With so many options, how do you know which one is right for you? The good news is that we compiled a list of the top 10 software to file taxes in 2022.

Whether you’re looking for free or paid options, these tools will offer everything from automatic calculation features to helpful guidance throughout the entire process.

So if you’re ready to take the stress out of tax season, keep reading! We’ve got all the information on The Best 10 Software to File Taxes in 2022 – Free and Paid.

What are the best software to file taxes?

TurboTax Premier is especially investor-friendly and offers more features than the free versions. It has comprehensive benefits with a higher price tag, but they may be worth it if you’re worried about taxes.

The website offers tax tips and information to help you understand the workings of the tax system. It has various features, such as tax calculators and estimators, to help you understand your taxes. Their site is easy to use and can help you maximize your deductions.

With its user-friendly interface and tax expertise, this application can take care of everything for you – from simple taxes like income and deductions to more complicated ones like estate planning.

TurboTax makes the personal tax preparation process more understandable and accessible than any competitor does.

Nick's Take

As easy as it is to use, TurboTax goes far beyond just filing your taxes – it helps make sure everything comes back clear so you can relax during what should be one of the most stressful times in your year. I like its free version, which is user-friendly and offers much helpful information about taxes.

Features

- No tax knowledge needed

- You can import W-2 info

- Tax credits for children

- Offers a step-by-step guide

- You can transfer last year’s info

- Free US-based product support through phone

Pricing

TurboTax Deluxe (Federal) – $59

TurboTax Deluxe (State) – $49

TurboTax Premier (Federal) – $89

TurboTax Premier (State) – $49

TurboTax Self-Employed (Federal) – $119

TurboTax Self-Employed (State) – $49

Since Taxslayer is considered one of the best software options for filing taxes in 2021-2022, it is no surprise that the company offers a wide range of services and features to its target market.

With unlimited personal guidance from a live tax professional, detailed help files, and searchable databases, TaxSlayer makes it easy to file your taxes quickly and efficiently.

Additionally, the company’s Deluxe plan costs less than some of its competitors’ Deluxe plans, making it an affordable option for online DIY tax prep.

With its quick filing process and support from a live customer service professional, this company can help you save time and money while getting all the assistance you need.

Nick's Take

TaxSlayer is user-friendly, offers a comprehensive online resource, and provides priority support in the event of an audit. The software is cheap and fast, making it a good option for people who want to do their taxes.

Features

- Automated uploads

- Priority support

- Donation Calculator

- Mobile app

- Free phone & email support

- IRS audit assistance

- Platform mobility

- Auto-import W-2 information

Pricing

Classic Federal – $29.95

Premium Federal – $49.95

Self-Employed Federal – $59.95

H&R Block is among the most popular and well-respected tax software programs. It is a respected household name in the US regarding personal tax preparation and has user-friendly interfaces and extensive coverage of tax topics.

H&R Block excels at explaining complex tax concepts in ways that users can easily understand and is a well-known and popular company. It has a wide range of locations and offers the same software quality as TurboTax, but at a slightly cheaper price.

You can expect your biggest refund possible with TaxAct’s guaranteed refund program.

Nick's Take

With H&R Block, you can take care of your taxes on your own time and get a guaranteed refund. I like its user-friendly interfaces, extensive coverage of topics, and context-sensitive help, making it easy for even the most complex tax situations to be understood.

Features

- Easy tax from upload and import

- Tax return storage

- Multiple refund options

- It offers a mobile version

- Step-by-step guidance

- Guaranteed accuracy

Pricing

H&R Block Deluxe Online – $49.99

H&R Block Premium Online – $69.99

H&R Block Self-Employed Online – $109.99

Cash App Taxes offer a reliable, accurate, and guaranteed service that is perfect for people with a simple tax situation. It’s not ideal for users who need to import files, but it’s simple and interview-style, which might be attractive to some.

Nick's Take

Cash App has launched a free tax preparation option that doesn’t skimp on available IRS forms and schedules. Because this software requires manual information input, I recommend it to those with a few forms and fairly simple tax situations.

