The best software for personal finances can help you stay on top of all your financials effortlessly.

The 12 best software for personal finances

Quicken

Quicken is a software program that helps users manage their finances, budget, and retirement plans. It offers a range of features to suit different budgeting needs, including the ability to track spending, review investment portfolios and make more informed money decisions. It is a secure and user-friendly financial software that integrates with other apps to help users stay on top of their finances.

Nick's Take

I think Quicken is suitable for individuals and families seeking a comprehensive solution to manage their money in one place.

Features:

- Quicken has a free phone support line and integrates with other apps to help you stay on top of your finances.

- Quicken can be an alternative to QuickBooks for small businesses that need property management features.

- Good real estate accounting software for landlords with few properties.

- Add and manage cryptocurrencies the same way as any other security in your portfolio.

- Supports restricted stock units (RSUs)

- Investment customers subscribed to Quicken Premier, or Home & Business will get real-time stock quotes.

- The app has bank feed integration so users can easily track their income and spending.

- You can also set up automatic billing alerts to make sure you never miss a payment again.

Pricing:

Starter – $3.49/month

Deluxe – $3.99/month

Premier – $5.99/month

Home & Business – $8.99/month

Mint

Mint is a comprehensive financial tool that can be used to track your finances, set and achieve goals, and get a better understanding of your personal financial situation. It is easy to use and suitable for both new and experienced investors. Mint offers creative data presentations and tools.

Nick's Take

I think that as one of the most popular personal finance free programs on the market today, Mint has legions of loyal users who love its ease of use and comprehensive approach to money management.

Features:

- Mint allows you to connect to your PayPal account to track all your online transactions.

- There are smart personal finance features that help you manage your budget, savings goals, and investments.

- With visual images illustrating your finances, Mint makes it easy for you to keep track of all your transactions in a comprehensive way.

- Mint will notify you about significant changes to your credit score, such as fees being charged and budget overruns.

- Keep your data secure with security scanning, multi-factor authentication, and more.

- The app tracks your cash flow and provides insights into opportunities to save money.

- The app links your bank accounts, credit cards, investments, and bills to provide a single view of your finances.

Pricing:

Mint doesn’t charge an activation fee but it does charge taxes and fees. The taxes and fees assessed vary depending on the customer’s location.

Personal Capital

Personal Capital is a great personal finance app that allows you to track your spending, income, and saving. The budgeting tool will enable you to see transactions by date, merchant, or vendor. You can also view your bills and credit card statements.

Nick's Take

I believe that Personal Capital offers powerful investment tracking and retirement planning tools and an outstanding user experience.

Features:

- The Savings Planner can help determine whether you’re saving enough for retirement.

- Can automatically organize your spending and savings data.

- Allows you to set monthly spending targets and see if you’re meeting them.

- Investment Checkup tool allows you to see how well your investments are performing.

- Financial Roadmap tool helps you create a personalized financial roadmap.

- Personal Strategy tool provides enhanced diversification and is linked to your financial goals.

- Smart Withdrawal feature helps you stay on budget, minimize taxes, and optimize your portfolio throughout retirement.

Pricing:

Personal Capital is free to use and does not share personal information with third-party marketers.

YNAB(You Need A Budget)

YNAB is a budgeting software that helps you keep track of your spending and progress. It is available on multiple platforms and supports a variety of currencies, so you can always have up-to-date information at your fingertips. Additionally, YNAB is easy to use, making it an excellent choice for anyone looking for help getting their finances in order.

Nick's Take

From my perspective, YNAB is a great budgeting tool because it teaches effective techniques to help you stick to your budget. It’s based on an effective budgeting philosophy and offers educational resources to help you stay on track with your spending.

Features:

- You can add a “Wallet” to your ledger to track earnings and expenses.

- You can also set a “pay off by date” for your credit card accounts, which helps you track and plan for when you’ll be debt-free.

- YNAB subtracts transactions from your cleared balance to create your budgeted balance.

- You can budget using YNAB even if you don’t have all the money in your account.

- Pay yourself first by setting aside money for the inevitable and desired expenses.

- Breaking the paycheck-to-paycheck cycle will help you see the importance of saving and hassling your bank about overdraft protection.

- You can set monthly goals for your spending categories.

