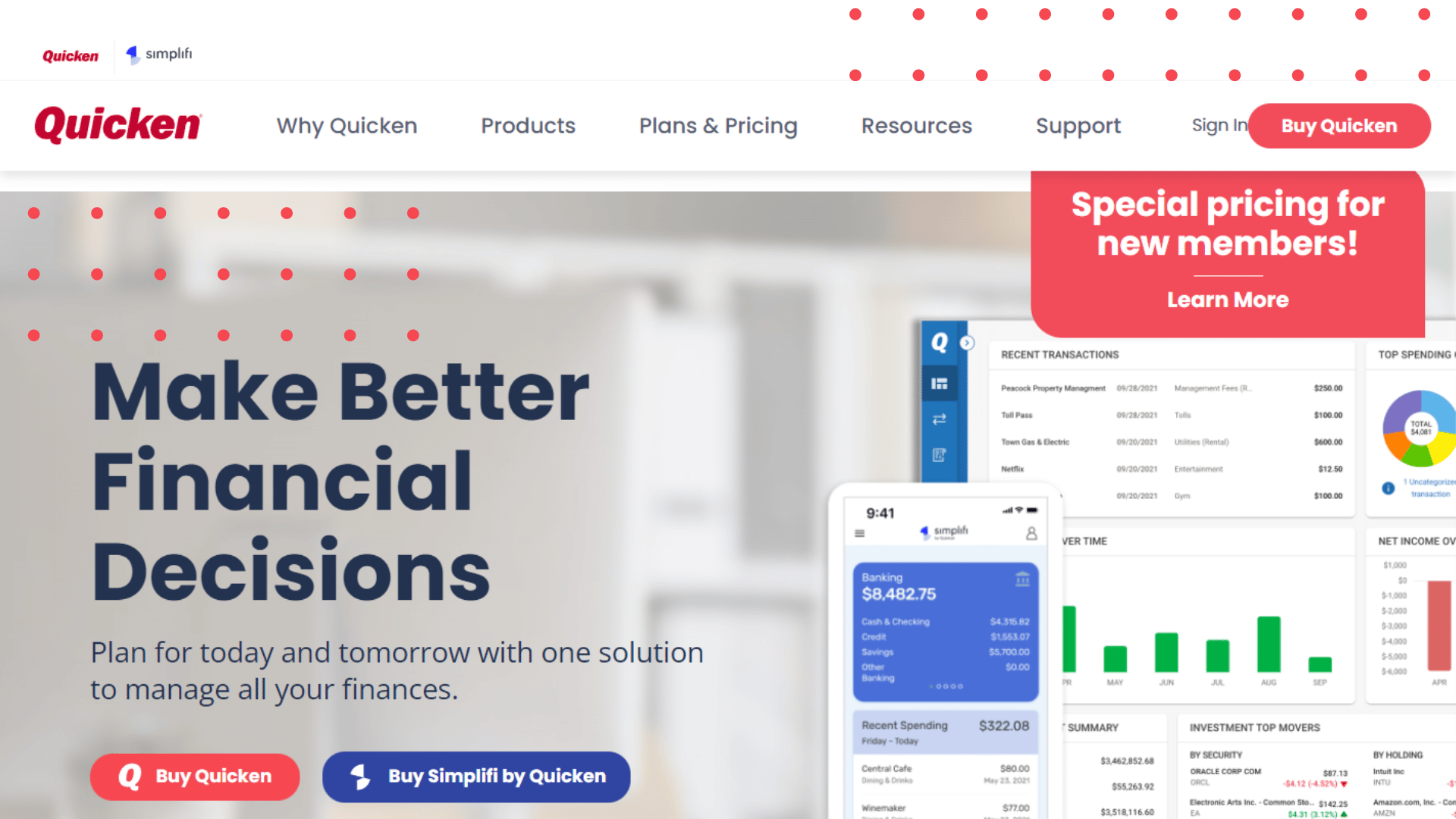

2. Quicken

Quicken is a financial management software that allows users to track their spending, budget, and investments in one place. It also provides features like bill pay and credit score tracking. Quicken is available for both Windows and Mac. Quicken also offers a mobile app so users can access their finances.

Nick's Take

Quicken is a great money management tool for those who want to see all their finances in one place. The software includes features like budgeting, tracking investments, and managing bills.

Features

- Budgeting

- Tracking investments

- Mobile app

- It offers various features to simplify everything from budgeting to paying bills.

- It has tools to help you track debts, create a savings plan, and even calculate your net worth.