Features

- Mobile app

- Free audit defense

- Max refund

- 100% free for both state and federal taxes

- Accurate calculations guaranteed

TaxACT is one of the two best DIY personal tax prep solutions that are simple to use and have great final review ratings.

It asks difficult financial questions that help you find deductions and credits you may be eligible for and offers well-curated bundles and specialized options that simplify filing taxes.

You can get reimbursed from TaxAct if you receive a tax refund, making it an attractive option for people who want to file their taxes quickly.

The software accurately reflect the service’s cost competition such as its user interface being more user-friendly than TurboTax or H&R Block.

Nick's Take

TaxAct provides importing way through the tax preparation process without having to worry about costs and doesn’t charge any fees beyond those of filing a federal return (except in certain cases where you might need to upgrade). I like the personal finance advice provided by TaxAct, which is helpful throughout the process, helping you save money on deductions and credits while ensuring accuracy down to the last penny.

Features

- Multi-user

- Deduction maximizer

- Money back guaranteed

- 1040 all clients

- Mobile app

- W-2 import

- 1040 Federal Edition

Pricing

1040 Bundle – $735

1040 Enterprise Bundle – $825

Complete Bundle – $1475

Complete Enterprise Bundle – $1820

FreeTaxUSA

FreeTaxUSA offers online filing services for taxes, including individuals, married filing jointly, and heads of household.

This easy-to-use software offers free federal tax filing and a range of features for discounted prices. Integrated previous tax return information, excellent customer support, and Over 350 credits and deductions make it the best choice for people who want to file their taxes on time and without hassle.

It is a great option for freelancers and sole proprietors who don’t need many benefits compared to other tax preparation software.

The price is likely to increase as DevOps becomes more popular, but it’s a great option overall if you’re looking for free federal tax filing.

With FreeTaxUSA’s fast processing times, you’ll be able to get your tax return filed in no time at all!

Nick's Take

FreeTaxUsa offers an easy-to-use interface suitable for both beginners and experienced tax preparers. The appeal of FreeTaxUsa is evident from the name alone: with this software, you can get your taxes done for free – which is an amazing value compared to other options on the market.

Features

- IRS Approved E-File provider

- Top Rated Software

- Maximum Refund

- Beginner friendly

- Max credits & deductions

- Earned income credit

Pricing

Federal Tax Preparation – Free

State Tax Preparation – $14.99

Deluxe Service – $7.99

Jackson Hewitt

Jackson Hewitt is a reliable and affordable option for taxpayers who want to file taxes in 2021-2022. The company has a wide range of products and services to meet the needs of all types of taxpayers, and its professionals are available 24/7 to help you with your return.

While Jackson Hewitt is not as good for someone who needs lots of handholding, its online help tools are strong enough for most people.

Jackson Hewitt offers a no-frills tax preparation experience with backup assistance if needed. In addition to its self-service options, Jackson Hewitt offers “file online with a tax pro” service for those who want more one-on-one attention when filing their taxes.

Prices for this option vary depending on where you live and what kind of assistance you need (from audit assistance to completing all your forms). It is a great choice for taxpayers who want easy access to helpful resources and reasonable prices.

Nick's Take

Jackson Hewitt offers affordable DIY online products and professional help in the form of professionals ready to take over if needed. I like that it protects against unexpected penalties or interest and free audit assistance if needed.