Pricing:

Annual Plan – $99 paid annually – $8.25/month

Monthly Plan – $14.99/month

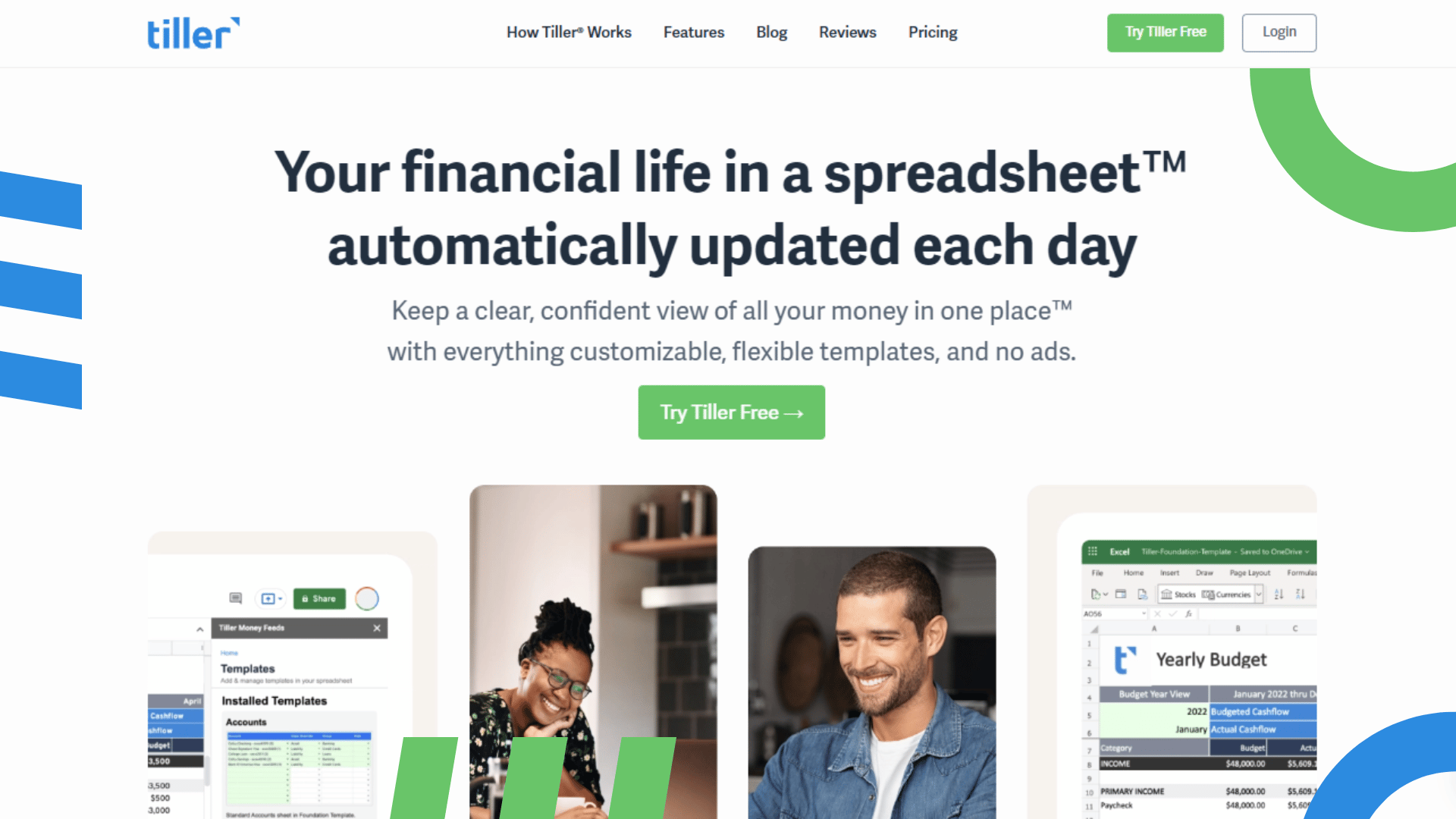

Tiller Money

Tiller Money is a financial management system that incorporates budgeting, financial forecasting, and asset allocation into the financial planning process. They aimed to make the transition to their platform seamless for most people who use spreadsheets to manage their finances.

Nick's Take

As for me, I think that Tiller Money is different from most spreadsheet systems because it automatically pulls new transactions from users’ accounts, making it easier to track finances.

Features:

- Tiller Money includes a dashboard that shows your net worth and spending behavior.

- You can manually categorize transactions or set them up to be automatically categorized.

- The Insights tab shows how much money you spend and where it’s going, as well as other useful information.

- You can analyze this data monthly, quarterly, annually, or set your custom timeframe.

- You can use the Debt Planner to develop a debt repayment plan and track progress.

- The Retirement Planner tool helps you plan for retirement by forecasting future earnings.

- The Cash Flow Forecast uses real data to give insights into your future cash flow.

Pricing:

Tiller Money offers a free trial that lasts for 30 days. If you decide to continue using the service after the trial, it will cost $79 per year. Alternatively, you can pay $6.58/month, which is ad-free and doesn’t have any hidden fees.