- You can access your data anywhere with Quicken’s versatile desktop and app versions and its online backup service.

- It supports Excel export, so you can easily share your data with others.

Pricing

Quicken pricing starts at $3.99 per year for the Deluxe version. It also offers a 30-day trial.

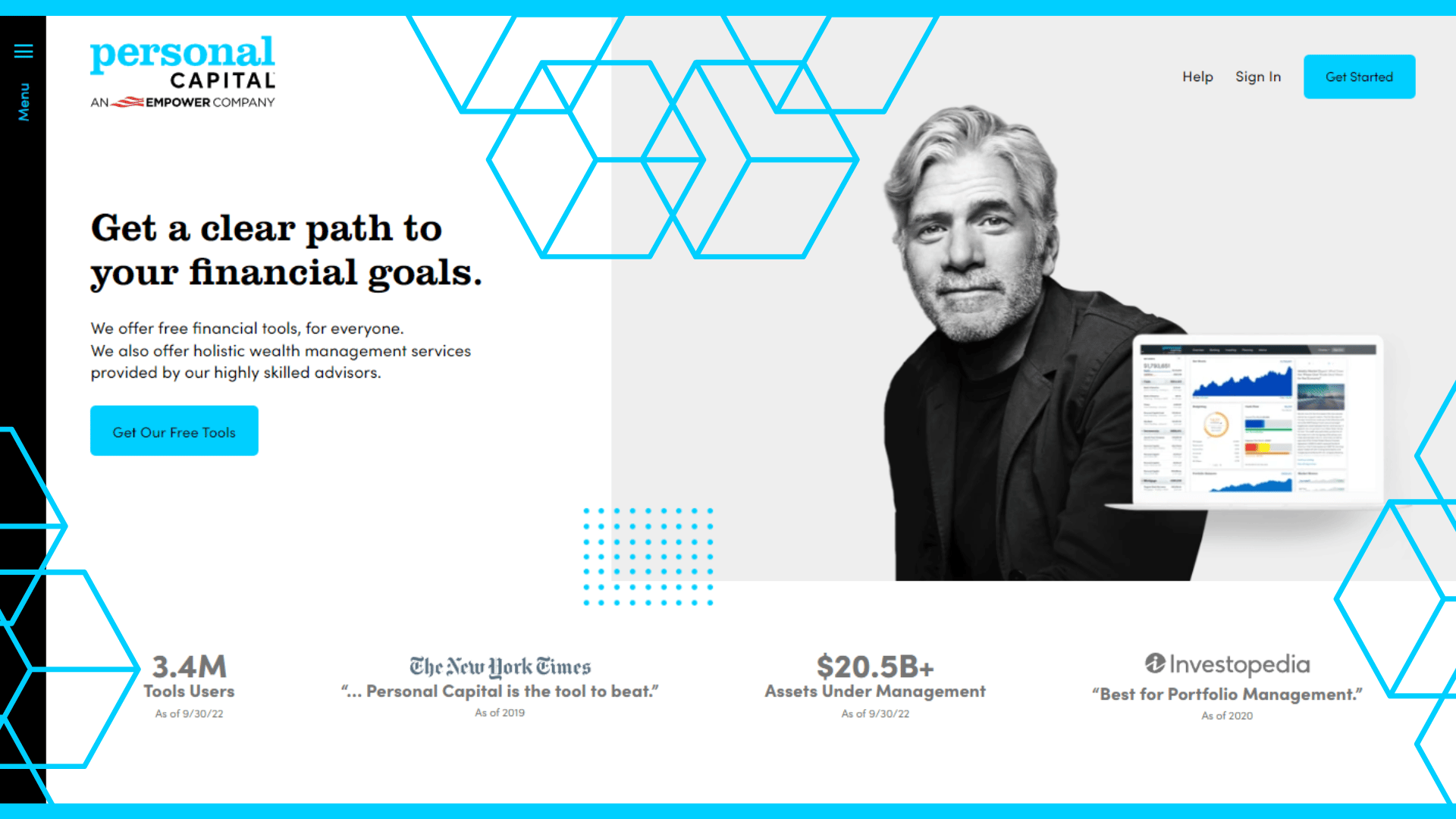

Personal Capital is one of the newer money management software options on the market, but it has quickly become a favorite among many users. The software provides an overview of your financial situation by linking your accounts and tracking your spending. It also offers investment advice and guidance, which can be helpful if you’re trying to save for a specific goal. Personal Capital is an excellent choice for quality personal finance software. It offers free budgeting and investment tracking tools and provides comprehensive tracking of various accounts. It also has the bonus of being available for both Windows and Mac platforms.