Features

- Maximum Refund Guarantee

- Unlimited state returns

- 100% accuracy guarantee

- Satisfaction Guarantee

- Online customer support

- Step-by-step guidance

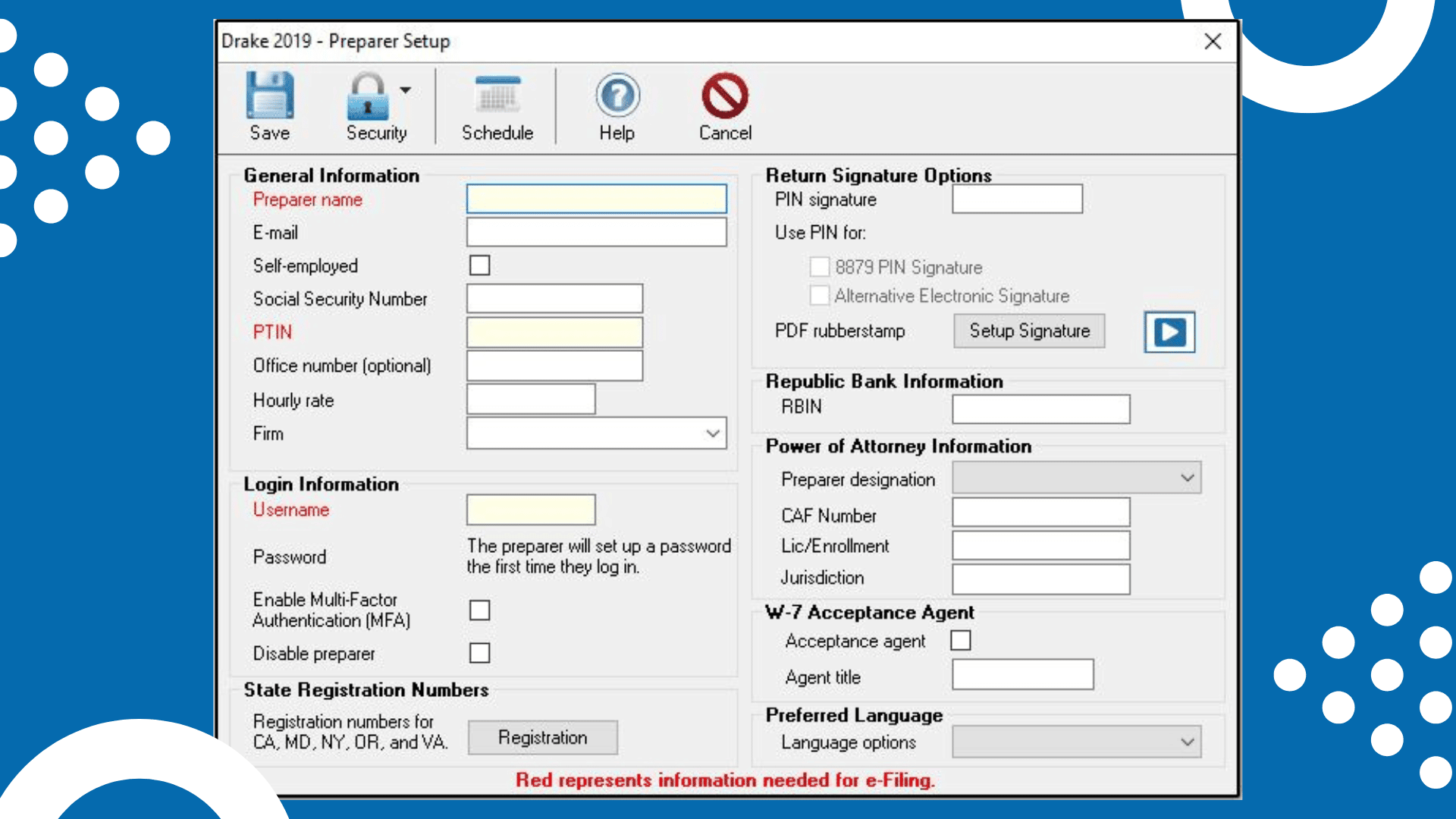

Drake Tax is an excellent tax software for preparers because it has multiple tiers designed to meet the needs of various professionals. It has been offering services since 1977, with an electronic filing option available since 1978.

The customer service is reported to be nice, so you shouldn’t have any problems getting help if needed. With limited third-party integration, Drake Tax is great for small businesses who want to stick with one provider while still having access to all of the features offered by the program.

You’ll need to renew Drake Tax every year to keep using it; however, this shouldn’t be too difficult since it has many features worth paying for annually (like calculating taxes and returns in just a click).

Nick's Take

Drake Tax has user-friendly forms and easy-to-understand instructions. I recommend this for taxpayers who need to file taxes on behalf of their clients, Drake Tax offers the eSign feature, which makes paperwork a thing of the past.

Features

- Tax Planning

- Billing & Invoicing

- K-1 Reporting

- Electronic Filing

- Tax calculation

- Data verification

E-File is simple and affordable, with a standard interface that features prior-year import and a support sidebar that guides you through every step.