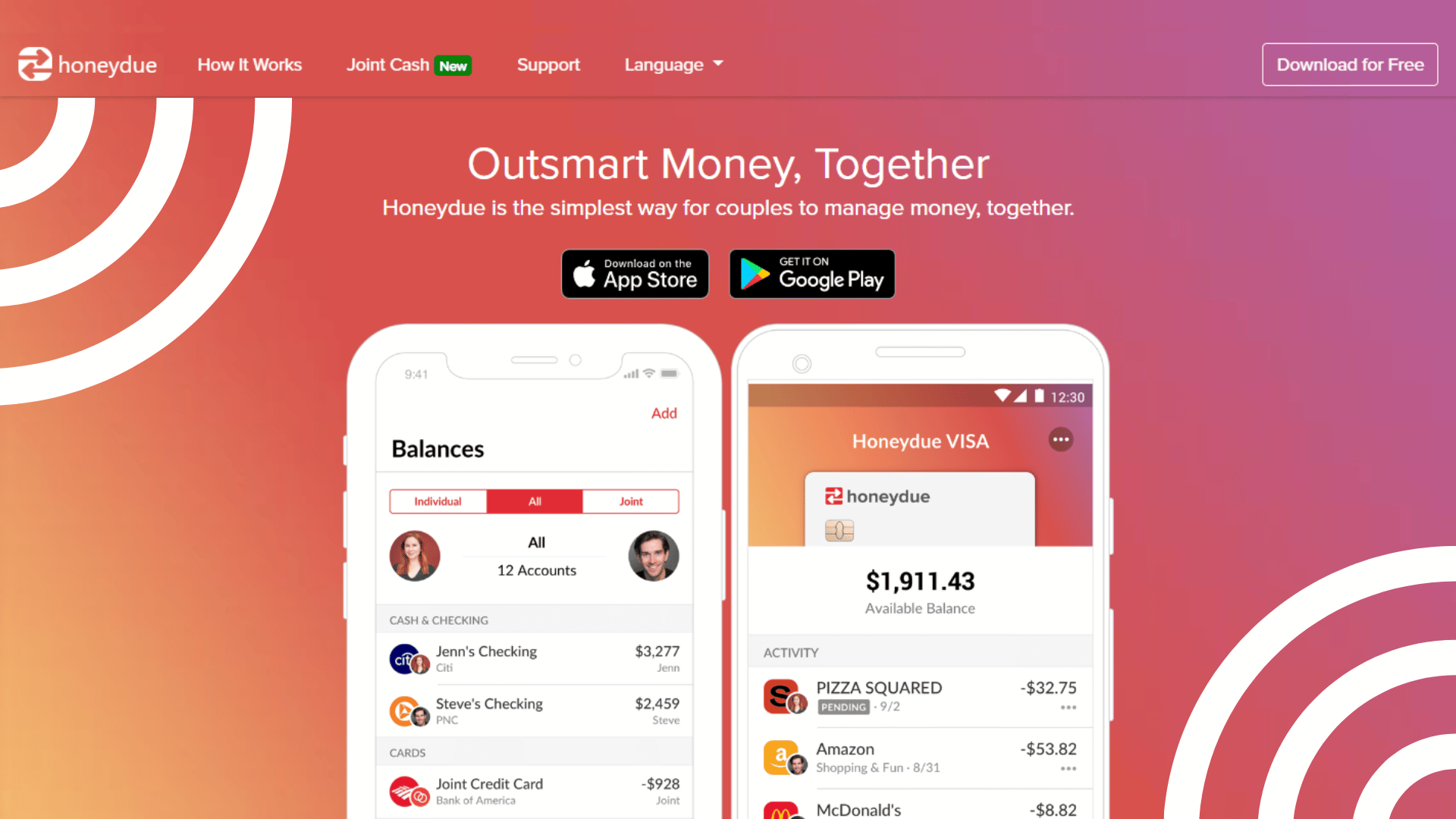

Honeydue

The Honeydue app is a free budgeting app designed to help couples communicate and manage their finances together. The app integrates easily with partners’ bank accounts, allows for chatty financial discussions, and offers a featured partner offer. There is no desktop version of the Honeydue app, so it’s convenient to use on the go.

Nick's Take

I think that Honeydue is not suitable for large-sized businesses as it offers fewer reporting options than some other budgeting programs. Still, they are customizable and help ensure no spending is overlooked.

Features:

- Honeydue allows users to categorize transactions and set custom alerts.

- This app allows you to link accounts, customize what information you share, and communicate about money issues directly through the app.

- Joint Cash offers budgeting tools and real-time balance updates.