Nick's Take

I think Personal Capital is an excellent choice if you’re looking for a comprehensive money management software option. The software is easy to use and provides many helpful features, including investment advice and guidance.

Features

- Linking of accounts: Personal Capital links your accounts so you can get an overview of your financial situation.

- Tracking of spending: The software tracks your spending and provides insights into where you are spending your money.

- Investment advise and guidance: Personal Capital provides investment advice and guidance, which can be helpful if you’re trying to save for a specific goal.

- The service’s free budgeting tool allows you to track income, spending, and saving over time. It then breaks down your spending habits into categories, allowing you to view transactions by date, merchant, or vendor so you can analyze each purchase.

- In addition to budgeting, Personal Capital also excels in investment tracking.

- Personal Capital is available for Windows and Mac platforms, making it a versatile choice for anyone looking for quality unique finance software.

- You can add various accounts to the platform, including investments, loans, and bank accounts, all of which are tracked comprehensively through Personal Capital’s already powerful investment tracking features.

Pricing

Personal Capital is free to use.

4. Acorns

Acorns is an app that helps you invest your spare change. It rounds up your purchases to the nearest dollar and invests that money in a portfolio of ETFs. Acorns also offers a variety of other investing and saving products, including IRA accounts. Acorns is a money management software that helps you invest your spare change and grow your wealth over time. The app rounds up your purchases to the nearest dollar and invests the difference into a portfolio of ETFs. Acorns also offers a variety of other features, including retirement planning and cash-back rewards from select retailers.

Nick's Take

I think Acorns is a great money management software for beginners looking to start investing. The app makes it easy to start saving and investing your spare change, and the other features are a nice bonus.

Features

- Rounding up your purchases to the nearest dollar and investing the difference into a portfolio of ETFs

- Cash-back rewards from select retailers

- With their various portfolio options, Acorns can help you save for retirement, spend more brilliantly, and earn more.

- Due to its comprehensive features and competitive pricing, you can easily set up an account with Acorns, one of our favorite personal finance software options.

- Acorns has a growing ecosystem that offers plenty of resources for both beginners and experienced investors, making it one of the best tax software options available today.

Pricing

There is also a one-time fee of $3 for Personal and $5 for the family when you sign up.

5. YNAB

YNAB or You Need A Budget, is a popular money management software that helps users take control of their finances. The software allows users to track their spending and create a budget and goals. YNAB is an excellent choice for users looking for comprehensive money management software. The software is easy to use and provides users with everything they need. The software connects to your bank account and tracks your spending to help you stay on budget. YNAB also offers features like goal setting and debt payoff assistance.

Nick's Take

I think YNAB is a great money management software option for people looking for help staying on budget and getting out of debt. The software is easy to use and offers many features to help you manage your finances.

Features

This program is easy to use and has bank syncing capabilities, making it an excellent choice for anyone looking to get control over their finances. With personal support from the developers, you’ll be able to manage any financial situation with ease.

- This program is easy to use and has bank syncing capabilities and personal support.

- You can easily use YNAB on the go because it’s loaded with features that simplify budgeting and forecasting.

- With personal support from the developers, you’ll be able to manage any financial situation with ease.

- Bank synchronization is one of the main advantages of using YNAB; this allows users to keep their finances in sync between all their devices.

- The paid version of YNAB offers many additional benefits, such as debt paydown, reporting bliss, goal tracking, etc.

- It provides a fantastic range of services that are perfect for anyone looking to get control over their finances.