E-file emphasizes speed and affordability. You can also print out your tax forms to mail in physically if you have questions before the filing deadline arrives—a helpful touch for busy people!

You can also call or email customer support for assistance during the filing process; this service comes with a fee but is often helpful nonetheless. It accepts promo codes, which saves money on fees.

From reducing stress levels during tax season to saving time on your legal documents, there are many reasons why you should consider using E-File in the future!

Nick's Take

The best software for budget-conscious filers is E-File.com, which offers a simple and affordable way to file taxes online or print out and mail in the forms. You can also use E-File.com’s customer support for assistance during the filing process, which comes with a fee but is often helpful.

Features

- Online filling support

- Free federal e-filing

- 100% accuracy guarantee

- Tax Refund

- IRS audit assistance

- Phone & online support

Liberty Tax Deluxe offers a good review tool so that you can trust what you’re being told about your taxes – and its 100% Guarantee ensures that you’ll never have any doubts about the accuracy of your return, making it a trusted online tax preparation service.

It offers competent online tax preparation services for people of all incomes and investment levels. You can use liberty tax deluxe to prepare your taxes online, eliminating the need to go to a Liberty Tax office.

Nick's Take

As one of the most trusted names in tax preparation, Liberty Tax Deluxe is a great choice for investors who need to stay on top of their finances. I recommend its site that is fast and easy to use, thanks to its clean and simple UI and mobile apps that make it possible to complete your tax returns anywhere you are.

Features

- Audit & inquiry assistance

- Free import of tax documents

- Mobile app

- W-2 download

- Credit maximizer

- Return preparation

- State Tax

- Tax return

Pricing

Liberty Deluxe – $44.95

Liberty Premium – $64.95

Liberty Basic – $24.95

What is a Software to File Taxes?

When it comes to filing taxes, many options are available depending on your personal needs and preferences.

At its simplest, you could manually fill in a paper tax form and mail it to the appropriate government agency along with any supporting documents and payment.

Alternatively, you could use a software program designed specifically for tax filing. These programs streamline the process of entering data, reducing the chance of costly mistakes or missed deductions.

They can also provide useful guidance and assistance in making informed decisions about how to file your taxes most effectively. Whether you rely on an accountant to handle your taxes or choose to file them yourself, a software tool can be invaluable for ensuring that your tax return is accurate and complete.

So if you’re looking for an easier way to file your taxes this year, consider using a software program designed specifically for the task. With one of these tools at your fingertips, there’s no need to worry about making mistakes or missing out on important information – sit back, relax, and let the software take care of everything for you!

Benefits of Using Tax Software Provider

Convenient & Easy To Use

Using the software is typically much more convenient and easier to use than relying on a third party. With interactive tutorials and prompts guiding you at every turn, tax software makes the process seamless and straightforward.

In addition, software can automatically import important information from past tax returns, such as employer information and account numbers.

Using tax-filing software can help streamline the entire filing process, making it one of the most efficient ways to file your taxes.

Cost Effective

One of the most important benefits of using software to file taxes is that it is a cost-effective way to complete this task. This software makes it easy to organize and save your financial information in one place, so you don’t have to worry about accidentally misplacing important documents or receipts.

Unlike preparing your taxes by hand, using tax software often results in fewer calculation errors, which can lead to costly mistakes and delays in receiving any potential refund.

And perhaps best of all, almost all tax programs offer completely free trial periods, so there is no financial risk involved in trying out the software for yourself.

Faster Receipt & Turnaround Time

It allows processing and receiving all relevant documents much more quickly. Whether it’s receipts, W-2 forms, or any other relevant documentation, the software can allow us to scan and import these documents into our account with ease.

This means we have access to the information we need to complete our taxes promptly, without having to wait for weeks for our accountant to turn things around.

Additionally, because this streamlined process involves less paperwork and fewer manual data entry costs, we can be sure that our returns will be filed more quickly than ever before.

Factors To Consider In Choosing Tax Filing Software

Pricing

When choosing tax filing software, there are several factors to consider. First and foremost, you will want to look at the price. Some software options are free or very low, while others can be quite pricey. Your budget is an important consideration when evaluating different programs.