- Offers a Visa debit card, no monthly fees, and fee-free access to more than 55,000 ATMs

- Has a live chat feature which is helpful for resolving disputes.

- Keeps track of your transactions and provides insights into your spending habits.

- Offers due date reminders and lets you enter who’s responsible for each bill.

Pricing:

The Honeydue app is free to use. However, there are some advertisements that will appear when using the app.

Turbotax

TurboTax is a great tax software for personal finances that makes the process of preparing and filing taxes easier. It offers online and desktop versions, so users can choose whichever works best. Additionally, TurboTax takes the complexity out of filing taxes by packaging everything up into easy-to-use packages.

Nick's Take

It seems to me that TurboTax is a great tax software as it takes the complexity out of filing your taxes by packaging them up into easy-to-use packages.

Features:

- TurboTax now supports cryptocurrency tax returns.

- Taxpayers can import their 2016 tax returns in PDF format.

- Offers professional help for those who want it, and detailed step-by-step instructions are available online.

- Has a secure server where users can store their documents

- Has a SmartLook feature that connects users with live, credentialed experts who specialize in self-employment taxes.

- The solution’s CompleteCheck feature runs a comprehensive review of the entire tax return before filing and walks users through any changes to ensure nothing gets missed.

- Offers the convenience of preparing and e-filing tax returns from virtually any connected computer or mobile device.

Pricing

Free Edition – $0

Deluxe – $59

Premier – $89

Self-Employed – $119

Buxfer

Buxfer is a free finance web app that lets you manage expenses and bills. Buxfer offers an online financial management service. Buxfer is budget-friendly and well-audited. The Buxfer app offers a range of features for paid users, including unlimited budgets, online payments, and advanced forecasts.

Nick's Take

I think that the visual reporting of Buxfer is great, and the fact that it’s flexible makes it useful for most people.

Features:

- The app allows for secure automatic syncing with over 20,000 banks all over the world.

- You can add transactions on the go and reconcile them later.

- The app provides budgeting capabilities and real-time alerts when you exceed your spending limits.

- The app predicts your net worth, balances, and expenses based on past spending patterns.

- The app has reminders to help you keep track of upcoming bills

- Get alerted about future problems before they happen with Smart Alerts.

- Plan for retirement and other long-term goals with the Retirement Planner.

- Track your entire portfolio and watch it grow with Investments.

- Keep track of multiple currencies with the Currency Converter.

Pricing:

Plus – $4.99/month

Pro – $5.99/month

Prime – $11.99/month

Banktree

BankTree is a personal finance software that lets you connect to your bank and other financial institutions. It offers budgeting and reporting features, as well as investment management tools. BankTree is available on desktop PC, Android phones and tablets, Apple phones, and iPad.

Nick's Take

It seems to me that Banktree is suitable for personal use as it provides helpful tools for personal finance, such as tracking spending and saving, and it’s also good for small businesses.

Features:

- Lets you track your income and expenditure, keep an eye on your balances, and budget with precision and accuracy.

- Support multiple currencies and is available on multiple platforms.

- Allows you to set up and manage your accounts and synchronize them with your bank or financial institution.

- Can categorize transactions automatically and provide live updates.

- Can import bank statements from over 50 financial institutions in the UK and Europe.

- You can manually enter payment and receipt details if you choose to do so

- Allows users to add investments and reconcile their accounts against statements

- You can add your mortgage repayment schedule and sales tax (VAT) to your account

- The app supports importing and exporting financial data from a variety of sources

Pricing:

You can install BankTree Desktop Personal Finance on one computer for $35. If you want to install it on additional computers, you will be charged £5.00 per computer. To test the software before buying, you can download the free 30-day trial.