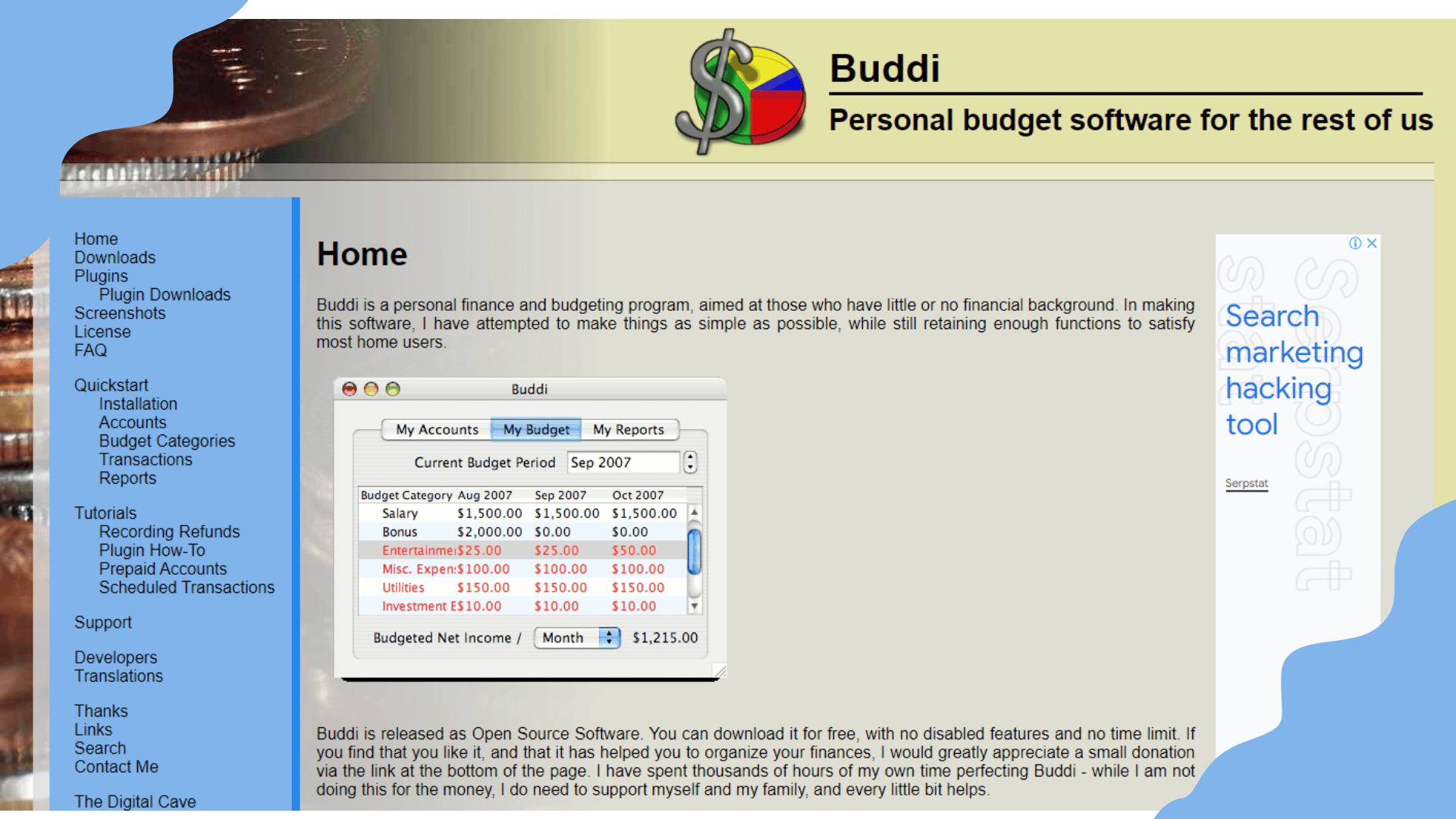

Buddi is a personal finance program that is available for free. The software can track income and expenses, create budgets, and generate reports. Buddi also includes a debt reduction planner and a loan calculator. Buddi is a good choice for people looking for simple money management software. The program is easy to use and can be customized to fit your needs. Buddi is a good choice for people who are new to budgeting and want to learn more about personal finance.

Nick's Take

Buddi is an excellent choice for people who want simple money management software. The program is easy to use and can be customized to fit your needs. Buddi is a good choice for people who are new to budgeting and want to learn more about personal finance.

Features

- A budget planner

- A loan calculator

- The ability to track your income and expenses

- The ability to create a savings plan

- The ability to set up bill reminders

- The ability to track your investments

- The ability to create a debt repayment plan

- The well-designed interface and excellent budgeting tools make it perfect for novice accountants and those who want something easy to use.

- This simple and well-designed money management program lets you set up different accounts, categories, transaction records, etc., with unlimited funds.

- Buddi is ideal if you’re new to finance software or are looking for an easy way to manage your finances on the go.

- The interface is straightforward and well-designed – ideal if you’re new to accounting or want something simple to use without all the bells & whistles that more complex programs might offer.