Ease of Use

Some programs are designed to be intuitive and straightforward, making them suitable for a wide range of users. However, other programs may be more complex or challenging to navigate, making them more suited for experienced filers who have a good understanding of tax laws and regulations.

Functionality

In addition to pricing and ease of use, the functionality should also be considered when weighing different tax filing software options.

While many programs offer similar features, such as data import and automatic calculations of refund amounts, some may include additional tools like calculators or decision trees that can help you choose the best refund option based on the specifics of your taxes.

There is no single program that will work for everyone; it is important to carefully evaluate each available option to make the right choice for your needs.

Customer Service

Tax season can be a stressful and confusing time for many people, and you must choose a program that provides reliable support when you need it most.

Look for a software provider that offers online help resources and phone and email support. For added peace of mind, choose a program with live chat capabilities to get quick answers to your questions in real-time.

FAQS

What is Tax?

Tax is a way for governments to generate revenue to fund public services like education, healthcare, and infrastructure. Typically, individuals and businesses pay taxes based on their income or the goods they produce.

These taxes can take many forms, such as income tax, sales tax, capital gains tax, and property tax. Despite the perceived burden of tax payments, they are an essential part of any thriving economy; they help ensure that everyone contributes their fair share to society and allow governments to provide key services to citizens.

While taxation can seem harsh or excessive, it is a necessary and important system that helps keep our communities running smoothly.

When are taxes due?

Taxes are due on a specific date each year, usually in April or May. The government sets this date and varies depending on your location and income level.

If you are self-employed, for example, you may have to pay your taxes quarterly throughout the year. Regardless of how your taxes are calculated or when they are due, it is important to stay informed about when they are due so that you don’t end up being hit with costly penalties.

Some people choose to file their taxes early to avoid waiting until the last minute, while others prefer to wait until closer to the deadline to ensure that all of the necessary information has been collected and that calculations are accurate.

In any case, it is critical to stay up-to-date on tax deadlines to plan accordingly and take care of this important responsibility on time.

What will happen if I miss the tax deadline?

Missing the tax deadline can have serious consequences, so it is important to take it seriously. If you don’t file your taxes on time, you may be hit with a penalty fee and an interest charge on the unpaid balance.

In addition, if you are late in paying what you owe, your account may be turned over to a collections agency and reported to the credit bureaus.

Whatever money you owe will remain on your record and could potentially delay future financial opportunities or prevent you from receiving loans or scholarships.

To avoid these consequences, staying up to date with your tax obligations is crucial by filing on time and making any payments due. So don’t miss out on this important opportunity – stay organized and ensure you send in all of your tax forms before the deadline!

Should I use tax software or hire an accounting firm?

When trying to manage your taxes, there are generally two main options: using software or hiring a professional accounting firm. Both methods have pros and cons, and it can be not easy to decide which approach is best for you.

With tax software, the process is largely automated, and the software handles everything from data entry to filing. This makes it a good choice for people who want to save time and hassle in preparing their taxes.

However, tax software can also be quite complex, so it’s important to research beforehand to ensure that you’re choosing the right product for your situation.

On the other hand, an accounting firm offers specialized expertise and support that you may not find with software. A good accountant will work closely with you throughout the year to help minimize your liability and maximize any deductions you may qualify for.

This can be especially useful if you have a more complex tax situation or are new to filing taxes independently. Ultimately, whether you choose tax software or an accounting firm depends on what kind of support you need and your budget and preferences.

So if you’re wondering whether or not to hire a professional accountant or try out some tax software instead, do some careful research and weigh your options before making a decision.

Conclusion

When it comes to filing your taxes, there is no one-size-fits-all solution. While some tax software programs offer a free version that allows you to do the basics, others offer more advanced features and additional support at a higher cost.

Choosing the right program can be a challenge, but with our list of the best ten software to file taxes in 2022, you can narrow down your options and find the right program.

Whether looking for an easy-to-use option or full customer support, we have the top software programs to help you easily file your taxes. So what are you waiting for? Start comparing today and get one step closer to finding your perfect tax solution!