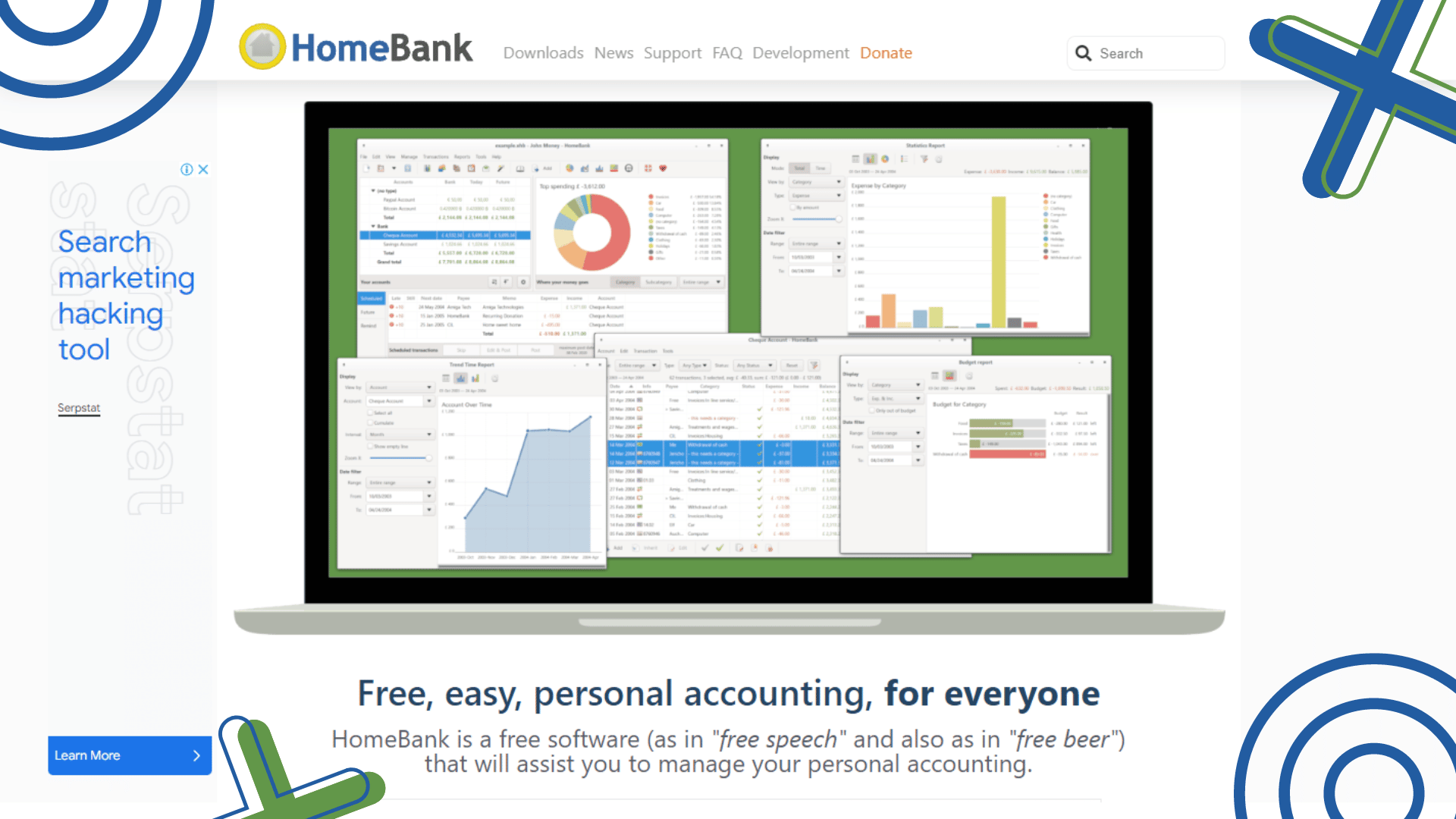

HomeBank

HomeBank is a free personal finance software that helps you keep track of your budget and finances. It comes with a lot of cool charts and visual tools that make managing your finances easier. These features can help you stay on top of your spending, see where your money is going, and set budgets for yourself.

Nick's Take

I believe that HomeBank is a great solution for users who want to manage their bank accounts without having to learn double-entry bookkeeping. It is simple and easy to use, so you can get started quickly.

Features

- Import your accounts from various financial management programs.

- Export your accounts to various formats, including QIF and CSV.

- Provides dynamic reports with powerful 2D charts.

- Variety of reports is available, including time, budget, and transaction reports.

- Assign different account types to your HomeBank account.

- Manage cheque numbers and increments during transactions.

- Has the ability to compare different sets of data together, schedule transactions, and transfer money between accounts easily.

- Can split transactions into several categories and automate internal transfers.

- Enjoy icons for payment mode and transaction status, as well as the tag field.

Pricing:

Homebank is available for free.