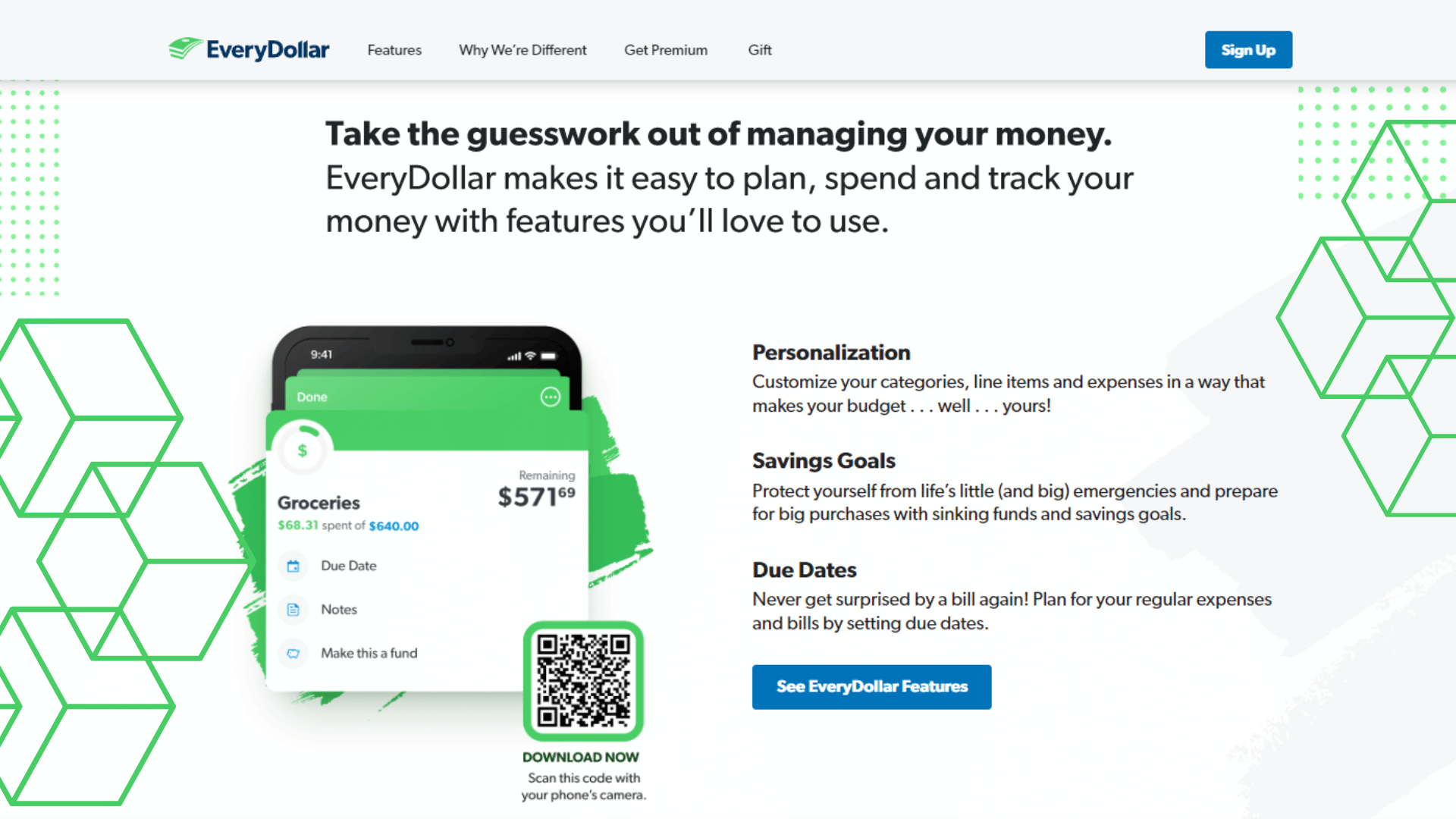

EveryDollar is a budgeting app created by Dave Ramsey, a famous financial expert and radio show host. The app is designed to help you create a zero-based budget, meaning your income minus your expenses should equal zero. EveryDollar is an excellent choice for people who are looking for a budgeting app that is simple to use and easy to understand. The app offers a variety of features, including the ability to create a budget, track your spending, and stay on top of your bills.

Nick's Take

EveryDollar is a great budgeting app for those looking for a simple and easy-to-use app. It offers a variety of features that can help you stay on top of your finances, including the ability to create a budget, track your spending, and stay on top of your bills.

Features

- The ability to create a budget, track your spending, and stay on top of your bills.

- The ability to create a Debt Reduction Plan and track your net worth.

- This simple yet powerful app provides a customizable template to help you with your expenses and the ability to track spending and save money.

- You can track your spending according to your plan, making it easy to see where your money is going and make amendments as needed.

- Every time you spend money, you can create a transaction, which helps you keep tabs on your spending.