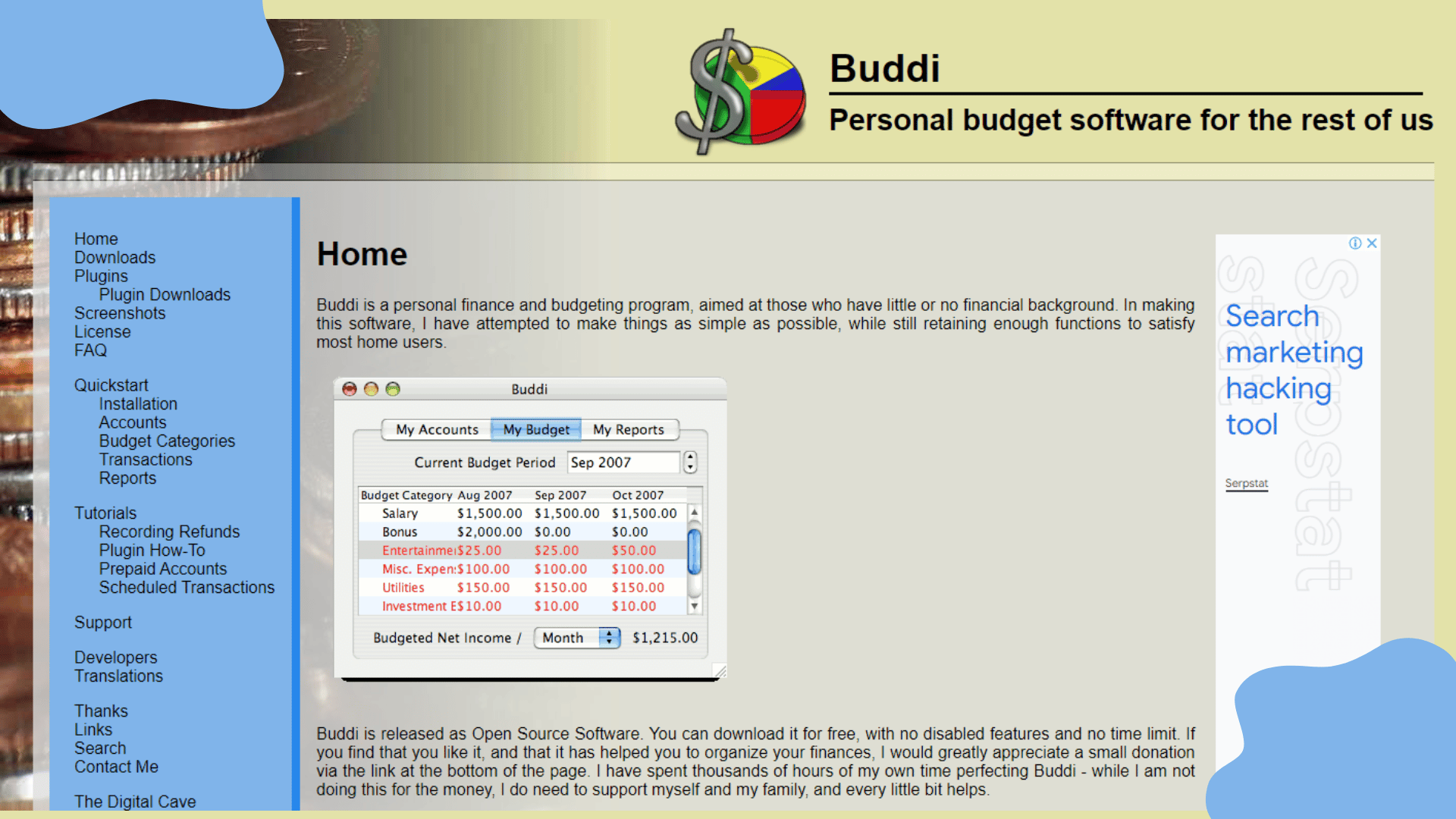

Buddi

Buddi is an open-source personal finance program designed for people who find mainstream programs too complex. In order to use Buddi, you need to have Java installed on your computer. This financial software is helpful for budgeting, tracking investments, and more.

Nick's Take

From my perspective, Buddi is useful as it can help you to save money by helping you stick to a budget and generate reports about your spending and earnings.

Features:

- This free software is perfect for small financial tasks that you need to perform daily, like tracking your spending and income.

- Buddi is ideal for setting up your accounts and tracking your spending and income. You can then generate reports or budgets for you to stick to.

- Available on Windows, Linux, and Mac platforms, you can use it on different devices. It also encrypts your data so that it’s safe from theft.

- Money can easily be pulled from and moved between different accounts with Buddi, and the program can generate all sorts of reports about your spending and earnings broken down in a variety of ways.

- Your financial data is securely encrypted with Buddi.

- You can download more plugins to add features to the software.

Pricing:

Buddi is a free personal finance software that can help you manage your finances and stay on top of your bills. If you find Buddi helpful, you can donate to the developer through their website.