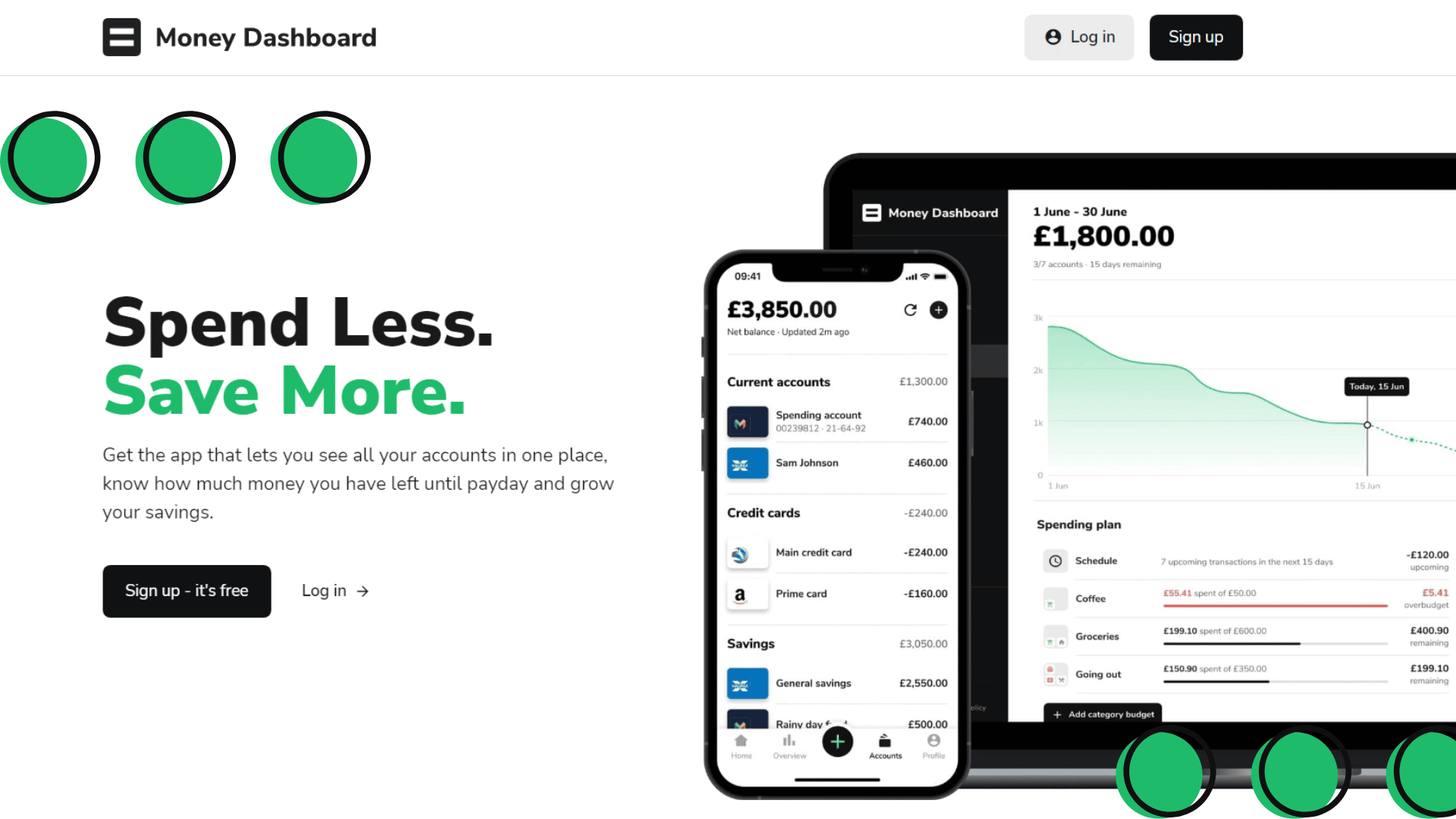

Money Dashboard is a free money management software that gives you a clear picture of your finances. It connects to your bank accounts, credit cards, and investment accounts to provide an overview of your spending, income, and net worth. Money Dashboard is an excellent choice for people who want a simple way to see their financial picture. The software is easy to use and provides many features for free.

Nick's Take

I think Money Dashboard is a great free money management software option! It gives you a clear overview of your finances, which is helpful in budgeting and keeping track of your spending.

Features

- A clear overview of your finances: You can see all your accounts in one place to track your spending, income, and net worth.

- Connectivity to your bank accounts: Money Dashboard connects to your bank accounts, so you can see your transactions and spending patterns.