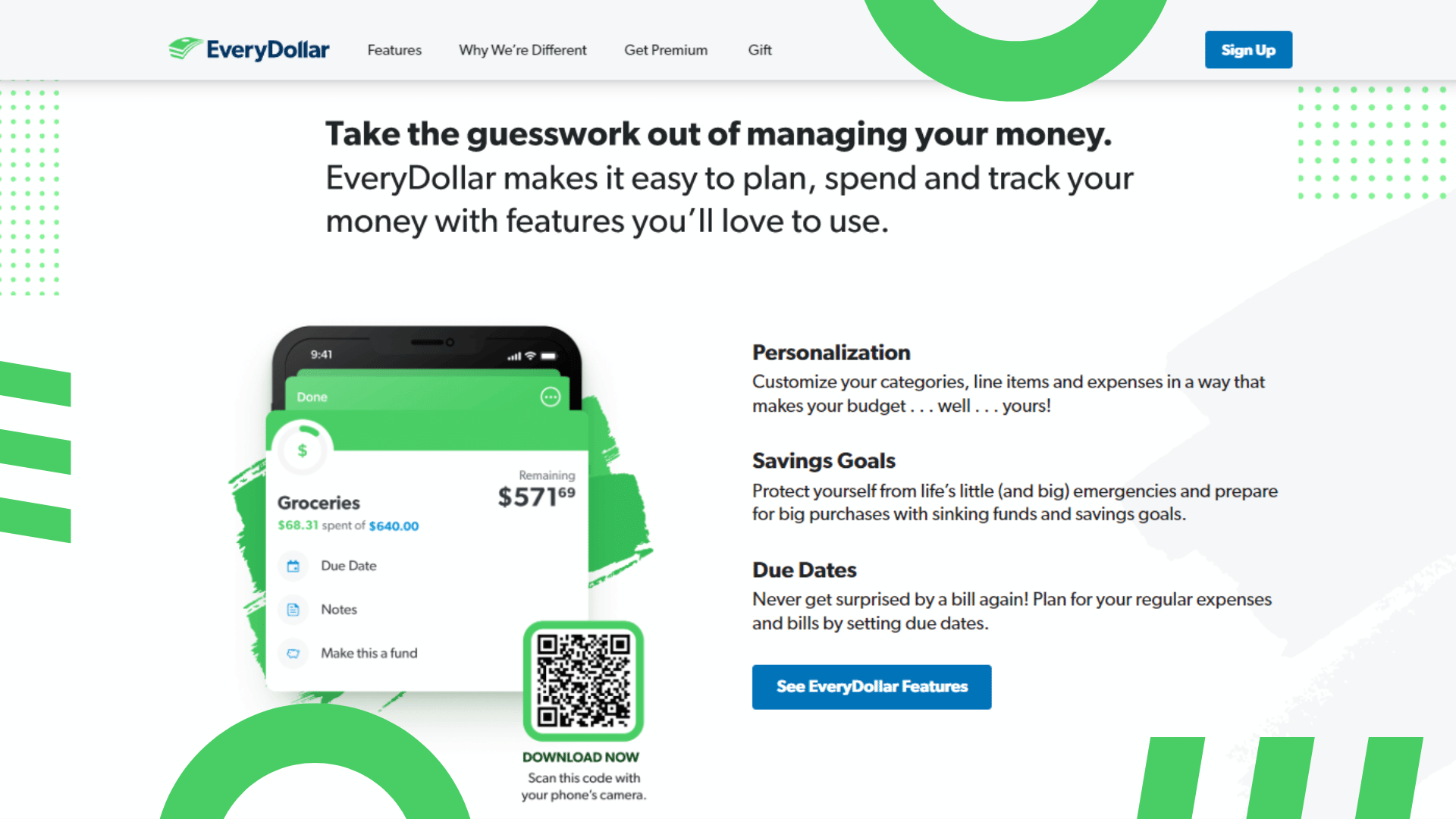

EveryDollar

EveryDollar is a budgeting app that was created by personal finance guru Dave Ramsey. It is accessible through both a web app and a mobile app, with support for iOS and Android devices. With EveryDollar, you can track your spending and save money.

Nick's Take

I think that EveryDollar is the best option for families because it makes budgeting easier and simpler.

Features:

- EveryDollar lets you split up your receipts into different categories and expenses.

- You can easily copy and paste your budget from month to month.

- You can make notes within budgets to remember what you were spending your money on.

- Allows you to set up a stacked emergency fund to avoid inconvenient incidents.

- Use the “Personalize Your Budget” feature to customize your budget.

- Avoid checkout-line freak-outs by using EveryDollar and setting due dates for expenses.

Pricing:

Monthly Plan – $12.99/month – A monthly subscription is just $12.99 after a free 14-day trial.

Annual Plan – $79.99/year – A yearly subscription is $79.99 after a free 14-day trial.

What is personal finance software?

Personal finance software can help you set up systems that work for you, track your spending and savings habits, offer investment advice, and much more. There are different types of personal finance software, each designed for a specific purpose. Financial software can also help you manage your investments and stay on top of your bills. When it comes to personal finance software, there are a number of great options to choose from. The best software usually offers quick and easy access to your financial goals, as well as being frustration-free.

Why is it important to track your finances?

There are many reasons why tracking finances is important. Perhaps the most obvious reason is to keep track of expenses. This is important for both individuals and businesses in order to stay on budget. Monitoring credit card and investment activity are also important, as it can help prevent fraud and keep track of important financial goals. Additionally, tracking finances can help businesses stay compliant with tax laws and make more informed decisions about where to allocate resources. Ultimately, understanding one’s financial situation is crucial for making sound decisions about both short-term and long-term financial planning.

How do these software packages help manage your finances?

Personal finance software packages offer a variety of features to help manage your finances. Typically, they allow you to link your accounts, set financial goals, and monitor your spending habits. Many personal finance software packages are cloud-based, which allows you to access your data at any time from any location. Some popular personal finance software packages include Mint, Quicken, and Money Dashboard.

- Depending on your needs, these packages can allow you to manage receipt logging and expenses from within one program. Plus, many of them allow you to share data with your preferred tax and accounting software–meaning you’ll be much better placed when it comes to filing taxes.

- Personal finance software typically works by collecting your data, linking it to your financial institution accounts, investment accounts, and credit cards, and then helping you set up your financial goals. Once you’ve linked your accounts, it can monitor your credit score and report different spending habits.

- Cloud-based personal finance packages let you keep all of your data in a safe place so that everything is accessible at any time–even if you’re offline. This makes them perfect for those who want total control over their finances no matter where they are.

- Many personal finance software packages are tailored to both online and offline needs, making them perfect for business owners who need access to their data anytime and mobile users who don’t have an internet connection available at all times!

- Some popular personal finance software packages include Mint, a cloud-based personal finance package; Quicken, a traditional software package; and Tilley Money, an app-only personal finance package.

- Personal finance software packages typically offer helpful tips and advice on budgeting, investing, and credit monitoring–as well as bill pay reminders and savings goal reminders.

How do you choose the best software for your needs?

Step 1: Decide what type of personal finance software you need.

There are a variety of types of software available, each with its own purpose.

- Budgeting software helps you manage your spending and create a budget.

- Financial planning software helps you plan for your financial future.

- Investment software helps you track your investments and make decisions.

- Tax software can help you prepare your taxes, find deductions, and file your return electronically.

- Accounting software helps you keep track of your income and expenses, prepare financial statements, and manage your accounts receivable and payable.

When choosing software to help manage your finances and budgeting, consider what features you need and how sophisticated you want the software to be. Cost is often a factor in choosing personal finance software. Look for a tool that syncs with your bank and credit card accounts. If you’re managing a complex financial situation, consider upgrading to software with more features. Consider tools that provide spending reports in graphical or chart form. If you’re a visual learner, look for software that is easy to use and provides spending data in an easily-digestible format. Look for software that offers human support and free credit score updates. Be sure to customize the reports to fit your financial goals.

Step 2: Consider your options.

There are many personal finance software options available, each with its own set of features and benefits. It’s important to consider how you will use the software before making a selection.

For example, if you want to track your expenses, investments, and credit cards, choosing a program with features for all of these activities would be useful. Another important factor to consider is whether the software matches your lifestyle and preferences.

Finally, it’s also worth taking time to review the different options and features offered by each software package before making a purchase. By doing your research upfront, you’ll be more likely to select a program that meets your needs and budget.

To find the best personal finance software for your needs, compare the features of different programs and select the one that best meets your requirements. Consider factors such as cost, goal setting, security features, and device compatibility when making your decision. It is also important to read customer reviews to get a sense of user satisfaction. The best personal finance software will help you manage your finances easily and help you reach your financial goals.

Step 3: Choose the right software for you.

When choosing personal finance software, the first step is to identify your needs. Once you know what you need the software for, you can research and compare different options to find the one that best suits your needs.

A few key factors to consider when choosing personal finance software are budget, goals, and desired features. It’s important to choose software that you can afford and has the features you need to meet your financial goals.

Quicken is an excellent choice for budget-minded people, while Personal Capital and Mint are good choices for those who want to manage their finances on the go. Ultimately, the best personal finance software is the one that matches your lifestyle and needs.

After you’ve compared your options and found the right financial software for you, it’s time to make your purchase. Be sure to read the user reviews before making your purchase, and ensure that the software you choose is compatible with your computer.

Our top picks for the best personal finance software are based on features and how these features will help you meet specific needs. If you’re looking for personal finance software that will streamline your life, our top picks are the best options available.

Conclusion

No matter what your financial goals are, there’s a software package out there that can help you achieve them. The best software for personal finances is the one that fits your specific needs. We’ve outlined 12 of the best packages available, so you can find the one that’s right for you.