- Credit card and investment account support: Connect your credit cards and investment accounts to Money Dashboard.

- Price: Money Dashboard is available for free, but future updates may increase its price.

- This mobile app provides the functionalities to manage all your accounts, including bills, payday countdown and predicted balance.

- It follows the best-in-class practices like FCA authorized & regulated and bank-level security, which makes it a safe platform to use.

Credit Karma is a personal finance website offering free credit scores, reports, monitoring, and customized recommendations to improve your finances. It also has a mobile app for iPhone and Android devices. Credit Karma is an excellent option for a comprehensive money management tool. It offers a variety of features, including credit scores and reports, financial recommendations, and mobile app access.

Nick's Take

Credit Karma is an excellent tool for managing your finances. It offers a variety of features, and the only downside is that it does not provide a budgeting feature.

Features

- Offers credit scores and reports

- Provides financial recommendations

- It has a mobile app for iPhone and Android devices

- Allows users to monitor their credit score and report for free

- This top-of-the-line personal finance software keeps you up to date on your current score and warns you of potential credit breaches.

- And if that’s not enough, it also has tools that help you find and secure the best deals for loans, credit cards, automobiles, and more.

- User friendly – With its easy-to-read graphs and user dashboard, Credit Karma is perfect for anyone who wants to understand their finances.

- Daily credit score – Seeing your credit score daily can help motivate you to improve it.

- Ads – Though Credit Karma is free, it makes money off ads to do so. If this isn’t something you’re comfortable with, Paid plans are also available!

Pricing

Credit Karma is a free app, but there are some paid features, such as seeing your credit score without providing your credit card information.

10. NerdWallet

Nerdwallet is one of the leading money management software platforms available today. The platform provides users with a comprehensive financial overview, allowing them to track their spending, income, debts, and investments in one place. NerdWallet also offers tools to help users manage their finances, including budgeting and goal-setting features. It is a personal finance website that helps people make smart financial decisions.

Nick's Take

I think Nerdwallet is one of the best money management software for managing finances. The software offers a comprehensive financial overview, allowing users to track their spending, income, debts, and investments in one place. The software is free to use, and there is no need to sign up for a paid subscription.

Features

- Nerdwallet reviews the best money management software for different types of users.

- This site offers free financial account management and credit score management, which are essential for anyone looking to improve their quality of life.

- Consumers and small businesses can use NerdWallet to arm themselves with the tools, information, data, and insight they need to make intelligent financial decisions.

- Provides articles about personal finance and offers for credit cards, mortgages, and other financial products.

- Like many of the best personal finance apps available today, Nerdwallet lets you track your net worth and cash flow and learn more about your credit score.

Moneydance is a powerful yet easy-to-use personal finance app for Mac, Windows, Linux, iPhone, and iPad. With online banking, online bill payment, investment management, and budgeting all in one place, Moneydance provides a complete solution for your financial life. Moneydance is easy to use and does the job without bells and whistles. It’s an excellent choice for those who want to keep things simple. Moneydance is a good choice for those who want to keep things simple. It’s easy to use and includes all the features you need in one place.

Nick's Take

Moneydance is one of the best money management software options out there. It’s easy to use and supports multiple currencies and languages, making it an excellent choice for managing your finances.

Features

- A powerful yet easy-to-use personal finance app

- Support for multiple currencies and languages

- The ability to connect to your bank and download transactions automatically.

- Generate reports to help you make informed financial decisions

- Plan for your future with our investment and retirement planning tools

- This user-friendly program can easily do it, including managing multiple currencies and practically operating any financial task.

- With Moneydance, users can easily manage transactions and payments from several financial institutions in one go.

- The software supports automatic sorting, organization, and cleaning up of downloaded transactions for a more accessible overview of your finances.

- Moneydance also offers reports and graphs to help you better understand your finances – everything from account balances to upcoming and overdue transactions and reminders.

- In addition to its desktop-based capabilities, Moneydance is also capable of working on the go thanks to its mobile app – perfect for keeping track of your finances on the go!

Wallethub is a personal finance website that offers users a variety of tools and resources to help them make informed financial decisions. One of the site’s main features is its free credit score simulator, which allows users to see how different financial decisions would impact their credit score. Wallethub also offers a variety of money management tools, including a budget calculator and a debt payoff calculator. Wallethub is an excellent option for free money management tools and resources. The site’s credit score simulator is a great way to see how different financial decisions would impact your credit score. The site’s blog has a wealth of information on topics such as credit card debt and retirement savings.

Nick's Take

Wallethub is an excellent resource for managing your finances. The site offers a variety of tools and resources that can help you stay on top of your finances and make the most of your money. The credit score feature is a great way to keep track of your credit health, and personalized advice can help you make informed financial decisions.

Features

- Free credit scores and reports

- Financial tools

- Personalized advice

- Access to VantageScore 3.0

- WalletHub focuses on users’ credit score—what it is, how to analyze them, and ways to improve them.

- This helps individuals quickly get the necessary information without wading through menus and toolbars. Because WalletHub emphasizes that one element of personal finance is essential, individuals can pop in and promptly convey the information they need without having to go through many navigation hoops first.

- This site has various calculators and resources to help you shape your budget, compare borrowing costs, and plan for the future.

- WalletHub focuses on your credit score—what it is, how to analyze it, and ways to improve it. This helps individuals quickly get the necessary information without wading through menus and toolbars.

- Because WalletHub emphasizes that one element of personal finance is essential, individuals can pop in and quickly get the information they need without having to go through many navigation hoops first.

Pricing

WalletHub is free to use.

What is money management software?

Money management software is a type of program that helps users keep track of their expenses, credit scores, and net worth. Money management software is more than just monitoring your bank account or credit card statements. Many different money management software options are available, some of which are free, and others charge a fee. Money management software should ideally help you with budgeting, goal setting, and analysis of your finances. Money management software can help you track your spending, find ways to save money and provide insights into your financial health. Various money management software programs are available, so it’s essential to find one that meets your needs.

How to choose the best money management software for you?

Step 1: Determine your needs

The first step in choosing the best money management software is determining your needs. This will help you narrow your options and find software that fits your financial situation. You must consider your total monthly income and list your essential monthly expenses.

Step 2: Compare features

Now that you know what kind of money management software is out there and what kinds of features each one offers, it’s time to start comparing them side-by-side. This will help you narrow your options and choose the best software.

When comparing money management software, there are a few key features you should always look for:

- Ease of use: The software should be easy to use and understand. It should have a clean, user-friendly interface.

- Budgeting tools: The software should offer budgeting tools to help you track your spending and save money.

- Investment tracking: The software should track your investments and provide valuable insights.

- Customer support: The software should offer customer support in case you have any questions or need help using the software.

Step 3: Compare costs

Some programs are free, while others charge a monthly or annual fee. Make sure to consider each program’s features and benefits before deciding.

Free money management software options include Mint, YNAB, and EveryDollar. These programs offer a variety of features to help you track your spending, budget for upcoming expenses, and stay on top of your financial goals.

Paid money management software options include Quicken, Personal Capital, and Moneydance. These programs offer more comprehensive features, such as tracking your investments and monitoring your credit score.

No matter which program you choose, make sure it offers the features and benefits that are most important to you.

Step 4: Check out user reviews

User reviews can be a helpful way to gauge whether money management software is right for you. When reading user reviews, pay attention to both positive and negative feedback. Consider what users like and don’t like about the software and whether their needs align with yours. It can also be helpful to read user reviews from multiple sources before deciding.

Step 5: Test-drive the software

Now that you’ve narrowed your options, it’s time to take them for a test drive. The best way to do this is by signing up for a free trial of each software. This will allow you to see how the software works and whether it fits your needs.

Step 6: Get expert advice

If you’re still unsure which money management software is right; it’s time to get expert advice. Talk to a financial planner or accountant about your specific needs and goals, and they can recommend software that will work well for you. They may also be able to give you tips on how to get the most out of the software so that you can make the

What is the best money management software?

There are many great money management software options; the best depends on your specific needs and goals. If you’re unsure where to start, talk to a financial planner or accountant about your situation, and they can help you choose the right software for your needs.

What Makes for a Successful Budget?

The best money management software will help you create and stick to a budget. A successful budget should be tailored to your unique financial situation and include long-term and short-term goals. It should also be realistic so you don’t get discouraged and give up on your budgeting efforts.

To find the best money management software for you, consider your specific needs and goals, and look for software that offers features that will help you meet those goals. For example, if you’re trying to get out of debt, you’ll want software with features like a YNAB. If you’re trying to save for a specific goal, look for software with features like Personal Capital.

Once you’ve determined what features you need, compare the costs of different money management software options to find one that fits your budget. Read user reviews to understand how well the software works in real-world scenarios.

Conclusion

There’s a lot to consider when choosing money management software. But we hope this guide has given you a good starting point. Consider your needs and read reviews before making your final decision. And once you’ve found the right software, sign up for the best money management software today!